Navigating the World of Cryptocurrency Trading

I. Introduction

Top of Page

A. Overview of the cryptocurrency market

-

Market Overview: The cryptocurrency market is a digital asset space where cryptocurrencies like Bitcoin, Ethereum, and many others are traded. It's known for its high volatility, with prices fluctuating significantly within short periods.

-

Major Cryptocurrencies:

- Bitcoin (BTC): The first and most well-known cryptocurrency, often referred to as digital gold. Bitcoin is seen as a store of value and a hedge against traditional financial systems.

- Ethereum (ETH): Known for its smart contract functionality, Ethereum is a platform for building decentralized applications (dApps).

- Other notable cryptocurrencies include Ripple (XRP), Litecoin (LTC), Cardano (ADA), and more, each with unique features and uses.

-

Market Trends: The market has seen considerable growth, especially in the adoption of cryptocurrencies for both investment and practical uses. However, it has also experienced significant downturns, highlighting its speculative nature.

-

Technological Innovations:

- Blockchain Technology: Cryptocurrencies operate on blockchain technology, a decentralized ledger that records all transactions.

- DeFi (Decentralized Finance): An emerging area in the crypto space, DeFi aims to recreate traditional financial systems, like banks and exchanges, with decentralized technologies.

- NFTs (Non-Fungible Tokens): These unique digital tokens represent ownership of specific items and have become popular for digital art and collectibles.

-

Regulatory Environment: The regulatory landscape for cryptocurrencies varies globally. Some countries embrace them, while others have imposed restrictions or outright bans. Regulation remains a key area of uncertainty and development.

-

Investment and Trading: Cryptocurrency trading occurs on various exchanges, offering opportunities for investment and speculation. The market is attractive to investors for its potential high returns, but it also carries high risk.

-

Adoption and Integration: More businesses are accepting cryptocurrencies as payment. Integration into traditional financial systems is increasing, with financial products like Bitcoin ETFs being introduced.

-

Risks: The market is prone to risks including price volatility, regulatory changes, technological vulnerabilities, and market manipulation. Investors are advised to exercise caution and conduct thorough research.

-

Future Outlook: The market is evolving with advancements in technology and growing interest from both retail and institutional investors. The long-term outlook is often debated, with some viewing cryptocurrencies as the future of money and others as speculative bubbles.

In summary, the cryptocurrency market is a rapidly evolving space characterized by innovation, volatility, and a shifting regulatory landscape. While it presents opportunities for investment and the transformation of traditional financial systems, it also carries significant risks that should be carefully considered.

What does Trading Cyptocurrency Involve?

Trading cryptocurrencies involves buying, selling, and exchanging digital currencies through various platforms, often with the goal of profiting from market fluctuations. Here's an overview of cryptocurrency trading and some common tactics used:

-

Platforms for Trading:

- Exchanges: Platforms like Binance, Coinbase, and Kraken allow users to trade cryptocurrencies. They offer different trading pairs (e.g., BTC/USD, ETH/BTC).

- Brokerages: Some traditional brokerage firms now offer cryptocurrency trading.

- Decentralized Exchanges (DEXs): Platforms that allow peer-to-peer trading without intermediaries, like Uniswap or Sushiswap.

-

Types of Trading:

- Spot Trading: Buying or selling cryptocurrencies at current market prices for immediate settlement.

- Margin Trading: Trading with leverage, allowing traders to borrow funds to increase potential returns (and risks).

- Futures and Options Trading: Derivative products that derive value from the underlying cryptocurrency, used for hedging or speculative purposes.

-

Trading Strategies:

- Day Trading: Involves making multiple trades within a single day to exploit short-term market movements.

- Swing Trading: Holding positions for several days or weeks to capitalize on expected upward or downward market shifts.

- Scalping: A strategy that involves making dozens or hundreds of trades in a single day to 'scalp' a small profit from each trade.

-

Technical Analysis:

- Traders use charts, patterns, and various indicators (like moving averages, Relative Strength Index, MACD) to predict future price movements.

- Technical analysis involves studying market trends, volume, and price graphs to make informed decisions.

-

Fundamental Analysis:

- This involves evaluating a cryptocurrency's value based on factors like technology, team, market trends, and news events.

- Investors might consider the long-term potential and underlying value of a cryptocurrency.

-

Risk Management:

- Setting Stop Loss and Take Profit orders to automatically close a trade at a predetermined price to manage losses and protect gains.

- Diversification across various cryptocurrencies to spread risk.

-

Automated Trading:

- Bots and automated trading systems can execute trades based on set criteria, allowing for a more hands-off approach to trading.

- Caution is advised as these systems require monitoring and can be risky.

-

Staying Informed and Continuous Learning:

- Keeping up with news, understanding regulatory changes, and staying informed about technological advancements in the crypto world.

- Continuous learning is vital due to the rapidly evolving nature of the cryptocurrency market.

-

Psychological Aspects:

- Emotional control is crucial; market volatility can lead to impulsive decisions driven by fear or greed.

-

Regulatory and Security Considerations:

- Being aware of the legal implications in your jurisdiction.

- Ensuring robust security practices to safeguard your investment.

In summary, cryptocurrency trading encompasses a wide range of strategies and approaches, each with different levels of risk and potential reward. Successful trading often requires a combination of market knowledge, analytical skills, disciplined risk management, and an understanding of the technological and regulatory landscape. As with any form of trading, there's no guaranteed profit, and it's essential to approach cryptocurrency trading with caution and informed decision-making.

What does it Mean to Trade Crypto on CFDs?

Trading cryptocurrencies with Contracts for Difference (CFDs) is a popular method that allows traders to speculate on the price movement of cryptocurrencies without actually owning the underlying digital assets. Here's what it means to trade crypto with CFDs:

-

Definition of CFDs:

- CFDs are financial derivative products that enable traders to speculate on price movements (up or down) of an asset.

- In a CFD, a trader agrees to exchange the difference in the price of a cryptocurrency from when the contract is opened to when it is closed.

-

Not Owning the Asset:

- When trading crypto CFDs, you're not buying or selling the actual cryptocurrency. Instead, you're trading on its price movement.

- This means there's no need to deal with a digital wallet or the security concerns associated with storing cryptocurrencies.

-

Leverage:

- CFDs are often traded on margin, meaning traders can open a larger position with a relatively small amount of capital (known as leverage).

- While leverage can amplify profits, it also increases the risk of losses, potentially exceeding the initial investment.

-

Going Long or Short:

- Trading CFDs allows you to take both long (buy) and short (sell) positions.

- If you believe the price of a cryptocurrency will rise, you go long. If you think it will fall, you go short.

-

Profit and Loss:

- Profits or losses are determined by the difference between the price at which the CFD is opened and the price at which it's closed.

- The amount of profit or loss depends on the position size and the magnitude of the price movement.

-

Risks:

- CFD trading involves significant risks, especially due to the volatile nature of cryptocurrency markets and the impact of leverage.

- It's crucial to understand the risks and employ strict risk management strategies.

-

Costs and Fees:

- Traders should be aware of the costs involved in CFD trading, such as spreads, overnight holding fees (swap rates), and commission fees.

-

Regulatory Aspects:

- The availability and regulation of cryptocurrency CFDs vary by country. Some countries have restrictions or specific regulations regarding CFD trading.

-

Suitability for Experienced Traders:

- Due to its complexity and risk, trading crypto CFDs is generally more suitable for experienced traders who understand the market dynamics and can effectively manage risk.

In conclusion, trading crypto with CFDs offers a way to speculate on cryptocurrency prices without owning the actual coins, with the flexibility to profit from both rising and falling markets. However, the use of leverage and the inherent risks involved make it essential for traders to approach CFD trading with caution, knowledge, and a solid understanding of risk management.

B. Introduction to Bitcoin Evolution as a trading platform

Bitcoin Evolution is a trading platform that has garnered attention in the cryptocurrency market for its automated trading features. It is designed to cater to both new and experienced traders interested in Bitcoin and other cryptocurrencies. Here's an introduction to Bitcoin Evolution:

Overview of Bitcoin Evolution

-

Purpose: Bitcoin Evolution is a platform aimed at simplifying the trading process in the volatile cryptocurrency market. It's particularly noted for its automated trading system, which is intended to assist traders in making informed decisions in real-time.

-

Technology: The platform employs advanced algorithms and artificial intelligence (AI) to analyze market trends and data. This technology enables it to execute trades on behalf of its users, aiming to capitalize on profitable opportunities in the crypto market.

-

User-Friendly Interface: Designed with user accessibility in mind, Bitcoin Evolution offers an interface that is easy to navigate, making it suitable for those new to cryptocurrency trading, as well as more experienced traders.

-

Automated and Manual Trading Options: While the platform is known for its automated trading features, it also provides options for manual trading, giving users control over their trading activities.

Key Features

-

Speed and Efficiency: The platform claims to perform market analysis and execute trades faster than traditional trading methods, a crucial factor in the fast-paced world of cryptocurrency trading.

-

Risk Management Tools: Bitcoin Evolution includes features that allow users to set their risk parameters, which can help manage and potentially minimize losses in volatile market conditions.

-

Demo Account: Many users appreciate the demo account feature, which allows them to get familiar with the platform and its functionalities without risking real money.

-

Accessibility and Convenience: Being an online platform, Bitcoin Evolution can be accessed from various devices, offering convenience and the ability to trade on the go.

Considerations

-

Market Risks: Despite the automated nature of the platform, trading in cryptocurrencies carries inherent risks due to market volatility. Users should be aware that profits are not guaranteed.

-

Regulatory Status: As with any crypto trading platform, it's important to consider the regulatory environment in your country. The legality and regulation of such platforms can vary.

-

Due Diligence: Prospective users should conduct thorough research and due diligence before engaging with the platform, including reading user reviews and understanding the terms of service.

In summary, Bitcoin Evolution presents itself as an automated trading platform designed to make cryptocurrency trading more accessible and efficient. Its combination of AI-driven market analysis and user-friendly interface appeals to a range of traders. However, the usual caveats of cryptocurrency trading – including market risk and regulatory considerations – apply.

C. Purpose of the article: Exploring how one can potentially make money through Bitcoin Evolution

Exploring the potential to make money through Bitcoin Evolution or any automated cryptocurrency trading platform, requires a cautious, well-informed, and strategic approach. Here are key steps and considerations:

-

Understand the Platform:

- Research: Thoroughly research Bitcoin Evolution. Understand how it works, its features, and its track record.

- Technology: Investigate the technology behind the platform, such as the algorithms and AI it claims to use for trading decisions.

-

Assess Credibility:

- Reviews and Testimonials: Look for reviews and testimonials from other users. Be wary of overly positive or promotional reviews which may not be impartial.

- Transparency: Evaluate the transparency of the platform regarding fees, risks, and trading strategies.

-

Start with a Demo Account:

- Before investing real money, use a demo account (if available) to get a feel for how the platform works and to test its effectiveness without financial risk.

-

Educate Yourself About Cryptocurrency Trading:

- Market Knowledge: Understand the cryptocurrency market dynamics, including factors that influence prices.

- Trading Strategies: Learn about different trading strategies and how they might be employed in an automated system.

-

Risk Management:

- Investment Amount: Only invest money that you can afford to lose. Cryptocurrency markets are volatile and can result in significant losses.

- Set Limits: Use risk management tools provided by the platform, like stop-loss orders, to protect your investment.

-

Monitor Performance:

- Even with automated systems, it's important to regularly monitor the performance and make adjustments as necessary.

-

Stay Informed:

- Keep abreast of the latest news in the cryptocurrency world as market sentiment can quickly change.

-

Understand the Legal and Tax Implications:

- Be aware of the legal status of cryptocurrency trading in your jurisdiction and understand the tax implications.

-

Be Skeptical of Promises:

- Be cautious of any platform that promises guaranteed returns. In trading, there are no guarantees.

-

Plan an Exit Strategy:

- Have a clear idea of when and how you will exit your positions, whether in profit or loss.

-

Consider Professional Advice:

- If unsure, consider seeking advice from a financial advisor who understands cryptocurrencies.

In summary, making money through platforms like Bitcoin Evolution involves understanding the platform's mechanisms, staying informed about the cryptocurrency market, managing risks effectively, and maintaining realistic expectations about potential profits and losses. Always approach with caution and prioritize preserving your capital.

II. Understanding Bitcoin Evolution

Top of Page

A. What is Bitcoin Evolution?

Bitcoin Evolution is an online trading platform that is marketed as specializing in automated cryptocurrency trading. It's designed to enable users, both beginners and experienced traders, to potentially earn profits from cryptocurrency trading by using advanced algorithms and artificial intelligence (AI) to make trading decisions. Here are some key aspects of Bitcoin Evolution:

-

Automated Trading: One of the main features of Bitcoin Evolution is its automated trading system. The platform uses algorithms to analyze market trends and execute trades based on this analysis, which is purported to help in making profitable trades.

-

User-Friendly Interface: It's designed to be accessible to traders of all experience levels, with a user-friendly interface that simplifies the trading process.

-

Market Analysis: The platform claims to use AI and machine learning technologies to scan and analyze the cryptocurrency market for profitable trading opportunities.

-

Speed and Efficiency: Bitcoin Evolution often claims to conduct trades faster than traditional manual trading methods, which is a significant aspect given the high volatility in the cryptocurrency market.

-

Risk Management Tools: It typically offers tools for setting stop-loss limits and determining trading amounts, which can help manage and potentially reduce risks.

-

Demo Trading Feature: Some versions of the platform offer a demo trading feature, allowing users to practice trading without risking real money.

-

Low Initial Deposit: It's often advertised that you can start trading with a relatively low initial deposit, making it accessible to a wider range of investors.

-

Variety of Cryptocurrencies: While focused on Bitcoin, the platform usually offers trading in various other cryptocurrencies as well.

-

High Success Claims: The platform often advertises high success rates and profits, but these claims should be approached with caution, as all trading involves risk, and returns can never be guaranteed.

It's important to note that while automated trading platforms like Bitcoin Evolution can offer convenience and an advanced approach to trading, they also come with risks. The cryptocurrency market is highly volatile, and automated systems can't always predict market movements accurately. Potential users should conduct thorough research, understand the risks involved, and consider their financial situation and trading experience before using such platforms. Additionally, be aware of the regulatory status of cryptocurrency trading in your jurisdiction.

B. How does the platform work?

Bitcoin Evolution, like many automated cryptocurrency trading platforms, works by leveraging algorithms and technology to facilitate trading in the cryptocurrency market. Here's an overview of how the platform generally operates:

-

Registration and Account Setup:

- Users begin by creating an account on the platform, providing necessary details as required.

- Verification processes may be involved to comply with regulatory standards, depending on the platform and jurisdiction.

-

Initial Deposit:

- To start trading, users are typically required to make an initial deposit. This amount varies but is often relatively low to encourage new traders.

-

Automated Trading Algorithms:

- The platform employs algorithms that analyze the cryptocurrency market to identify potentially profitable trading opportunities.

- These algorithms are designed to scan the market, interpret data, and execute trades based on predefined criteria and market analysis.

-

Use of Artificial Intelligence and Machine Learning:

- Bitcoin Evolution claims to use AI and machine learning to improve the accuracy of its market analysis and trading decisions.

- This technology purportedly enables the platform to learn from market trends and adjust strategies accordingly.

-

User Settings and Customization:

- Users can typically customize certain settings, such as risk levels, investment amounts, and which cryptocurrencies to trade.

- These settings guide the automated system on how to execute trades on behalf of the user.

-

Demo Trading Feature:

- Many platforms, including Bitcoin Evolution, offer a demo trading mode, allowing users to practice and get familiar with the system without risking real money.

-

Live Trading:

- Once the user is comfortable, they can switch to live trading, where the system starts to make real trades based on the user’s settings and its market analysis.

- Trades are executed automatically, requiring minimal user intervention.

-

Withdrawals and Deposits:

- Users can deposit additional funds or withdraw their earnings as per the platform's guidelines and procedures.

-

Monitoring and Adjusting:

- While the system operates automatically, it's advisable for users to monitor their accounts regularly and adjust settings as needed based on market changes or personal preferences.

-

Risk Management Tools:

- The platform may offer risk management tools like stop-loss orders, which help users protect against significant losses in volatile market conditions.

It's important to emphasize that while Bitcoin Evolution and similar platforms offer automated trading, they do not guarantee profits. The cryptocurrency market is inherently volatile and unpredictable, so there's always a risk of loss. Users should approach such platforms with caution, understand the risks involved, and consider their level of trading experience and financial capacity before engaging in trading activities.

C. Key features of Bitcoin Evolution

Bitcoin Evolution, as an automated cryptocurrency trading platform, typically offers several key features designed to attract users ranging from beginners to experienced traders. These features focus on simplifying the trading process and enhancing the potential for profitability. Here are some of the main features commonly associated with Bitcoin Evolution:

-

Automated Trading System:

- The platform's core feature is its automated trading system, which uses algorithms to analyze the market and make trades on behalf of the user.

-

Advanced Algorithmic Technology:

- Utilizes advanced algorithms, often claimed to be powered by artificial intelligence (AI) and machine learning, to scan and analyze market trends for profitable trading opportunities.

-

User-Friendly Interface:

- Designed to be accessible and easy to navigate, even for those with no prior experience in cryptocurrency trading.

-

High-Speed Trading:

- The platform often claims to execute trades faster than traditional manual trading methods, a crucial feature given the rapid price movements in the cryptocurrency market.

-

Demo Trading Account:

- A demo account feature allows users to practice trading with virtual funds, enabling them to get familiar with the platform and its functionalities without risking real money.

-

Risk Management Tools:

- Provides tools to help manage trading risks, such as setting stop-loss limits, which can be crucial in the volatile cryptocurrency market.

-

Multiple Cryptocurrencies:

- While focused on Bitcoin, the platform usually supports trading in various other cryptocurrencies, broadening trading opportunities.

-

Low Minimum Deposit:

- Typically requires a relatively low initial deposit to start trading, making it accessible to a wide range of potential investors.

-

Accessibility:

- Often accessible from various devices, including desktops and mobile phones, offering convenience and flexibility for on-the-go trading.

-

Customer Support:

- Provides customer support services to assist users with any queries or issues they might encounter.

-

Withdrawal System:

- Often features a straightforward and quick withdrawal process, allowing users to access their funds with relative ease.

It's important to note that while these features can be appealing, especially to those new to cryptocurrency trading, potential users should approach with caution. The high volatility of the cryptocurrency market and the risks inherent in automated trading systems require a careful and informed approach. Users should thoroughly research the platform, understand the risks involved, and consider their personal financial situation before engaging in trading. Additionally, skepticism is advisable regarding any platform that promises guaranteed returns, as such outcomes can never be assured in the world of trading.

D. The technology behind the platform (e.g., algorithms, AI-based trading)

Bitcoin Evolution, like many automated cryptocurrency trading platforms, reportedly utilizes a combination of sophisticated algorithms and artificial intelligence (AI) to enable trading. Here's an overview of the technology typically claimed to be behind such platforms:

-

Advanced Algorithms:

- The platform uses complex algorithms designed to scan the cryptocurrency market continuously.

- These algorithms analyze vast amounts of market data to identify potential trading opportunities based on predefined criteria.

-

Artificial Intelligence (AI) and Machine Learning:

- AI is a significant component, enabling the system to make intelligent decisions. AI algorithms can process and analyze data at a scale and speed far beyond human capability.

- Machine learning, a subset of AI, allows the system to learn from market trends and historical data. This means the platform can potentially improve its trading strategies based on past outcomes and market behavior.

-

Market Analysis and Prediction:

- The algorithms perform technical analysis, which involves analyzing statistical trends gathered from trading activity, such as price movement and volume.

- They can also be programmed for fundamental analysis, which considers external factors like news events, market sentiment, economic indicators, and more.

-

High-Frequency Trading (HFT):

- The Bitcoin Evolution technology may enable high-frequency trading, where the system executes a large number of trades at high speeds. This is particularly useful in exploiting small price gaps and fluctuations in the cryptocurrency market.

-

Risk Management and Optimization:

- The algorithms can include risk management protocols, helping to minimize potential losses by setting stop-loss orders and managing trade sizes.

- Optimization techniques ensure that the trading strategy remains effective under different market conditions.

-

Integration with Crypto Exchanges:

- The platform’s technology is integrated with various cryptocurrency exchanges to facilitate real-time trading.

- This integration allows for the execution of trades directly on the exchange, based on the signals generated by the platform’s algorithms.

-

User Customization and Settings:

- While the trading is automated, users typically have options to customize certain parameters, like setting risk levels, choosing which cryptocurrencies to trade, and determining the amount of capital to allocate to each trade.

-

Security Protocols:

- Secure technology practices are essential to protect user data and funds. This includes encryption protocols and secure communication channels.

It's important to note that while the technology behind platforms like Bitcoin Evolution is often marketed as highly advanced and capable of generating profits, trading in cryptocurrencies is inherently risky and complex. The effectiveness of these technologies can vary, and their past performance is not always indicative of future results. Therefore, potential users should approach with caution, fully aware of the risks involved, and should not invest more than they can afford to lose. Additionally, users should conduct thorough research and due diligence to verify the platform's claims before engaging in trading activities.

III. The Process of Trading on Bitcoin Evolution

Top of Page

A. Setting up an account

Setting up an account on a platform like Bitcoin Evolution generally follows a straightforward process. While the exact steps might vary slightly from one platform to another, here is a general guide on how you can set up an account:

-

Visit the Official Website:

- Start by visiting the official Bitcoin Evolution website. Be cautious and ensure you are on the correct site, as there can be fake sites mimicking the real one.

-

Registration Form:

- On the homepage, you'll typically find a registration form. You will need to fill in basic information such as your name, email address, and phone number.

- Ensure that the information you provide is accurate, as it might be used for verification purposes.

-

Account Verification:

- After submitting the registration form, you may need to verify your email address and/or phone number through a verification link or code sent to your email or SMS.

- Some platforms may require additional verification steps to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This might include submitting identification documents like a passport or driver’s license.

-

Creating a Secure Password:

- You will likely be prompted to create a password for your account. Choose a strong and unique password to ensure the security of your account.

-

Initial Deposit:

- To start trading, you will need to make an initial deposit. Check the platform's minimum deposit requirement, which is often relatively low.

- The platform should provide various payment methods for depositing funds, such as credit/debit cards, bank transfers, or e-wallets.

-

Setting Up Trading Parameters:

- Once your account is funded, you can set up your trading parameters. This includes setting risk levels, the amount to invest in each trade, and any specific cryptocurrencies you wish to trade.

- For beginners, it's advisable to start with minimum investments and conservative trading settings.

-

Accessing the Demo Account:

- If the platform offers a demo account, it's a good idea to start with that. A demo account allows you to practice trading with virtual money and understand how the platform works without any financial risk.

-

Starting to Trade:

- After familiarizing yourself with the platform using the demo account, you can begin live trading.

- Keep in mind that automated trading platforms carry risks, and it’s important to monitor your account regularly.

-

Customer Support:

- If you encounter any issues or have questions, use the customer support provided by the platform. Reliable platforms usually offer customer support through email, phone, or live chat.

Remember, while setting up an account might be simple, trading in cryptocurrencies carries significant risks. It's crucial to understand these risks, do thorough research, and consider your financial situation before beginning to trade. Also, be wary of platforms that guarantee profits; in the world of trading, there are no guarantees.

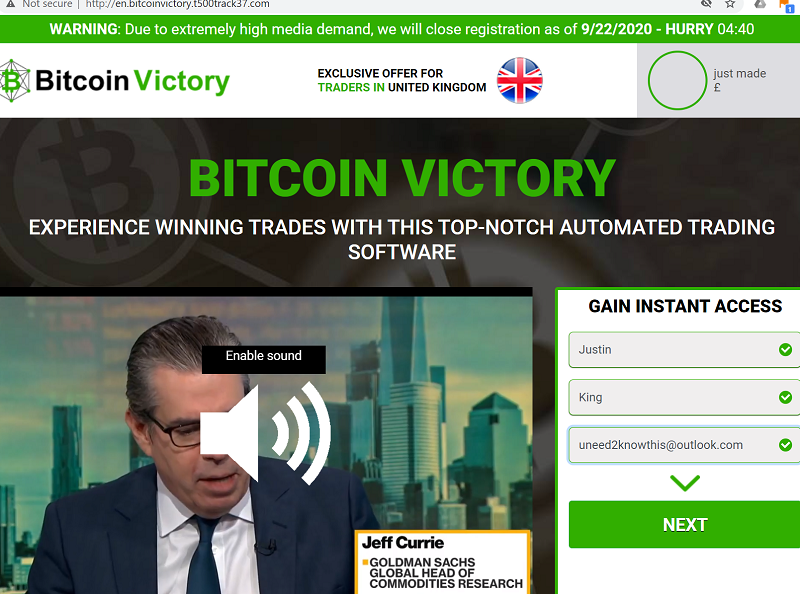

Determining the legitimacy of a website, especially for platforms like Bitcoin Evolution, can be challenging due to the presence of multiple websites claiming to be the official one. This issue is common in the cryptocurrency space, where scams and fraudulent sites are prevalent. Here are steps to help you identify the real or more authentic website:

-

Online Research:

- Conduct thorough online research. Look for reviews or discussions about Bitcoin Evolution on reputable financial news websites, forums, and trusted cryptocurrency blogs.

-

Website Security:

- Check for website security features. A legitimate website should have an SSL certificate, indicated by "https://" in the URL and a padlock icon in the address bar.

-

Contact Information and Support:

- A genuine website usually provides clear contact information, like an email address, phone number, or live chat support. Check if the contact details are legitimate and responsive.

-

User Reviews and Testimonials:

- Look for user reviews and testimonials about the website. Be cautious, as some reviews might be fake or paid promotions. Independent review sites or financial forums can be more reliable sources.

-

Consistency in Information:

- Compare the information provided on different websites. The real website should have consistent, detailed, and professional content regarding how the platform works, its features, and trading processes.

-

Check for Red Flags:

- Be wary of websites that promise guaranteed returns or those that pressure you to make quick decisions. These are common tactics used by scam websites.

-

Regulatory Compliance:

- Check if the website mentions any compliance with financial regulations or provides information about its regulatory status. Legitimate trading platforms often provide such information.

-

Domain Age and History:

- Use tools like WHOIS to check the domain age and history. A newly created domain might be a red flag, whereas a long-standing domain could indicate legitimacy.

-

Professional Design and Functionality:

- The website should have a professional design, be easy to navigate, and function correctly without broken links or errors.

-

Social Proof and Media Coverage:

- Look for social proof and media coverage. An authentic platform might be mentioned in news articles or have a social media presence.

If you're still unsure about which website is the official one, exercise caution and perhaps seek advice from financial advisors or experienced traders in the cryptocurrency field. Remember, when it comes to online trading and investment, it's better to be overly cautious than to risk falling victim to a scam.

B. Understanding the user interface

Understanding the user interface (UI) of a trading platform like Bitcoin Evolution is crucial for effective navigation and trading. A well-designed UI should be intuitive, user-friendly, and provide easy access to all necessary features for trading. Here’s a guide to understanding the typical UI of such platforms:

-

Dashboard/Main Interface:

- Upon logging in, you'll usually be directed to a dashboard. This is the central hub where you can view your account balance, active trades, and market trends.

- The dashboard might also display key performance indicators such as your trading history, success rate, and current market conditions.

-

Trading Area:

- The trading section is where you execute trades. Here, you should see options to select different cryptocurrencies, set trade amounts, and initiate buy or sell orders.

- In automated platforms like Bitcoin Evolution, you may find options to activate or deactivate the auto-trading feature.

-

Market Analysis Tools:

- Look for market analysis tools, such as charts and graphs showing historical price movements, trading volumes, or other relevant financial data.

- Some platforms offer advanced charting tools with various time frames and indicators for technical analysis.

-

Account Management:

- The account or profile section typically includes personal information, deposit and withdrawal options, and settings for notifications.

- Ensure you know how to access and manage your account settings, including changing your password and setting up security features.

-

Risk Management Settings:

- Familiarize yourself with any risk management features, such as setting stop-loss limits, take-profit levels, and the amount of capital allocated per trade.

-

Educational Resources:

- Some platforms offer educational materials like tutorials, guides, or webinars. These can be particularly useful for beginners.

-

Customer Support Access:

- Identify how to access customer support, whether through live chat, email, or a support ticket system, in case you need assistance or encounter issues.

-

Demo Trading Feature:

- If a demo account is available, it’s a valuable tool to understand the UI without risking real money. Use it to familiarize yourself with various features and trading processes.

-

Notifications and Alerts:

- Check how the platform notifies you of important events like executed trades, market changes, or updates to your account.

-

Mobile App Accessibility:

- If the platform offers a mobile app, explore its interface to ensure you can manage your trades and monitor your account on the go.

Understanding the user interface in-depth will enhance your trading experience, allowing you to utilize the platform’s features effectively. Take your time to navigate through different sections, explore available tools, and read any help guides or FAQs provided. Remember, a good grasp of the UI is key to managing your trades and making informed decisions.

Is there Really an 'Autopilot' Button?

In the context of automated cryptocurrency trading platforms like Bitcoin Evolution, the term "autopilot" is often used to describe their automated trading feature. This feature allows the platform to execute trades on behalf of the user based on its algorithmic analysis of the cryptocurrency market. Here's what you need to know about this aspect:

-

Autopilot Feature:

- The "autopilot" button typically refers to a setting that, when activated, enables the platform’s trading robot to conduct trades automatically.

- This function is designed to make decisions based on predefined criteria or the platform's own algorithms without requiring manual input from the user for each trade.

-

How It Works:

- When you activate the autopilot feature, the platform's algorithms continuously scan the market for potential trading opportunities.

- Based on its analysis, the system autonomously executes buy or sell orders, aiming to capitalize on profitable market movements.

-

User Settings and Preferences:

- Before activating the autopilot, users usually have the option to set certain parameters, such as the amount to invest per trade, stop loss limits, risk levels, and which cryptocurrencies to trade.

- These settings guide the automated system on how to execute trades on the user’s behalf.

-

Benefits:

- The main advantage is convenience, as it allows for trading without the need for constant market monitoring.

- It's particularly appealing to those who may not have the time or expertise to conduct detailed market analysis and execute trades manually.

-

Considerations:

- While the autopilot feature offers convenience, it's important to remember that automated trading systems cannot guarantee profits. The cryptocurrency market is highly volatile and unpredictable.

- Users should regularly review and adjust their settings in response to market changes and personal risk tolerance.

-

Risk Management:

- Effective use of the autopilot feature involves prudent risk management. It's advisable not to invest more than you can afford to lose.

- Periodic monitoring of the account is recommended, even when using automated features, to ensure that the trading aligns with your financial goals and risk appetite.

-

Reality Check:

- Marketing materials for such platforms often tout the effectiveness of their autopilot features. However, users should approach these claims with a healthy dose of skepticism and conduct thorough research and due diligence.

In summary, while there might be an "autopilot" feature in the sense of automated trading, it's important to understand the associated risks and limitations. Relying solely on automation without understanding the market and the platform’s operation can lead to unfavorable trading outcomes. As with any form of investment, informed and cautious engagement is key.

Could an 'Autopilot' Button Really Work?

The concept of an "autopilot" button in automated cryptocurrency trading platforms, which allows for automated trading without constant user intervention, is theoretically feasible and does exist in various forms. However, whether it "really works" in the sense of consistently generating profits with minimal user input is a more complex question. Here are several factors to consider:

-

Algorithmic Trading:

- Automated trading systems use algorithms to analyze market data and execute trades. These algorithms can process vast amounts of data and execute trades faster than a human trader.

- If well-designed, these algorithms can identify and act on market opportunities based on predefined criteria or signals.

-

Market Volatility:

- The cryptocurrency market is known for its high volatility. While this can present opportunities for profit, it also comes with significant risks.

- An autopilot system might capitalize on short-term price movements, but it's also subject to the unpredictability of the market.

-

Limitations of Automation:

- No algorithm is infallible. Automated systems are based on historical data and predetermined rules; they cannot foresee every market scenario or external factor influencing the market (like regulatory news or technological breakthroughs).

- Emotional trading is eliminated, which can be both a strength and a weakness. Human traders might pick up on subtleties or contextual cues that an algorithm might miss.

-

Risk Management:

- Successful trading often involves effective risk management, which can be partially programmed into an autopilot system (like setting stop-loss orders).

- However, users should actively manage their risk settings and not rely solely on the system's default configurations.

-

User Involvement:

- While the system can operate on autopilot, user oversight is advisable. Regular monitoring and adjustments based on market conditions and personal risk tolerance can be crucial.

-

Claims vs. Reality:

- Some platforms make exaggerated claims about the success rates and profitability of their autopilot systems. It's essential to approach these claims with skepticism.

- Profits are never guaranteed in trading, regardless of the system or technology used.

-

Regulatory and Ethical Considerations:

- The regulatory landscape for automated trading systems, especially in cryptocurrencies, can be complex and varies by region.

- Ethical considerations, like the transparency of the system's operations and the security of user funds, are also important.

In summary, while an autopilot feature in a cryptocurrency trading like Bitcoin Evolution platform can function and potentially execute profitable trades, its effectiveness is subject to the complexities of the market, the limitations of the algorithms, and the need for occasional human oversight. Users should not view autopilot systems as a surefire way to generate profits but rather as a tool that, when used wisely and cautiously, can be part of a broader trading strategy.

Could it Really Trade with a Known Reliability?

The idea of an automated trading system, like the "autopilot" feature in platforms such as Bitcoin Evolution, trading with known reliability is both appealing and challenging. While these systems can potentially offer consistent trading actions based on programmed algorithms, the concept of "known reliability" in the highly volatile and unpredictable cryptocurrency market is more complex. Here's a breakdown of the considerations:

-

Algorithmic Efficiency:

- Automated trading systems use algorithms designed to analyze market trends and execute trades based on set criteria. When these algorithms are well-designed, they can efficiently process market data and make trades at opportune moments.

- However, the effectiveness of these algorithms largely depends on their programming, the quality of the market analysis, and their ability to adapt to changing market conditions.

-

Market Volatility:

- Cryptocurrency markets are notoriously volatile, with prices often experiencing rapid and significant fluctuations. This volatility presents both opportunities and risks for automated trading systems.

- While algorithms can capitalize on certain predictable patterns, they may not always accurately predict or cope with sudden market changes or extraordinary events.

-

Historical Data vs. Future Performance:

- Trading algorithms are typically based on historical market data and trends. While past data can provide insights, it is not always a reliable indicator of future market behavior.

- Financial markets are influenced by a myriad of factors, including economic indicators, political events, and investor sentiment, many of which are unpredictable and can diverge from historical patterns.

-

Risk Management:

- Reliable trading systems incorporate risk management strategies, like setting stop-loss limits, to help protect investments from significant losses.

- However, risk management cannot guarantee profits or completely prevent losses, especially in a market as unpredictable as cryptocurrencies.

-

Claims of High Success Rates:

- Many automated trading platforms claim extremely high success rates and profitability. It's critical to approach these claims with a healthy dose of skepticism.

- Transparency about the platform's performance history and independent verifications can provide more confidence, but they still don't guarantee future results.

-

Need for Oversight:

- Even with automated systems, human oversight is important. Traders should regularly review their trading strategies, adjust settings as needed, and stay informed about market conditions.

- Total reliance on autopilot for trading decisions can be risky, especially for those who do not fully understand the underlying trading strategies or the crypto market.

-

Regulatory and Security Aspects:

- The regulatory environment for cryptocurrencies and automated trading systems varies by region and can impact the operation and reliability of these systems.

- Security is also a crucial concern, as the platform needs to protect user data and funds.

In conclusion, while automated cryptocurrency trading systems can offer a level of consistency in executing trades based on their programming, the notion of "known reliability" in terms of consistent profitability is not straightforward. The unpredictable nature of the crypto market, coupled with the limitations of algorithmic trading, means that such systems should be used cautiously and with realistic expectations. As with any investment, there is no substitute for personal diligence and informed decision-making.

If it Claims o Autotrade with a 99.4% Accuracy, is that BS?

A claim of 99.4% accuracy in auto-trading, especially in the context of the highly volatile and unpredictable cryptocurrency market, is highly suspect and should be approached with a significant degree of skepticism. Here's why:

-

Market Volatility: The cryptocurrency market is known for its extreme volatility. Prices can fluctuate wildly within short periods due to various factors, including market sentiment, regulatory news, technological developments, and macroeconomic trends. This inherent unpredictability makes consistently accurate trading, as suggested by a 99.4% success rate, extremely unlikely.

-

Algorithm Limitations: While trading algorithms can process vast amounts of data and identify patterns faster than humans, they are not infallible. They operate based on predefined parameters and historical data, which may not always predict future market behaviors accurately. Algorithms also can't fully account for unexpected market events or changes in regulatory environments.

-

Marketing Gimmicks: Extraordinarily high success rates are often used as marketing tactics to attract users. In the world of investment and trading, whether traditional or crypto-based, such levels of accuracy are implausible. Professional traders and investment firms with access to sophisticated tools and market insights do not achieve such high success rates.

-

Risk of Overfitting: In algorithmic trading, there's a risk known as "overfitting," where a model is excessively fine-tuned to historical data, performing well on past data but poorly on new, unseen data. A claimed accuracy rate of 99.4% raises the question of whether the system's algorithms have been overfitted.

-

Lack of Independent Verification: Claims made by trading platforms should ideally be verified by independent third parties. Without transparent, independent verification of these claims, they remain unverified and potentially misleading.

-

Regulatory Warnings: Regulatory bodies in various countries have issued warnings about high-yield investment programs and platforms promising unrealistic returns. Such claims are often associated with high risks, scams, or fraudulent activities.

In conclusion, a claim of 99.4% accuracy in auto-trading should be treated with skepticism. It's important to conduct thorough research, seek independent reviews and analyses, and understand the risks involved in using such platforms. As a rule of thumb in investing and trading, if something sounds too good to be true, it usually is. Remember, successful trading and investment require a balanced approach, realistic expectations, and an understanding of the risks involved.

Wouldn't Such a Claim Make a Real Company Highly Vulnerable?

Indeed, a claim of near-perfect accuracy in trading, such as a 99.4% success rate, would make a legitimate company highly vulnerable for several reasons:

-

Regulatory Scrutiny:

- Financial regulators closely monitor investment and trading platforms for misleading or deceptive claims. A company asserting such a high level of accuracy is likely to attract the attention of regulatory bodies, potentially leading to investigations and sanctions if the claims are found to be unsubstantiated or misleading.

-

Legal Risks:

- Promising extremely high success rates can lead to legal risks, including lawsuits or legal action from users who feel misled, especially if they incur significant losses based on these claims.

- Consumer protection laws in many jurisdictions are designed to guard against false advertising and deceptive business practices, which can include unrealistic claims about investment returns.

-

Reputational Damage:

- If a company fails to deliver on its lofty promises, it risks significant reputational damage. In the investment world, reputation and trust are crucial. Once lost, they are hard to regain.

- Negative reviews, word of mouth, and public criticism can have a lasting impact on a company's credibility and its ability to attract and retain customers.

-

Market Skepticism:

- Experienced traders and investors are generally skeptical of extraordinary claims due to their understanding of market volatility and risks. Such claims might lead to a loss of credibility among knowledgeable market participants.

- This skepticism could deter a more informed and savvy clientele, limiting the company's appeal to a broader, more discerning customer base.

-

Internal Pressure:

- Maintaining a near-perfect success rate is virtually impossible in the long term, especially in markets as volatile as cryptocurrencies. This puts immense pressure on the company to continuously perform at these levels, which may not be sustainable.

-

Ethical Considerations:

- Ethical business practices involve providing accurate and realistic information to customers. Overstating capabilities can reflect poorly on a company's ethics and corporate responsibility.

In summary, while sensational claims might attract initial interest or publicity, they can lead to significant regulatory, legal, and reputational risks, especially if they are not based on factual and verifiable information. Legitimate companies usually adopt a more cautious and realistic approach in their communications, focusing on potential rather than guaranteed outcomes, and highlighting the inherent risks involved in trading and investment.

When a platform like Bitcoin Evolution or similar trading systems makes overly ambitious claims, such as a 99.4% success rate in trading, it's very likely to be misleading or potentially a scam. Here are key reasons to support this view:

-

Unrealistic Claims: In the world of investment, especially in highly volatile markets like cryptocurrency, such high success rates are unrealistic. Professional traders and sophisticated investment firms with extensive resources rarely, if ever, achieve such levels of accuracy.

-

Common Scam Tactics: Promising extraordinarily high returns with minimal risk is a common tactic used in financial scams. These promises play on the desire for quick and easy profits, which can lead to hasty decisions without proper due diligence.

-

Regulatory Warnings: Many financial regulatory authorities across the globe have issued warnings about investment schemes that promise high returns with little to no risk. These are often signs of fraudulent activities or scams.

-

Lack of Verifiable Evidence: Typically, such platforms do not provide verifiable evidence or transparent audit trails to back up their claims. Without independent verification, these claims remain dubious.

-

Market Volatility: The cryptocurrency market's inherent unpredictability makes it extremely challenging, if not impossible, for any automated system to consistently predict market movements with such a high degree of accuracy.

-

Risk of Financial Loss: Users attracted by these claims might end up risking and potentially losing significant amounts of money. The risk is especially high for those who are inexperienced or unaware of the inherent volatility in cryptocurrency trading.

-

Ethical Business Practices: Legitimate and reputable companies in the financial sector typically avoid making guarantees about investment returns, acknowledging the unpredictability of markets and the risks involved in trading.

Given these points, it's prudent to approach such platforms with a high level of caution. Always conduct thorough research, seek out independent reviews, and consider the risks involved. Remember that in investing and trading, if something seems too good to be true, it usually is. Opting for well-established, transparent, and regulated platforms is generally safer when it comes to financial investments.

C. Making your first investment

Making your first investment, especially in the realm of cryptocurrency or through a trading platform like Bitcoin Evolution, requires careful consideration and a strategic approach. Here's a step-by-step guide to help you navigate your first investment:

-

Educate Yourself:

- Gain a solid understanding of the cryptocurrency market and how it operates. Familiarize yourself with key concepts, market dynamics, and the specific currencies you're interested in.

- Learn about different types of investments and trading strategies to determine what aligns best with your goals and risk tolerance.

-

Research the Platform:

- Conduct thorough research on the trading platform you plan to use. Verify its legitimacy, read user reviews, and understand its fee structure.

- Be cautious of platforms making unrealistic promises, like extremely high success rates or guaranteed returns.

-

Start with a Budget:

- Decide on the amount of money you are willing to invest. It should be an amount you can afford to lose, considering the high risks associated with cryptocurrency trading.

- Avoid investing money that is earmarked for essential expenses or emergency savings.

-

Set Up Your Account:

- Follow the platform’s process to set up your trading account. This will typically involve providing some personal information and completing any required verification steps.

- Ensure that your account is secure, using strong passwords and any available two-factor authentication.

-

Understand the Fees:

- Be aware of any transaction fees, withdrawal fees, or other charges that might apply on the platform.

-

Explore the Platform:

- Familiarize yourself with the platform’s user interface. Understand how to navigate it, where to find important information, and how to execute trades.

- If a demo account is available, use it to practice without risking real money.

-

Decide on an Investment Strategy:

- Determine whether you want to engage in active trading (buying and selling frequently) or long-term investing.

- Consider starting with more well-known cryptocurrencies like Bitcoin or Ethereum before exploring less established coins.

-

Risk Management:

- Use risk management tools such as setting stop-loss orders to limit potential losses.

- Diversify your investments to reduce risk. Don’t put all your funds into one cryptocurrency or one type of asset.

-

Make Your First Investment:

- Once you are comfortable, make your first investment. Monitor the market and manage your investment based on your strategy.

-

Stay Informed and Adjust as Necessary:

- Keep up-to-date with market trends, news, and analysis. Be prepared to adjust your strategy in response to market changes.

-

Seek Professional Advice If Needed:

- If you're uncertain, consider seeking advice from a financial advisor experienced in cryptocurrency investments.

Remember, cryptocurrency markets are known for their volatility and unpredictability. While they can offer high returns, they also come with high risks. It’s important to approach your first investment with caution, armed with knowledge and a clear strategy.

D. Strategies for effective trading on the platform

Developing sound strategies for effective trading on platforms like Bitcoin Evolution or other cryptocurrency trading systems is crucial for both protecting your investment and maximizing potential returns. Here are some key strategies to consider:

-

Educate Yourself:

- Before diving into trading, it's essential to have a solid understanding of the cryptocurrency market. This includes understanding the factors that influence market movements, different types of cryptocurrencies, and the risks involved.

-

Start Small:

- Begin with a small investment to test the waters, especially if you're a beginner. This helps to mitigate risk while you gain experience.

-

Set Realistic Goals:

- Define clear, realistic, and achievable goals for your trading activities. Whether it's a specific profit target or a learning objective, having clear goals can help guide your trading decisions.

-

Risk Management:

- Implement risk management strategies. This includes setting stop-loss orders to limit potential losses and only investing money you can afford to lose.

- Diversify your investments to reduce risk. Avoid putting all your capital into a single trade or a single cryptocurrency.

-

Use Demo Accounts:

- If the platform offers a demo account, use it to practice your trading strategies without financial risk. This is an excellent way to get familiar with the platform's features and test different trading approaches.

-

Stay Informed:

- Regularly follow cryptocurrency news, market trends, and analysis. Staying informed will help you make more educated decisions.

-

Monitor Your Trades:

- Even with automated trading systems, it's important to regularly monitor your trades and the market. This allows you to adjust your strategies in response to changing market conditions.

-

Understand the Platform’s Technology:

- Familiarize yourself with how the platform’s trading technology works, including any automated features and how to customize settings to match your trading style.

-

Emotional Discipline:

- Maintain emotional control and discipline. Avoid making impulsive decisions driven by fear or greed. Stick to your trading plan.

-

Continuous Learning:

- The cryptocurrency market is continuously evolving. Engage in ongoing education to keep your knowledge and skills up to date.

-

Review and Adjust Strategies:

- Regularly review the performance of your trades and strategies. Be willing to adjust your approach as you gain experience and as market conditions change.

-

Compliance with Regulations:

- Ensure that your trading activities are compliant with the regulations in your jurisdiction, especially regarding taxation and reporting.

-

Seek Professional Advice:

- Consider consulting with financial advisors or trading experts, especially when dealing with substantial investments.

Remember, there is no one-size-fits-all strategy in trading. What works for one trader might not work for another. It's important to develop a strategy that aligns with your investment goals, risk tolerance, and level of expertise. Additionally, always approach trading with caution and skepticism of platforms that promise guaranteed returns.

IV. Risks and Rewards of Trading with Bitcoin Evolution

Top of Page

A. Potential benefits of using Bitcoin Evolution for trading

Using a platform like Bitcoin Evolution for trading cryptocurrencies can offer various potential benefits, especially for those new to cryptocurrency trading or those looking for automated trading solutions. However, it's important to approach these benefits with an understanding of the associated risks. Here are some potential benefits:

-

Automated Trading:

- One of the main attractions of Bitcoin Evolution is its automated trading feature, which can execute trades on behalf of the user based on set algorithms. This can be particularly useful for those who lack the time or expertise to analyze the market and make trading decisions manually.

-

Accessibility to Novices:

- The platform is often designed to be user-friendly, making it accessible to individuals who may be new to cryptocurrency trading. It can lower the entry barrier for those who might find traditional trading platforms intimidating.

-

Efficiency and Speed:

- Automated trading systems can process large volumes of data and execute trades at a speed that is typically beyond human capabilities. This can be beneficial in the fast-paced and volatile cryptocurrency market.

-

Market Analysis:

- Bitcoin Evolution claims to use advanced algorithms and AI technology to analyze market trends and predict price movements, potentially offering insightful market analysis.

-

Risk Management Tools:

- The platform may provide various risk management tools, such as setting stop-loss orders, which can help traders manage their potential losses.

-

Potential for Profit:

- Automated systems can potentially capitalize on market opportunities, leading to profits. However, these should not be taken for granted, as the market's volatility can lead to losses as well.

-

Time-Saving:

- Since the system operates automatically, it can save time for users by reducing the need for continuous market monitoring and manual trade execution.

-

Demo Accounts:

- Some platforms offer demo accounts, allowing users to practice trading with virtual funds, which is a great way to learn about the platform and test strategies without financial risk.

-

Diversification:

- Automated trading platforms can allow users to trade various cryptocurrencies, offering a means of diversification within the crypto asset class.

-

Emotion-Free Trading:

- Automated trading can eliminate emotional decision-making, which can be beneficial in maintaining a disciplined trading approach.

It's important to note that while these benefits can be appealing, they come with risks, particularly given the inherent volatility of the cryptocurrency market. The effectiveness of automated systems can vary, and their past performance is not always indicative of future results. Therefore, potential users should approach such platforms with caution, fully aware of the risks involved, and should not invest more than they can afford to lose. Additionally, skepticism is advisable regarding any platform that promises guaranteed returns, as such outcomes can never be assured in the world of trading.

B. Risks associated with cryptocurrency trading

Cryptocurrency trading, while offering potential for high returns, comes with a unique set of risks. Understanding these risks is crucial before engaging in trading activities:

-

Market Volatility:

- Cryptocurrencies are known for their extreme price volatility. Rapid and significant price swings can occur, leading to potential high gains but also substantial losses.

-

Regulatory Risk:

- The regulatory environment for cryptocurrencies is still evolving and varies greatly between jurisdictions. Changes in regulations can impact market prices and the legality of certain crypto-related activities.

-

Liquidity Risk:

- While major cryptocurrencies like Bitcoin and Ethereum generally have good liquidity, smaller altcoins may not. This can make it difficult to execute large trades without affecting the market price or to exit positions at desired prices.

-

Security Risk:

- The risk of hacking and cyber theft is significant in the crypto world. Exchanges and wallets are potential targets for hackers. Loss of funds due to security breaches has been a recurring issue in the industry.

-

Operational Risk:

- This includes risks associated with the technology of exchanges or trading platforms, such as system failures, technical glitches, or downtime, which can impact trading.

-

Counterparty Risk:

- When trading through an exchange or platform, you are reliant on the counterparty to execute trades and hold your funds. There is a risk that the exchange or platform could fail or engage in fraudulent activities.

-

Lack of Consumer Protections:

- Cryptocurrency markets are not regulated to the same degree as traditional financial markets. This means fewer safeguards and protections are in place for consumers and investors.

-

Market Manipulation:

- The cryptocurrency market is susceptible to manipulation due to its relative youth, lower market capitalization (compared to traditional markets), and lack of regulation.

-

Investment Scams:

- The rise in popularity of cryptocurrencies has led to an increase in related investment scams, including fraudulent ICOs (Initial Coin Offerings) and Ponzi schemes disguised as crypto investments.

-

Legal and Tax Implications:

- Cryptocurrency traders must navigate complex and evolving tax regulations regarding their trading activities. Failure to comply with tax laws can lead to legal repercussions.

-

Emotional and Psychological Risks:

- The intense volatility of the crypto market can lead to emotional trading decisions driven by fear or greed, which can result in poor decision-making and losses.

Given these risks, it's important for anyone considering cryptocurrency trading to conduct thorough research, understand the nature of the market, use risk management strategies, and only invest funds that they can afford to lose. Additionally, staying informed about regulatory changes and practicing good cybersecurity hygiene are crucial.

C. Managing risks and protecting your investment

Effective risk management is crucial in protecting your investment, especially in the volatile world of cryptocurrency trading. Here are key strategies to help you manage risks:

-

Understand the Market:

- Educate yourself about the cryptocurrency market, including different currencies, technologies, market trends, and factors that influence price movements.

-

Start Small:

- Begin with a small investment, particularly if you are new to cryptocurrency trading. This limits potential losses as you learn and gain experience.

-

Diversification:

- Don’t put all your investment in one cryptocurrency or one type of asset. Diversify your portfolio across different cryptocurrencies and other asset classes to spread risk.

-

Use Risk Management Tools:

- Utilize tools such as 'stop-loss' and 'take-profit' orders. A stop-loss order automatically sells your asset when its price drops to a certain level, limiting potential losses.

- A take-profit order works similarly but locks in profit by selling when the asset price reaches a predetermined high.

-

Set Realistic Goals and Limits:

- Establish clear, achievable goals for your trading activities. Decide in advance the amount of profit you aim for and the level of loss you are prepared to tolerate.

-

Avoid Emotional Trading:

- Maintain a disciplined approach to trading. Avoid making decisions based on emotions like fear or greed, which can lead to impulsive and risky actions.

-

Regularly Monitor Your Investments:

- Keep track of your investments and market conditions. Be prepared to adjust your strategy in response to changes in the market.

-

Stay Informed:

- Follow news and developments in the cryptocurrency space. Regulatory changes, technological advancements, and significant global events can all impact the market.

-

Security Practices:

- Practice good cybersecurity. Use strong passwords, enable two-factor authentication, and ensure that your investment is stored in a secure wallet or platform.

-

Understand Leverage and Margin Trading:

- If using leverage or engaging in margin trading, understand that while it can amplify gains, it also significantly increases the risk of losses.

-

Know When to Exit:

- Have a clear exit strategy. Know when to cut your losses, take your profits, or simply step away from trading.

-

Seek Professional Advice:

- If in doubt, consult with a financial advisor, especially for significant investments.

-

Compliance with Tax and Legal Regulations:

- Ensure you are compliant with the tax and legal regulations in your jurisdiction regarding cryptocurrency trading.

Remember, while these strategies can help mitigate risks, they cannot eliminate them. Cryptocurrency trading inherently carries high risks, and it’s important to only invest what you can afford to lose.

D. Testimonials and case studies

The authenticity of testimonials and case studies, especially those presented by platforms like Bitcoin Evolution, can vary and should be approached with caution. Here are some considerations to help assess their veracity:

-

Source Verification:

- Check if the testimonials and case studies are from verifiable sources. Often, platforms might use generic or stock photos with fictitious names, making it difficult to confirm the authenticity of the claims.

-

Independent Reviews:

- Look for reviews and testimonials on independent and reputable websites or forums. These are more likely to provide a balanced view than those featured on the platform's own website.

-

Exaggerated Claims:

- Be skeptical of testimonials or case studies promising high returns with little to no risk. In the realm of investing, particularly in volatile markets like cryptocurrencies, such high returns are rarely guaranteed and come with significant risks.

-

Uniformly Positive Reviews:

- A red flag is a set of reviews that are uniformly positive, especially in a field known for its volatility and risks. Authentic reviews typically include a range of experiences, both positive and negative.

-

Marketing Tactics:

- Be aware that testimonials can be a marketing tactic used to build trust and credibility. Companies might selectively showcase only positive stories and omit any negative experiences.

-

Regulatory Warnings:

- Regulatory bodies in various countries have warned consumers about misleading marketing practices in the cryptocurrency space, including fabricated testimonials.

-

Professional Opinions:

- Compare the testimonials with opinions from financial experts or seasoned traders. Professional insights can offer a more realistic perspective on what to expect.

-

Lack of Specific Details:

- Generic testimonials that lack specific details about how the returns were achieved can be a sign of fabrication.

-

Use of Actors:

- Some platforms have been known to use paid actors to deliver scripted testimonials. If a testimonial appears overly scripted or seems like a sales pitch, it may not be genuine.

-

Cross-Verification:

- Attempt to cross-verify the information presented in the testimonials. For instance, if a case study mentions a specific market event, check if that event actually occurred.

In summary, while testimonials and case studies can provide insights into a platform's potential, they should not be taken at face value without thorough scrutiny. It’s advisable to conduct comprehensive research, considering independent sources, and to maintain a healthy skepticism about extraordinary claims. Remember, in financial investments, especially in areas as speculative as cryptocurrency, there is rarely a one-size-fits-all success story.

Top of Page

A. Unique features of Bitcoin Evolution

Bitcoin Evolution, like many cryptocurrency trading platforms, claims to offer a range of features designed to attract users and facilitate trading in the volatile crypto market. While these features may be presented as unique, it's important to note that many are commonly found across various crypto trading platforms. Here's a look at some of the features often attributed to Bitcoin Evolution:

-

Automated Trading Algorithms:

- One of the key features advertised by Bitcoin Evolution is its automated trading system, which uses algorithms to analyze market trends and execute trades. This is aimed at users who prefer a hands-off approach to trading.

-

High-Frequency Trading:

- The platform may utilize high-frequency trading strategies, enabling it to make a large number of trades in a fraction of a second, potentially capitalizing on even the smallest market movements.

-

User-Friendly Interface:

- Bitcoin Evolution often claims to have a user-friendly interface that is easy for beginners to navigate, reducing the learning curve associated with trading platforms.

-

Demo Trading Account:

- A demo account feature allows users to practice trading with virtual money, which can be a useful tool for beginners to get accustomed to the platform without risking real funds.

-

Multiple Cryptocurrency Trading:

- In addition to Bitcoin, the platform may offer the ability to trade various other cryptocurrencies, providing users with more trading options and opportunities for diversification.

-

Customizable Trading Settings:

- Users can typically customize certain trading settings, like setting the amount to invest per trade, choosing which cryptocurrencies to trade, and determining risk levels.

-

Risk Management Tools:

- Features like stop-loss orders and take-profit points can be available to help users manage their risk, especially important in the volatile crypto market.

-

Market Analysis and Insights:

- The platform may provide market analysis and insights, leveraging its algorithmic technology to identify potential profitable trading opportunities.

-

Accessibility and Convenience:

- Bitcoin Evolution is likely accessible online, enabling users to trade from various devices and locations, which adds to the convenience factor.

-

Speed and Efficiency:

- The platform may claim to execute trades faster than traditional methods, an important feature given the fast-paced nature of the cryptocurrency market.

It's crucial to approach these features with a critical mind. Similar features are often touted by various automated trading platforms, and their effectiveness can vary. Additionally, the cryptocurrency market's inherent risks mean that even the most sophisticated technology cannot guarantee profits. Users should conduct thorough research, understand the risks involved, and consider their personal financial situation before engaging in trading activities. As with any investment, caution and due diligence are advisable when using Bitcoin Evolution.

B. How it stands out from other platforms

Bitcoin Evolution, like many cryptocurrency trading platforms, claims a range of features intended to distinguish it from competitors. However, it's important to critically assess these features and the platform's overall offering, especially in the context of a market filled with many similar platforms. Here's how Bitcoin Evolution may attempt to stand out:

-

Automated Trading Technology:

- Bitcoin Evolution often emphasizes its automated trading technology, which uses algorithms purported to analyze market trends and execute trades on behalf of the user. The effectiveness and sophistication of this technology are typically highlighted as key differentiators.

-

User-Friendly Interface:

- The platform is often marketed towards both beginners and experienced traders, with claims of a user-friendly interface that simplifies navigation and trading, potentially making it more accessible to a wider audience.

-

Speed of Transactions:

- High-speed transaction processing is another feature that Bitcoin Evolution may claim, suggesting that it can execute trades faster than manual trading or other automated platforms, which is crucial in the rapidly fluctuating crypto market.

-

Diverse Range of Cryptocurrencies: