Introduction:

In today's digital world, where technology is rapidly advancing, scams have also evolved. One of the most dangerous scams targeting unsuspecting individuals is the Quantum AI Boiler Room Scam. These scams exploit people's trust in technology and their aspirations for financial success. In this article, we will explore the dark side of autotrading robots and how to protect yourself from falling victim to these scams.

1. Understanding Quantum AI and Autotrading Robots

Top of Page

If Quantum AI is a real technology, how could it help people trading online and what would the benefits be?

Quantum AI, when combined with the concept of quantum computing, refers to the use of quantum algorithms and computing techniques to solve complex problems in the field of artificial intelligence. If such technology becomes practically applicable to online trading, it could offer several potential benefits:

- Speed: Quantum computers can process vast amounts of data at speeds unimaginable with classical computers. This would allow traders to receive real-time analyses of global markets, taking into account countless variables at once.

- Optimization: Quantum algorithms are particularly good at optimization problems. In the context of trading, this could mean finding the optimal trading strategy given a set of constraints or the optimal portfolio distribution for risk minimization.

- Predictive Analytics: With the ability to analyze large datasets quickly, quantum AI could vastly improve predictive models. This could provide traders with more accurate forecasts and insights into market trends.

- Complex Simulations: Quantum computers can run highly complex simulations in a fraction of the time it would take classical computers. Traders could simulate various market scenarios to understand potential outcomes and risks better.

- Enhanced Security: Quantum computers have the potential to revolutionize encryption methods, making online transactions and communications more secure. This could reduce the risk of hacks and security breaches in online trading platforms.

- Pattern Recognition: Quantum algorithms might excel at recognizing patterns in vast datasets, potentially identifying market trends or anomalies that classical algorithms might miss.

- Arbitrage Opportunities: The speed and efficiency of quantum AI could help traders identify and exploit arbitrage opportunities almost instantaneously.

- Risk Analysis: Quantum computing could provide more intricate models for risk analysis, helping traders understand the potential risks associated with various investments in real-time.

- Global Market Analysis: With the ability to process vast amounts of data quickly, traders could get a real-time holistic view of global markets, aiding in better decision-making.

- Reducing Overhead Costs: As quantum AI systems might be able to perform tasks more efficiently, they could potentially reduce the computational overhead and associated costs for trading firms.

However, it's essential to note a few caveats:

- Quantum computing and, by extension, quantum AI are still in their infancy. While there's significant promise, practical and scalable quantum computers are not yet available for widespread commercial use.

- As with any technology, there will be challenges in implementation, integration with existing systems, and potential unforeseen consequences in the financial markets.

- Just as quantum AI could provide advantages to traders, it could also lead to challenges, such as market fluctuations caused by many traders using similar quantum-based strategies.

In conclusion, while Quantum AI holds immense promise for the world of online trading, it's a technology that's still being developed. As it matures, it's likely that we'll see a transformative impact on trading strategies, risk management, and the overall efficiency of financial markets.

What has prompted the rise of autotrading robots and what really is their ability to automate trading decisions?

The rise of autotrading robots, or algorithmic trading systems, can be attributed to a combination of technological advancements, evolving market dynamics, and the pursuit of competitive advantages in the financial sector. Here are some key factors that have prompted their rise:

1. Technological Advancements: - Computing Power: The exponential growth in computing power over the past few decades has made it feasible to run complex trading algorithms in real-time. - Connectivity: High-speed internet and the rise of electronic trading platforms have facilitated instant execution of trades, making it possible for algorithms to operate effectively.

- Data Availability: The proliferation of data sources, from news feeds to social media to proprietary datasets, has provided ample information that algorithms can analyze and act upon. Big data analytics and machine learning techniques can sift through vast amounts of data to identify trading signals.

- Cost Efficiency: Automated trading can reduce the costs associated with manual trading, such as salaries for traders and errors due to human oversight.

- Speed and Scalability: Autotrading robots can execute trades in milliseconds, allowing them to capitalize on narrow windows of opportunity. They can also simultaneously analyze multiple markets and execute thousands of trades in the time it would take a human to make a single decision.

- Risk Management: Algorithms can be designed with strict risk management rules, ensuring that trading strategies adhere to predefined risk tolerance levels.

- Consistency: Unlike human traders who may be influenced by emotions like fear and greed, algorithms execute trades based on predefined criteria, ensuring consistency in decision-making.

- Competitive Advantage: As financial markets become more competitive, firms seek any edge they can find. Algorithmic trading can provide advantages in terms of speed, accuracy, and efficiency.

- Evolving Market Structure: The rise of electronic exchanges and the decrease in manual, floor-based trading have facilitated the growth of algorithmic trading.

- Regulatory Changes: Some regulatory changes have unintentionally favored algorithmic trading. For example, regulations promoting transparency and competition can make markets more fragmented, creating opportunities for algorithms to find inefficiencies.

As for their ability to automate trading decisions:

- Strategy Execution: Autotrading robots can execute a wide range of strategies, from simple ones based on moving averages to complex strategies involving multi-factor models.

- Real-time Analysis: They can analyze vast amounts of data in real-time to make trading decisions, from price and volume data to news feeds.

- Adaptive Learning: With the integration of machine learning, some algorithms can adapt and learn from new data, refining their strategies over time.

- Backtesting: Before deployment, algorithms can be tested on historical data to gauge their effectiveness, allowing for refinement before real-world application.

- Portfolio Management: Some algorithms are designed for portfolio optimization, rebalancing portfolios based on predefined criteria.

However, it's essential to understand that while autotrading robots offer many benefits, they are not infallible. Market anomalies, unexpected news events, or even software bugs can lead to significant losses. Furthermore, the widespread use of similar algorithmic strategies can exacerbate market volatility or lead to flash crashes. As with any tool, their efficacy depends on their design, implementation, and the context in which they are used.

What is the appeal of such systems to young people looking for passive income opportunities?

Autotrading robots and algorithmic trading systems have become particularly appealing to young people looking for passive income opportunities for several reasons:

- Technological Affinity: Younger generations have grown up in a digital era, making them more comfortable and trusting of technology-driven solutions. The idea of using algorithms and technology to generate income aligns with their inherent tech-savviness.

- Low Entry Barriers: Many autotrading platforms have user-friendly interfaces and offer educational resources, making it easier for novices to get started. Some platforms also have low initial deposit requirements.

- Perceived Passive Nature: The allure of "making money while you sleep" is strong. Autotrading systems give the impression that once set up, they can generate income with minimal ongoing effort, aligning with the idea of passive income.

- Diversification: These systems often allow users to diversify their investments across different assets, strategies, or geographic regions, potentially reducing risk.

- Speed and Efficiency: The ability of autotrading robots to operate 24/7 and execute trades rapidly can be appealing to those who value efficiency and continuous operation.

- Avoiding Emotional Trading: Young investors, especially those new to the market, might recognize their susceptibility to emotional trading decisions. Automated systems can mitigate the risks associated with panic selling or impulsive buying.

- Learning Opportunity: For those interested in finance and technology, setting up and monitoring an autotrading system can be an educational experience. It offers a hands-on approach to understanding market dynamics, algorithmic strategies, and risk management.

- FOMO (Fear of Missing Out): As discussions about algorithmic trading and its successes become more prevalent on social media and among peer groups, many young people might feel they're missing out on a lucrative opportunity and are thus drawn to try it.

- Flexibility: Autotrading systems can operate without constant monitoring, allowing young people to pursue other activities, jobs, or studies simultaneously.

- Customizability: Some platforms allow users to customize their trading strategies, risk tolerance, and other parameters, giving a sense of control and personalization.

However, it's crucial for young people to approach autotrading with caution. While these systems can offer potential profits, they also come with risks. It's essential to understand the underlying strategies, the risks involved, and to be wary of platforms that promise guaranteed returns. Investing in education and due diligence before diving into autotrading can help mitigate potential pitfalls.

2. The Rise of Quantum AI Boiler Room Scams

Top of Page

What was the Origin of the Boiler Room Scam?

The term "boiler room" refers to an outbound call center selling questionable investments by telephone. The term carries a negative connotation because the sales tactics used are often high-pressure, manipulative, and sometimes fraudulent. The origin and evolution of the boiler room scam can be traced back to the following factors:

- Evolution of Telecommunication: As telephone communication became widespread in the 20th century, it opened up opportunities for various businesses, including those with nefarious intentions, to reach a broader audience.

- Lack of Regulation: Before the establishment of strict securities regulations, it was easier for unscrupulous brokers to sell worthless or nonexistent stocks to unsuspecting investors.

- High-pressure Sales Tactics: The "boiler room" environment typically involves salespeople working in close quarters (often in a cramped room, hence the name), using aggressive tactics to persuade potential investors to buy stocks or other securities that might be overvalued or outright fraudulent.

- Quick Profits: The rise of the boiler room scam can also be attributed to the allure of quick profits. Brokers in these operations were often incentivized with high commissions, pushing them to make as many sales as possible, regardless of the investment's legitimacy.

- Targeting Unsuspecting Individuals: Boiler rooms often targeted individuals with little investment experience or knowledge, making them more susceptible to the sales pitch.

- Mob Involvement: In some cases, organized crime groups were involved in boiler room operations, using them as a means to defraud people and launder money.

- Limited Information Flow: Before the internet age, investors had limited resources to verify the legitimacy of an investment opportunity. This lack of information made it easier for boiler rooms to operate.

While the classic boiler room scams involving stock sales over the phone have diminished due to stricter regulations and increased public awareness, the concept has evolved. Modern-day boiler rooms might use email, social media, or other online platforms to reach potential victims. The essential characteristics remain: high-pressure sales tactics and questionable or fraudulent investment opportunities.

To combat these scams, regulatory bodies in various countries have put in place strict rules regarding securities sales and have made efforts to educate the public about potential investment fraud.

How Did the Idea of Quantum Computer AIs Become Involved?

The idea of quantum computers and artificial intelligence (AI) converging is rooted in the pursuit of enhancing computational capabilities to address complex problems. Here's a brief overview of how the two concepts became intertwined:

- Limits of Classical Computing: As AI models, especially deep learning models, grew in complexity, they demanded more computational power. There was a realization that classical computers might eventually hit a limit in terms of their ability to efficiently train and run these models.

- Quantum Mechanics and Computation: Quantum mechanics, a fundamental theory in physics, describes nature at the smallest scales of energy levels of atoms and subatomic particles. In the early 1980s, physicist Richard Feynman proposed that quantum mechanics could give rise to a new kind of computer that could simulate quantum systems, something classical computers struggle with. This idea laid the groundwork for quantum computing.

- Quantum Speedup: Quantum computers, in theory, can process vast amounts of data and perform computations at much higher speeds than classical computers due to principles like superposition and entanglement. This potential "quantum speedup" was seen as a way to address some of the computational challenges faced by AI.

- Quantum Machine Learning: As quantum computing research progressed, researchers began exploring its applications in various fields, including machine learning. The term "quantum machine learning" was coined to describe algorithms that run on quantum computers and can potentially offer speedups over their classical counterparts.

- Addressing AI Challenges: Some problems in AI, like optimization problems, could potentially benefit from the inherent properties of quantum computation. For example, the quantum version of annealing (a technique used for finding optimal solutions) might provide faster solutions than classical methods.

- Research Investments: Recognizing the potential of quantum computing in various sectors, including AI, governments, and private entities, began investing in quantum research. This further fueled the exploration of quantum-AI synergies.

- Hype and Speculation: As with many emerging technologies, there's a mix of genuine promise and hype. The idea of quantum computers revolutionizing AI became a popular narrative, even though practical, large-scale quantum computers remain a work in progress.

- Caveats: It's essential to understand that while quantum computers hold promise for certain computational problems, they're not a universal solution for all AI challenges. Their practical utility in AI remains an active area of research, and significant breakthroughs are still needed to make quantum-AI applications widespread.

In summary, the idea of quantum computer AIs emerged from the pursuit of enhanced computational methods to address challenges in AI, combined with the theoretical capabilities of quantum mechanics. As both fields continue to evolve, their convergence remains a fascinating area of exploration.

The combination of "Quantum AI" and "Boiler Room Scam" is an example of how modern scammers evolve their tactics to exploit current technological trends and public interest. Here's a general overview of how the concept of Quantum AI might be integrated into a boiler room scam:

- Technological Mystique: The term "Quantum" has a certain mystique and is associated with advanced, cutting-edge technology. For the average person, quantum mechanics and quantum computing are complex and not well-understood. Scammers exploit this lack of understanding to make their pitches sound more convincing.

- Leveraging AI Hype: AI is another term that has gained significant attention and is associated with revolutionary changes in various sectors. By combining "Quantum" with "AI", scammers create a term that sounds incredibly advanced and promising.

- Promising Unrealistic Returns: Scammers in boiler room operations might pitch an investment opportunity related to a "Quantum AI" startup or technology that promises to revolutionize an industry. They would claim that this is a "once-in-a-lifetime" opportunity that offers astronomical returns.

- Limited Time Offers: To add pressure, the scammers might claim that the Quantum AI investment opportunity is available for a limited time, urging the potential victim to act quickly without conducting proper due diligence.

- Lack of Tangible Proof: Given the abstract nature of quantum computing and AI, it's easier for scammers to fabricate stories without providing tangible proof. They might use technical jargon and fabricated demonstrations to convince potential investors of the legitimacy of their claims.

- Targeting the Unsuspecting: Just as with traditional boiler room scams, the target audience is often individuals who lack in-depth knowledge about the technology in question. The complexity of quantum computing and AI makes it easier to deceive such individuals.

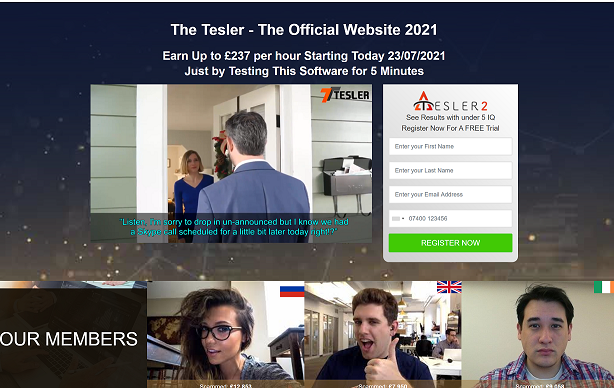

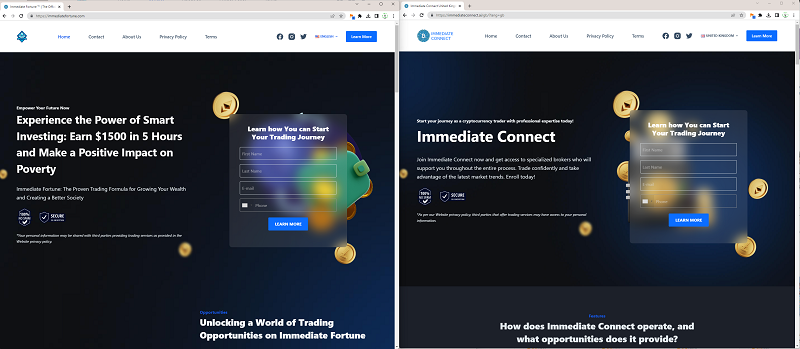

- Online Evolution: Modern boiler room scams have evolved from phone calls to online platforms, including emails, websites, and social media. A scammer might set up a professional-looking website touting their Quantum AI technology, complete with fake testimonials and endorsements.

It's essential to note that while the concept of Quantum AI is legitimate in scientific and research contexts, its use in investment scams is a perversion of the term. As with all investment opportunities, especially those related to complex technologies, individuals should conduct thorough research, seek advice from trusted professionals, and be wary of offers that sound too good to be true.

Quote from an expert or victim of such a scam to emphasize the seriousness of the issue.

3. Red Flags and Warning Signs to Look Out For

Top of Page

What are the Signs of these Scams, such as promises of unrealistic profits, aggressive sales tactics, and unregulated brokers?

Boiler room scams, whether they tout Quantum AI or other investment opportunities, typically exhibit several red flags. Recognizing these signs can help individuals avoid falling victim to such schemes. Here are common signs of these scams:

- Unrealistic Profits: One of the most glaring red flags is the promise of high returns with little to no risk. Scammers might claim that their investment opportunity can double or triple your money in a short period, often backing up their claims with fabricated success stories or testimonials.

- Aggressive Sales Tactics: Scammers often use high-pressure sales tactics to persuade potential victims to invest. They might rush you to make a decision, saying that the opportunity is limited or that you'll miss out if you don't act immediately.

- Unregulated Brokers: Many boiler room scams operate outside the purview of regulatory authorities. If a broker or firm isn't registered with relevant regulatory bodies or if you can't find any information about them from reputable sources, it's a red flag.

- Cold Calls: Unsolicited phone calls or emails from brokers or firms you've never heard of or had any prior relationship with can be a sign of a scam. These cold calls often come out of the blue, offering an exciting investment opportunity.

- Secretive or Complex Strategies: Scammers might use complex jargon or convoluted explanations about their investment strategy, hoping to confuse potential investors. They might claim that their method is a "secret" or "proprietary" technique that outsiders can't understand.

- Lack of Documentation: Legitimate investment opportunities usually come with a wealth of documentation, including prospectuses, financial statements, and other relevant materials. Scammers might be reluctant to provide such documentation or might offer fake or incomplete documents.

- Requests for Personal Information: Be wary if you're asked for personal or financial information without any legitimate reason. Scammers might use this information for identity theft or other fraudulent activities.

- Difficulty Withdrawing Funds: If you've already invested and find it challenging to withdraw your money or are faced with unexpected fees or barriers, it might be a sign that you're dealing with a scam.

- Too Good to Be True: If something sounds too good to be true, it often is. Trust your instincts. If an investment opportunity seems overly favorable or out of line with market conditions, proceed with caution.

- Lack of Transparency: Scammers might be evasive when asked about their company's history, location, leadership, or other essential details. A lack of transparency is a significant red flag.

- Online Presence: Fake or recently created websites, the absence of genuine customer reviews, or a lack of presence on social media can be warning signs.

- Misuse of Technical Terms: Scammers might throw around technical terms like "Quantum AI" or "blockchain" without a clear understanding, hoping to impress or confuse potential investors.

To protect oneself, always conduct thorough research before making any investment. Verify the credentials of brokers and firms, check for reviews or complaints online, and consult with trusted financial advisors. And remember, it's okay to say "no" and walk away from any investment opportunity.

What are some examples of fake reviews, fake news articles, and celebrity endorsements (e.g. Elon Musk) used by scammers to manipulate victims?

Scammers often employ a range of deceptive tactics to appear legitimate and entice victims. Here are some examples of how they might use fake reviews, fake news articles, and celebrity endorsements:

- Fake Reviews: - Purchased Reviews: Scammers might buy fake positive reviews for their products or services on platforms like Amazon, Google, or Yelp. These reviews typically sound generic and don't provide specific details about the product. - Review Farms: There are businesses that offer bulk positive or negative reviews for a fee. Scammers might use these "farms" to flood their product pages or websites with glowing testimonials. - Fake User Profiles: On forums or social media, scammers might create fake profiles to post positive experiences or defend their product/service against critics.

- Fake News Articles: - Fabricated News Websites: Scammers might create websites that mimic reputable news outlets, complete with fake logos and domain names that are slightly altered. - Misleading Headlines: Articles might have sensationalized or misleading headlines that don't match the content, designed to draw clicks and shares. - Fabricated Stories: These articles might contain completely made-up stories about a product's success or a company's achievements. - Date Manipulation: Some fake news sites manipulate publication dates to make old or recurring scams appear timely and relevant.

- Celebrity Endorsements: - Misappropriated Images: Scammers might use images of celebrities without their permission, suggesting that they endorse or use the product. - Fake Quotes: Alongside the images, there might be fabricated quotes where the celebrity supposedly extols the virtues of the product or service. - Elon Musk and Cryptocurrency: A notable example involves scammers using Elon Musk's image and fake quotes to promote cryptocurrency scams. They might claim that Musk is releasing a new cryptocurrency or that he's endorsed a particular crypto investment strategy. - Talk Show Fabrications: Scammers might falsely claim that their product was featured or endorsed on popular TV shows or talk shows. - Deepfakes: With advancements in AI, there's a growing concern about "deepfakes," where videos are manipulated to make it appear as if celebrities are saying or doing things they never did.

It's essential for consumers to approach such endorsements, reviews, and news articles with skepticism. Always verify information from multiple, reputable sources before making any decisions. If a celebrity supposedly endorses a product, check their official social media profiles or websites for confirmation. Remember, just because something is widely shared or appears professional doesn't mean it's genuine.

Can you Give me Quote from an industry professional on the importance of conducting thorough research before investing?

Certainly! Here's a quote that emphasizes the importance of due diligence before making investment decisions:

Warren Buffett, CEO of Berkshire Hathaway, known for his investment prowess and often considered one of the most successful investors in the world, has frequently spoken about the importance of thorough research:

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price. The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors."

— Warren Buffett

Buffett's advice underscores the necessity of understanding what you are investing in and the importance of a company's long-term strategic advantage in the marketplace. This is a cornerstone of his investment philosophy and a guiding principle for investors seeking to make informed decisions.

4. The Role of Quantum Computing and Artificial Intelligence

Top of Page

What is the actual potential of quantum computing and artificial intelligence in trading?

Quantum computing and artificial intelligence (AI) each have their own distinct potential in the realm of trading, but when combined, they could revolutionize the field in various ways. Here's a breakdown of their potential:

1. Quantum Computing:

Quantum computers use the principles of quantum mechanics to process vast amounts of data simultaneously. They're fundamentally different from classical computers, which process data in a linear fashion. Here's how quantum computing can impact trading:

- Speed: Quantum computers can theoretically process complex calculations exponentially faster than classical computers. This means they could analyze vast datasets or run intricate simulations in a fraction of the time.

- Optimization: Many trading strategies involve optimization problems, like finding the best combination of assets for a portfolio. Quantum computers can navigate and optimize complex systems more efficiently.

- Risk Analysis: By running simulations quickly, quantum computers can evaluate the risk of various trading strategies or investment portfolios more effectively.

- Cryptography: Quantum computers have the potential to break many of the cryptographic methods currently used in finance. However, they can also lead to the development of new, more secure cryptographic techniques.

2. Artificial Intelligence (AI):

AI encompasses a variety of techniques, including machine learning, deep learning, and natural language processing, which can be applied to trading in the following ways:

- Predictive Analytics: AI can analyze vast datasets, from price history to social media sentiment, to predict market movements.

- Algorithmic Trading: AI can automatically execute trades at high speeds based on a set of predefined criteria, making millions of trades in a day.

- Portfolio Management: Robo-advisors, powered by AI, can automatically allocate assets in an investment portfolio based on an individual's risk tolerance and financial goals.

- Fraud Detection: AI can quickly identify unusual trading patterns or activities, helping to detect and prevent fraudulent activities.

- Natural Language Processing (NLP): AI can analyze news articles, financial reports, and social media to gauge market sentiment or identify potential market-moving events.

Combined Potential of Quantum Computing and AI:

When we consider the combination of quantum computing and AI in trading, the potential is immense:

- Enhanced Machine Learning: Quantum computers could run machine learning algorithms much faster, leading to quicker model training and more accurate predictions.

- Complex Simulations: Traders could use quantum-enhanced AI to run intricate financial simulations, considering a multitude of variables and scenarios simultaneously.

- Real-time Decision Making: The speed of quantum computing combined with the analytical power of AI could lead to real-time decision-making tools in trading, allowing for instantaneous reactions to market changes.

- Data Analysis: With quantum computing's ability to process vast datasets and AI's capability to derive insights from this data, traders could uncover hidden patterns or correlations that weren't previously apparent.

In conclusion, while both quantum computing and AI have individual strengths that can benefit trading, their combined potential could lead to unprecedented advancements in the field. However, it's essential to note that the practical, large-scale integration of quantum computing into trading is still in its infancy, and many challenges remain to be addressed.

Emphasize the limitations and challenges that make the use of Quantum AI in autotrading robots highly unlikely at present.

The integration of quantum computing and artificial intelligence into autotrading robots presents a tantalizing future, but there are significant limitations and challenges that currently make their widespread use in this context highly unlikely:

1. Quantum Computing Challenges:

- Nascent Technology: Quantum computing is still in its early stages. While there have been breakthroughs, we're yet to have quantum computers that consistently outperform classical computers in a wide range of tasks.

- Error Rates: Quantum computers currently suffer from high error rates due to quantum decoherence. This means that the qubits (quantum bits) can lose their quantum state easily, leading to computational errors.

- Hardware Challenges: Building and maintaining a quantum computer requires extremely low temperatures, high vacuums, and other stringent conditions. This makes them expensive and challenging to scale.

- Quantum-Classic Transition: Translating quantum results into actionable classic computing instructions is not straightforward. It requires specialized algorithms and understanding.

- Cryptography Concerns: Quantum computers have the potential to break current cryptographic methods. While this might sound advantageous for some, it poses a significant security risk for financial transactions and data.

2. Artificial Intelligence Challenges:

- Data Dependency: AI, especially deep learning models, requires vast amounts of data to train accurately. In trading, where new, unprecedented events can occur, having enough relevant data for every possible scenario is challenging.

- Overfitting: AI models can sometimes fit too closely to their training data, making them perform poorly in real-world, unseen scenarios. In trading, this can lead to significant financial losses.

- Transparency: Many advanced AI models, like neural networks, are considered "black boxes." It's hard to understand why they make certain decisions, which is a significant concern in a regulated industry like finance.

- Bias: If training data contains biases, AI models can perpetuate or even exacerbate these biases, leading to skewed or unfair trading decisions.

3. Combining Quantum Computing and AI:

- Lack of Frameworks: While there's theoretical interest in quantum machine learning, practical frameworks and tools for integrating quantum computing and AI are still in their infancy.

- Complexity: Combining the intricacies of quantum mechanics with the nuances of AI models adds layers of complexity. This can make troubleshooting, optimization, and scaling even more challenging.

- Cost: Given the current costs of developing and maintaining quantum computers and the resources needed for advanced AI, deploying quantum AI for autotrading on a large scale would be prohibitively expensive for most entities.

4. Regulatory and Ethical Concerns:

- Accountability: In case of financial mishaps or irregularities, it might be challenging to hold a quantum AI system accountable, especially if its decision-making process isn't transparent.

- Regulations: The finance sector is heavily regulated. Introducing new, untested technologies like quantum AI would require navigating a complex web of regulations, standards, and compliance checks.

In conclusion, while the potential of quantum AI in autotrading is vast, the current challenges and limitations make its widespread adoption improbable in the immediate future. As both fields mature, there might be more opportunities for integration, but for now, caution and research are paramount.

How do scammers exploit the buzz around these emerging technologies to deceive unsuspecting investors?

Scammers are adept at exploiting the hype surrounding emerging technologies like quantum computing and AI to deceive unsuspecting investors. By tapping into the excitement, complexity, and often the general lack of understanding of these technologies, fraudsters create elaborate schemes to take advantage of people. Here's how they typically go about it:

1. Complex Jargon and Overwhelming Technicality:

- Technical Smoke Screen: Scammers use complex technical jargon to confuse potential investors. By sounding highly technical and advanced, they give an illusion of legitimacy and expertise.

- Inaccessibility: The complex nature of quantum computing and AI makes them relatively inaccessible to the average person. Scammers exploit this gap in understanding to present themselves as experts, making it hard for individuals to challenge or question their claims.

2. Fake Endorsements and Reviews:

- Celebrity Endorsements: As seen in many scams, fraudsters claim that their technology or investment opportunity is endorsed by celebrities or renowned tech experts. These endorsements are entirely fabricated but can lend a veneer of credibility.

- Fake User Testimonials: Scammers often create fake reviews and testimonials, showcasing individuals who've supposedly made significant profits from the investment or technology.

3. Too-Good-To-Be-True Promises:

- Guaranteed Returns: One of the most significant red flags is when scammers promise guaranteed high returns. They exploit the buzz around the technology by claiming that it's a "sure thing" or "the future of trading," ensuring incredible profits.

- Limited-Time Offers: To create a sense of urgency, scammers often claim that their offer is for a limited time or available only to a select few.

4. Fake Platforms and Products:

- Mock Platforms: Scammers might develop fake trading platforms or software that appear sophisticated, showcasing real-time trading analytics, profits, and more. These platforms are designed to lure investors into depositing money.

- Non-Existent Products: In some cases, the technology or product they're promoting doesn't even exist. It's merely a concept or a facade to attract investments.

5. Exploiting Fear of Missing Out (FOMO):

- The Next Big Thing: Scammers present the technology as the next revolution, drawing parallels to past technological breakthroughs. They play on the fear that those who don't invest now will miss out on massive future gains.

6. Lack of Transparency and Regulation:

- Opaque Operations: Many scams lack transparency about their operations, technology, and financial dealings. They might avoid giving straight answers or providing verifiable details about their company.

- Unregulated Brokers: Scammers often operate through unregulated brokers or platforms, which lack the oversight and accountability of regulated financial institutions.

7. Aggressive Marketing and Sales Tactics:

- High-Pressure Sales: Potential investors might be subjected to high-pressure sales tactics, with scammers pushing them to invest before they've had a chance to think or do their research.

- Targeting Vulnerable Groups: Scammers often target individuals who might not be tech-savvy or those who've shown interest in quick wealth-generation schemes.

In conclusion, while emerging technologies like quantum computing and AI hold genuine promise, it's crucial for investors to be wary of schemes that exploit the buzz around these technologies. Due diligence, skepticism of too-good-to-be-true offers, and thorough research are essential to avoid falling prey to such scams.

5. Staying Safe: Tips to Avoid Quantum AI Boiler Room Scams

Top of Page

What practical advice on protecting oneself, such as conducting background checks on companies and brokers, reading genuine customer reviews, and seeking advice from trusted sources do you have?

Protecting oneself from investment scams, especially those exploiting the allure of emerging technologies like quantum computing and AI, requires vigilance and informed skepticism. Here’s some practical advice:

Conduct Thorough Background Checks

- Company Verification: Check if the company is registered with relevant authorities, such as the Securities and Exchange Commission (SEC) in the U.S. or other financial regulatory bodies globally. - Physical Office: Confirm that the company has a legitimate physical address and contact details.

- Management Team: Research the people behind the company. Look for their professional histories on platforms like LinkedIn.

Utilize Regulatory Resources

- Regulatory Listings: Use resources like the Financial Industry Regulatory Authority (FINRA) BrokerCheck in the U.S. to see if a broker or firm is authorized.

- Investment Scam Check: Many regulatory bodies offer tools to check for known investment scams or warnings about companies.

Read Genuine Customer Reviews and Feedback

- Independent Review Sites: Look for reviews on third-party websites that are not directly affiliated with the company.

- Forums and Community Feedback: Explore forums and online communities for any red flags raised by others who might have interacted with the company.

Seek Advice from Trusted Sources

- Financial Advisors: Consult with a licensed financial advisor or planner who can offer unbiased advice.

- Educational Workshops: Attend workshops and seminars about investing that are held by reputable organizations.

Understand the Investment

- Educate Yourself: Take the time to understand the basics of the investment, including how it supposedly generates returns.

- Ask Questions: Don’t be afraid to ask detailed questions about the technology or business model. A legitimate company will be transparent and forthcoming.

Be Wary of Unsolicited Offers

- Cold Calls/Emails: Be cautious of unsolicited investment offers, especially those that come from cold calls, emails, or social media messages.

- Pressure Tactics: Legitimate firms will not rush you into an investment or use fear of missing out (FOMO) as a selling point.

Look Out for Red Flags

- Guaranteed Returns: Be skeptical of any investment offering guaranteed returns, as all investments carry some risk.

- Complex Strategies: Be cautious of investments that are described using overly complex strategies that are difficult to understand.

Secure Personal Information

- Data Security: Never share personal financial information without verifying the legitimacy of the company or website.

Regular Monitoring and Reporting

- Keep Records: Maintain detailed records of communications, transactions, and research.

- Report Scams: If you suspect a scam, report it to the relevant authorities immediately to help prevent others from being victimized.

Stay Updated

- Stay Informed: Keep up with news on investment scams and new tactics being used by fraudsters.

- Regulatory Updates: Follow updates from financial regulators regarding new rules, regulations, and advisories.

By following these steps, individuals can better shield themselves from the sophisticated tactics scammers use and make more informed decisions about their investments. Remember, if it sounds too good to be true, it probably is.

What can be done to encourage people to be skeptical and critical of information presented to them, especially online?

Encouraging skepticism and critical thinking, especially regarding online information, is a multifaceted challenge. Here's what can be done to promote these vital skills:

Educational Initiatives:

- Media Literacy Programs: Incorporate media literacy into educational curriculums from a young age to teach students how to critically evaluate information sources. - Critical Thinking Workshops: Offer workshops and courses for all age groups focused on developing critical thinking and fact-checking skills.

- Public Awareness Campaigns: Run public service announcements that highlight the importance of skepticism when consuming online information.

Use of Technology:

- Fact-Checking Tools: Promote the use of fact-checking websites and tools that can help verify the credibility of information. - Browser Extensions: Encourage the use of browser extensions that alert users to known fake news sites or fact-check stories in real-time.

- AI and Algorithms: Improve and advocate for AI systems that can detect and flag misinformation on social media and other platforms.

Building Trustworthy Sources:

- Credible Journalism: Support and subscribe to reputable news organizations known for rigorous journalistic standards.

- Transparency: Encourage content creators and platforms to be transparent about their sources and to disclose any potential biases or conflicts of interest.

Strengthening Community Engagement:

- Forum Discussions: Create and maintain forums where people can discuss and verify the news and share insights.

- Social Media Literacy: Guide people on how to evaluate the credibility of social media posts and the importance of cross-checking information before sharing.

Policy and Regulation:

- Regulatory Measures: Advocate for policies that require online platforms to actively combat the spread of misinformation.

- Legal Consequences: Work towards establishing legal consequences for deliberately spreading misinformation that can cause harm.

Encouraging Personal Responsibility:

- Pause Before Sharing: Instill the habit of pausing to consider the source and truthfulness of information before sharing it online.

- Self-Reflection: Encourage individuals to reflect on their biases and how these may affect their perception and sharing of information.

Role of Influencers and Educators:

- Influencer Responsibility: Encourage influencers to use their platforms to educate followers about misinformation and the importance of critical thinking.

- Professional Development: Provide ongoing professional development for educators to stay informed about the latest digital literacy strategies.

Corporate Responsibility:

- Platform Accountability: Hold social media platforms and search engines accountable for the content they promote and provide them with guidelines to minimize the spread of misinformation.

- Corporate Training: Implement training programs within organizations to enhance employees' ability to critically assess information, especially in decision-making roles.

Personalized Strategies:

- Understanding Psychological Biases: Educate people about common cognitive biases that can affect judgment and the acceptance of misinformation.

- Individual Empowerment: Empower individuals with the understanding that their actions online, such as sharing unverified information, have real-world consequences.

Enhancing Dialogues:

- Interdisciplinary Discussions: Foster interdisciplinary dialogues between technologists, psychologists, educators, and policymakers to develop comprehensive strategies to combat misinformation.

Encouraging skepticism and critical thinking is an ongoing process that requires cooperation across society. By combining education, technology, policy, and community engagement, we can create a more informed public that is better equipped to navigate the complex landscape of online information.

How Can I Identify Disreputable Sites like InsideBitcoins and Finixio And Avoid Unreliable Information?

When navigating the complex and often volatile world of cryptocurrencies and online trading, it's crucial to rely on reputable sources for information and news. Here’s a general guide to assessing platforms and sources:

Assessing the Credibility of Online Platforms:

- Check Their Track Record: Investigate the history of the platform. Have they been involved in scandals, misinformation, or regulatory issues? - Source Verification: Analyze whether the platform cites reliable sources for its information or if it often relies on hearsay and unverifiable claims. - Editorial Policies: Look into the platform's editorial policies. Reputable sites have clear policies on corrections, transparency, and conflicts of interest. - Expertise of Authors: Evaluate the credentials and expertise of the authors and contributors. Experts in the field are more likely to provide accurate information. - Community Feedback: Search for feedback from the community. Long-standing complaints about accuracy or bias could be a red flag.

- Design and Presentation: Sometimes, a poorly designed website with numerous ads and sensationalist headlines can indicate a less reputable source.

Warning Signs to Watch Out For:

- Promotional Content: Be cautious if the platform frequently features promotional content or seems to push specific investments without solid, unbiased analysis. - Unverified Claims: Steer clear of platforms that make unverified or unrealistic claims about investment returns. - Lack of Transparency: Avoid sources that do not disclose ownership, funding, or potential conflicts of interest. - Sensationalism: Be wary of platforms that use sensational headlines or emotionally charged language to attract readers. - One-sided Reporting: A lack of balanced viewpoints can be a sign of a less reputable news source.

- Anonymity: If it's difficult to determine who is behind the platform or who the authors are, that's a potential concern.

Alternatives for Reliable Information:

- Established Financial News Outlets: Turn to well-known and established financial news services with a track record of reliability. - Official Regulatory Releases: Use information from official regulatory bodies like the SEC, CFTC, or other relevant financial authorities. - Academic Publications: Look for insights from academic journals or publications associated with reputable universities and research institutions.

- Certified Financial Experts: Follow commentary and advice from individuals with recognized financial certifications and qualifications.

Steps to Take:

- Diversify Sources: Don’t rely on a single source for your news and information. Diversifying helps cross-check facts and provides a broader perspective. - Fact-Checking: Make use of fact-checking websites that can help verify financial news and information. - Continuous Education: Stay informed about how to safely invest in cryptocurrencies and trading by reading books, attending seminars, and following courses from credible institutions.

- Use Direct Sources: When possible, use direct sources for financial information, such as press releases from the companies involved and data from official stock exchanges.

In summary, while navigating online platforms, always exercise due diligence and critical thinking. Look for signs of credibility, transparency, and professionalism before trusting the information provided, especially when it comes to making financial decisions in the realms of cryptocurrency and trading.

6. Reporting Scams to the Proper Authorities

Top of Page

Why Is It Important to Keep Reporting these Scams?

Reporting scams is a critical action for several reasons:

Protection of Individuals:

- Prevents Losses: Reporting can help prevent potential financial losses for individuals by alerting them to the existence of a scam.

- Victim Support: It can lead to support and recovery opportunities for those who have already been victimized.

Safeguarding Communities:

- Awareness: It raises public awareness, which is crucial in educating people about the types of scams that are currently active.

- Community Defense: By reporting scams, individuals contribute to a collective defense mechanism that protects the entire community.

Law Enforcement and Regulatory Action:

- Tracking and Investigation: Reports provide data that can help law enforcement track the activities of scammers and develop strategies to combat them. - Legal Action: Accumulating reports can lead to legal action against the perpetrators if there is sufficient evidence.

- Policy Development: Reporting scams can aid regulators in understanding the scope of the problem, which can influence the development of policies to protect consumers.

Economic Stability:

- Market Integrity: Scams can undermine the integrity of financial markets. Reporting them helps maintain trust in these systems.

- Consumer Confidence: As scams are identified and addressed, consumer confidence in legitimate services and platforms can be maintained or restored.

Evolution of Scams:

- Adaptation and Response: Scams are constantly evolving. Reporting them helps anti-fraud organizations and law enforcement stay ahead by understanding new tactics and responding accordingly.

Resource Allocation:

- Focus on Serious Threats: Reports help to identify the most harmful scams, allowing for better allocation of resources to where they are needed most.

Corporate Accountability:

- Platform Responsibility: Reporting scams that occur on specific platforms can prompt those platforms to improve their security measures and user verification processes.

Data Collection:

- Pattern Recognition: Reports contribute to databases that can be analyzed to identify patterns and trends in scamming activities.

Global Impact:

- Cross-Border Cooperation: Scams often operate across international borders. Reporting them can enhance global cooperation in combating these activities.

Moral Responsibility:

- Ethical Duty: There is an ethical imperative to protect others if you have knowledge of harmful activities.

Deterrence:

- Discouraging Scammers: A culture of active reporting can make it more difficult and risky for scammers to operate, potentially deterring them.

In essence, reporting scams is a fundamental part of the ecosystem that keeps the public informed, law enforcement agencies active, and policy-makers well-equipped to enact measures that protect citizens and the integrity of financial systems.

What are the Contact Details for the Bodies I Should Report These Scams To?

The contact details for reporting financial scams can vary depending on your location. Below are some of the leading agencies in different regions that handle such reports:

United States:

- Federal Trade Commission (FTC): You can report scams to the FTC online at ReportFraud.ftc.gov. - Securities and Exchange Commission (SEC): For investment-related scams, use the SEC’s online tip-off form at sec.gov/tcr. - Commodity Futures Trading Commission (CFTC): Report suspicious activities using their online form at cftc.gov/TipOrComplaint.

- Internet Crime Complaint Center (IC3): For scams that occurred online, file a complaint at ic3.gov.

United Kingdom:

- Action Fraud: As the UK’s national reporting center for fraud and cybercrime, you can report scams via their website at actionfraud.police.uk or by calling 0300 123 2040.

- Financial Conduct Authority (FCA): Use the FCA’s scam reporting form on their website at fca.org.uk/consumers/report-scam-us.

- sircles.net Ltd: Use the contact form here: https://blog.sircles.net/contact or on 0344 880 1618 and we will parade these scammers across the web however we can.

Canada:

- Canadian Anti-Fraud Centre (CAFC): Report fraud by phone at 1-888-495-8501 or through their online reporting system at antifraudcentre-centreantifraude.ca.

- Ontario Securities Commission (OSC): For investment scams, report to the OSC at 1-877-785-1555 or through osc.gov.on.ca.

Australia:

- Scamwatch (run by the Australian Competition & Consumer Commission): Report scams on their website at scamwatch.gov.au.

- Australian Securities and Investments Commission (ASIC): Use ASIC’s online complaint form at asic.gov.au.

Europe:

- Europol’s European Cybercrime Centre (EC3): While Europol doesn’t take individual reports, you can find your national authority’s contact details on their platform at europol.europa.eu.

- Your Local National Consumer Protection Office: Many European countries have their own consumer protection offices where you can report scams.

International:

- Econsumer.gov: For international scams, this website allows consumers to report complaints about online and related transactions with foreign companies.

Before you report a scam, gather all relevant information you have about the scam, such as emails, transaction details, and communications. Always ensure that you're contacting legitimate and official websites or phone numbers to avoid falling into a secondary scam. If in doubt, consult with local law enforcement or legal counsel to ensure you’re reporting the scam through the proper channels.

7. The Fight Against Unregulated Brokers and Scams

Top of Page

What powers do the FCA and Action Fraud have if they decide a site is fraudulent and needs to be blocked?

While we have no power to require sites to be taken down, we have an arrangement with Nominet, the UK domain registrar, which enables us to request takedowns where the site has a UK domain with the result the site is removed and users are redirected to an FCA warning page. Unfortunately, most scam sites do not have UK domains which makes takedowns for non-UK domains more difficult.

Mark Steward, Executive Director of Enforcement and Market Oversight

Well actually the FCA can do very little apart from add sites to warning lists and expect people to be aware of these lists, and here is the problem. Because something like the FCA exists people expect the Internet in the UK to be a pretty safe place, but of course the Internet isn't in the UK and the FCA have little or no influence on it at all. The FCA make people feel safe, but do little more than that. Their actual effect upon Internet safety is therefore a net loss.

The Financial Conduct Authority (FCA) and Action Fraud in the UK have distinct roles and powers when dealing with fraudulent activities:

Financial Conduct Authority (FCA):

- Investigation: The FCA has the authority to investigate companies and individuals suspected of financial misconduct. - Enforcement: If they find that a firm is conducting fraudulent activities, they have a range of enforcement powers, including the withdrawal of FCA authorization, imposition of fines, and the issuance of warnings to the public. - Legal Action: In certain cases, the FCA can initiate criminal prosecutions against those involved in financial crime. - Injunctions and Orders: The FCA can seek court orders to freeze assets and can petition for injunctions to prevent further activity. - Public Warnings: The FCA regularly publishes alerts about unauthorized firms and scams on its website to warn the public.

- Website Blocking: While the FCA itself does not have the direct power to block websites, it can work with internet service providers (ISPs) and other regulatory bodies to restrict access to fraudulent websites through court orders.

Action Fraud:

- Reporting Centre: Action Fraud is the UK’s national fraud and cybercrime reporting center and acts as a central point for collecting information about fraudulent activities. - Referral to Law Enforcement: Action Fraud analyses reports and, if necessary, refers them to the National Fraud Intelligence Bureau (NFIB), which is operated by the City of London Police. - Investigation and Prosecution: The NFIB can assess if there is enough information to enable a law enforcement body to investigate. However, Action Fraud itself does not have investigation or prosecution powers.

- Preventive Measures: They may take preventive measures by informing the public and businesses about current scams and fraud methods.

Collaboration with Other Entities:

Both the FCA and Action Fraud can also collaborate with other entities to block access to fraudulent websites: - Working with ISPs: They can request ISPs to block access to scam websites. - Collaboration with the Police: They often work with the police who have the authority to take down illegal operations.

- Domain Registrars and Hosting Services: They can request that domain registrars and web hosting services take down fraudulent websites.

International Cooperation:

In cases where fraud is cross-border, these UK bodies may work with international law enforcement agencies and regulatory bodies to tackle scams operating outside of the UK.

Public Engagement:

Both bodies also engage in public education campaigns to help prevent people from falling victim to scams in the first place.

While the FCA and Action Fraud can take various actions against fraudulent activities, it’s important to note that the process of getting a fraudulent site blocked can be complex, especially if the site is hosted outside the UK or is adept at evading regulatory action. Collaboration with international law enforcement and regulatory bodies is often necessary in such cases.

The Advertising Standards Authority (ASA) in the UK does have jurisdiction over online advertising and can take action against misleading, harmful, or offensive advertisements, including those on the internet. The ASA's role and powers concerning online content include:

Regulation of Online Ads:

- Scope: The ASA regulates online advertisements in the same way as traditional media. This includes ads on websites, social media, and other digital platforms.

- CAP Code: Online advertisers must comply with the UK Code of Non-broadcast Advertising and Direct & Promotional Marketing (CAP Code), which sets standards for accuracy and honesty.

Actions Against Non-compliant Ads:

- Adjudications: The ASA can investigate complaints about online ads and publish its adjudications. If an ad breaks the rules, the ASA can demand that it is changed or withdrawn. - Sanctions: While the ASA cannot impose legal sanctions or fines, it has various measures to enforce compliance, such as Ad Alerts to its members or the removal of paid-for search advertising. - Naming and Shaming: The ASA may resort to "naming and shaming" persistent offenders, which can damage a company's reputation.

- Working with Partners: The ASA works with search engines and social media platforms to remove problematic ads. It also works closely with other bodies, such as the FCA, to address misleading financial advertising.

Internet Oversight:

- Website Monitoring: The ASA monitors websites and can act proactively to ensure compliance with advertising standards.

- Influencer Marketing: The ASA also regulates influencer marketing, ensuring influencers and brands disclose commercial relationships clearly.

Collaboration:

- Collaborative Actions: The ASA collaborates with other regulatory bodies for enforcement. For example, it can refer repeat offenders to Trading Standards, which has the power to impose legal sanctions.

The ASA's authority extends to all forms of advertisements in the UK, including those that appear on the internet. While its powers are not legal in the sense of imposing fines or taking direct legal action, its rulings are widely respected within the industry, and there is a strong expectation for companies to comply with its decisions. Non-compliance can lead to adverse publicity, referral to Trading Standards, and potential legal action.

What are Some recent cases of successful prosecutions and enforcement actions against scammers?

The landscape of enforcement and prosecution against financial scammers is quite dynamic, with several agencies around the world actively pursuing cases. Given the international nature of many scams, cooperation across borders is often essential. As of my last update, here are some notable examples of enforcement actions and prosecutions:

United States:

Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC) Actions: - The CFTC has won cases against Ponzi schemes involving commodities and cryptocurrencies, resulting in significant restitution orders.

- The SEC frequently prosecutes cases of securities fraud, including insider trading, misrepresentation, and Ponzi schemes. In a recent high-profile case, the SEC charged individuals involved in a massive Ponzi scheme that had bilked investors of billions of dollars.

Department of Justice (DOJ) Prosecutions:

- The DOJ, often in conjunction with the FBI, regularly prosecutes financial crimes. There have been recent cases where individuals behind investment fraud schemes have been sentenced to federal prison.

United Kingdom:

Financial Conduct Authority (FCA) Enforcement:

- The FCA has taken action against unauthorised firms and individuals, including fines and securing injunctions to prevent further illegal activity. For instance, the FCA has successfully pursued individuals who carried out Forex scams.

Action Fraud and National Economic Crime Centre (NECC):

- Action Fraud reports on various successful actions against scammers, ranging from arrests to convictions. The NECC, which coordinates the UK's response to economic crime, has been involved in dismantling large-scale fraud networks.

European Union:

Europol Operations:

- Europol, the EU's law enforcement agency, facilitates the sharing of information between national police forces. They have supported operations that have taken down cybercrime infrastructures and arrested individuals involved in investment scams.

Australia:

Australian Securities and Investments Commission (ASIC) Actions:

- ASIC often takes enforcement actions against fraudulent financial services, including superannuation (pension) scams, investment fraud, and binary options scams.

International:

Interpol Operations:

- Interpol coordinates international operations against cybercrime, including online scams and financial fraud. They've been instrumental in global operations that have led to the arrest of individuals behind investment and romance scams.

These are just a few examples, and they do not cover the full extent of ongoing efforts to combat financial fraud. It's worth noting that due to the complexity of these cases and the requirement for due process, successful prosecutions can take a considerable amount of time from the initial investigation to the final verdict and sentencing. Enforcement agencies worldwide are improving their strategies and cooperation to address the evolving tactics of scammers.

There were several high-profile cases of enforcement actions against financial fraud and scams. Here are some specific examples:

United States:

Bernie Madoff's Ponzi Scheme:

- Perhaps the most infamous, Bernie Madoff was convicted in 2009 for running a Ponzi scheme considered to be the largest in world history, with estimated losses around $65 billion. Madoff was sentenced to 150 years in prison and passed away in 2021.

Elizabeth Holmes and Theranos:

- Elizabeth Holmes, the founder of the now-defunct biotech company Theranos, was charged by the SEC with an "elaborate, years-long fraud" in 2018 for misleading investors, policymakers, and the public about the efficacy of Theranos's blood-testing technologies. She was found guilty on multiple counts in January 2022.

United Kingdom:

Binary Options Scam:

- In 2019, Lee Elbaz, the CEO of a binary options trading company called Yukom Communications, was convicted in the U.S. for her involvement in a scheme that defrauded global investors, including from the UK, of $145 million. The case was a result of an international investigation.

London Capital & Finance (LCF):

- The FCA conducted an investigation into the collapse of LCF, which resulted in losses of £237 million for 11,600 investors. In 2021, the UK government announced it would establish a compensation scheme for affected LCF bondholders.

Australia:

Westpac Banking Corporation Fine:

- In 2020, Westpac, one of Australia's largest banks, agreed to pay a record 1.3 billion Australian dollar fine to settle the country's largest breach of money laundering and terrorism financing laws.

International:

Wirecard Scandal:

- German payment processor and financial services provider Wirecard AG collapsed after revealing that €1.9 billion supposedly held in trustee accounts did not exist. The scandal led to the arrest of several executives and ongoing investigations in several countries.

OneCoin Cryptocurrency Scam:

- OneCoin, which operated as a cryptocurrency Ponzi scheme, was investigated by multiple countries. In 2019, US prosecutors charged one of the leaders of the scam, which had generated approximately $4 billion in revenue from investors worldwide.

These cases illustrate the international nature of financial fraud and the collaborative efforts required for successful prosecutions. They also highlight the significant impact such crimes can have on investors and the importance of regulatory oversight and legal enforcement to maintain trust in financial systems. It's important to note that the legal landscape is always changing, and new cases emerge regularly as enforcement agencies crack down on financial crimes.

What do the industry experts working towards making the investment landscape safer think?

Certainly, industry experts and advocates often provide insights into the importance of making the investment landscape safer for investors. Here is a quote from a notable figure in the financial industry:

Andrew Bailey, Governor of the Bank of England (former Chief Executive of the Financial Conduct Authority), has been vocal about investor protection:

"The best protection we can offer to investors is a system of regulation and oversight that holds financial actors to high standards and that punishes wrongdoing severely. It is through diligent regulation and a culture of compliance that we can ensure the integrity of our financial system. We must be constantly vigilant, as the nature of financial scams is ever-evolving, and our actions need to adapt to effectively counter them."

— Andrew Bailey

This quote captures the ongoing efforts required to safeguard the investment landscape and the crucial role of regulatory bodies in maintaining high standards and integrity within the financial system.

Conclusion:

Top of Page

The rise of Quantum AI Boiler Room Scams is a concerning trend, particularly for young people seeking to capitalize on emerging technologies. By being vigilant and informed, individuals can protect themselves from falling victim to these scams. Remember to question suspicious offers, conduct thorough research, and seek advice from trusted sources. Together, we can fight against unregulated brokers and scams, making the investment landscape a safer place for all.

If you or someone you know has been a victim of a Quantum AI Boiler Room Scam, report it immediately to the authorities and share your experience in the comments below. Help us raise awareness and protect others from falling into the same trap.