A get-rich-quick scheme is a fraudulent or deceptive investment opportunity that promises quick and easy profits with little effort or risk. These schemes often involve high-pressure sales tactics, exaggerated claims, and false promises of high returns.

Some common examples of get-rich-quick schemes include:

1. Pyramid schemes: Pyramid schemes involve recruiting investors with the promise of high returns, but rather than generating profits through legitimate investments, they rely on recruiting new members to pay returns to earlier investors. Eventually, the scheme collapses when it becomes unsustainable.

2. Ponzi schemes: Ponzi schemes involve using new investors' money to pay returns to earlier investors, with the promise of high returns. The scheme relies on attracting new investors to generate enough money to pay earlier investors, and eventually collapses when new investors stop joining the scheme.

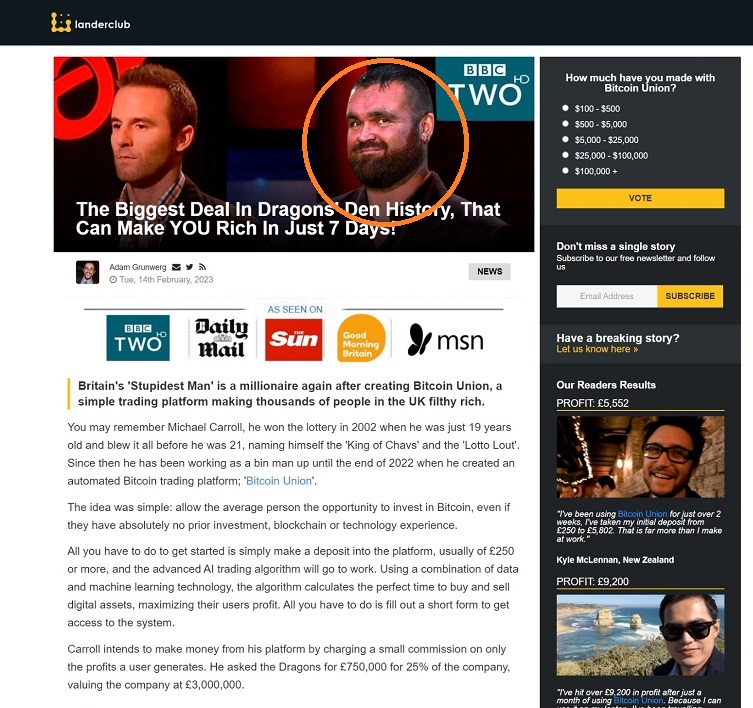

3. High-yield investment programs (HYIPs): HYIPs are investment opportunities that promise unusually high returns on investment, often claiming to use advanced trading algorithms or investments in exotic markets. These programs often turn out to be fraudulent, and investors end up losing their money.

4. Multi-level marketing (MLM) schemes: MLM schemes involve recruiting members to sell a particular product, with the promise of high commissions and bonuses. The focus is often on recruiting new members rather than selling the product, and participants often end up losing money rather than making a profit.

It is important to be wary of any investment opportunity that promises quick and easy profits with little effort or risk. Always do your own research and seek professional advice before investing your money. Remember that there is no such thing as a guaranteed investment or a free lunch, and that legitimate investments require time, effort, and risk.

What are Famous Historical Get Rich Quick Schemes?

Throughout history, there have been many famous get-rich-quick schemes that have resulted in significant losses for investors. Here are some examples:

1. The South Sea Bubble (1711-1720): The South Sea Bubble was a speculative investment scheme in England that promised investors high returns from trading with the Spanish colonies in South America. The scheme involved the creation of the South Sea Company, which was granted a monopoly on trade with South America. However, the scheme was based on false promises, and the company's profits never materialized. The bubble eventually burst in 1720, resulting in significant losses for investors and causing widespread financial ruin.

2. The Mississippi Bubble (1717-1720): The Mississippi Bubble was a speculative investment scheme in France that was led by John Law, a Scottish economist. The scheme involved the creation of the Mississippi Company, which was granted a monopoly on trade with Louisiana and the Mississippi River. Law promised investors high returns, but the scheme was based on false promises and speculation. The bubble burst in 1720, causing widespread financial ruin in France.

3. The Tulip Mania (1636-1637): The Tulip Mania was a speculative investment bubble in the Netherlands that involved the trading of tulip bulbs. At the height of the bubble, tulip bulbs were selling for prices equivalent to several years' wages for the average worker. However, the bubble burst in 1637, and prices collapsed, causing significant losses for investors.

4. The Gold Rush (1848-1855): The California Gold Rush was a period of intense speculation and investment in the United States, as people rushed to California in search of gold. Many investors spent large sums of money on equipment and supplies, hoping to strike it rich. However, the vast majority of gold seekers failed to find significant amounts of gold, and many ended up losing their life savings.

These historical examples serve as a reminder that get-rich-quick schemes are often based on false promises and speculation, and can result in significant financial losses for investors. It is important to approach investment opportunities with caution and to do your own research before investing your money.

Is There a Real Way to get Rich Quick?

Sure, if you know anything that is going to happen, you can make money from it. Otherwise, there is no guaranteed or foolproof way to get rich quick. Any investment or opportunity that promises quick and easy profits with little effort or risk should be approached with extreme caution, as it is likely to be a scam or a high-risk investment.

Becoming rich typically requires hard work, dedication, and long-term planning. Some people may achieve wealth quickly through inheritance, business success, or other fortunate circumstances, but these cases are the exception rather than the rule.

It is important to remember that legitimate investments require time, effort, and risk. Building wealth through investments like stocks, real estate, or starting a business typically involves a long-term approach and a willingness to weather the ups and downs of the market. It is important to do your own research and seek professional advice before investing your money, and to avoid any investment opportunity that promises quick and easy profits with little effort or risk.

Can Autotrading Robots Make me Rich?

There is no guarantee that autotrading robots will make you rich. While autotrading robots can be programmed to analyze market data and execute trades on your behalf, they are not foolproof and can still make mistakes or be affected by market volatility.

Autotrading robots are often marketed as a way to make easy money with minimal effort, but it is important to approach these claims with caution. Many autotrading robots are scams that are designed to take your money, and do not actually provide any real trading functionality.

If you are considering using an autotrading robot, it is important to do your own research and choose a reputable provider with a track record of success. You should also be prepared to invest time and effort into setting up and monitoring the robot, and to be aware of the risks involved with any investment.

Ultimately, while autotrading robots may be able to assist with trading, it is important to remember that there are no guarantees when it comes to investing, and that any investment involves risk. It is important to approach any investment opportunity with caution and to seek professional advice before investing your money.

Auto-trading robots are automated software programs that are designed to make trades on behalf of investors based on pre-programmed algorithms. While auto-trading robots can execute trades more quickly and efficiently than humans, they cannot guarantee profits or make you rich.

Auto-trading robots are not foolproof and can make mistakes or suffer losses due to unexpected market conditions or technical errors. Moreover, many auto-trading robots are scams that promise unrealistic returns and use aggressive marketing tactics to attract investors.

It is important to approach auto-trading robots with caution and to do your own research before investing your money. Look for reviews and feedback from other users, and seek professional advice if you are uncertain about an auto-trading robot's legitimacy or potential returns.

Remember that there is no substitute for careful research, sound investment strategies, and disciplined risk management when it comes to building long-term wealth. While auto-trading robots may be a useful tool in your investment arsenal, they should not be relied on as a sole means of achieving financial success.

Are Get Rich Quick Schemes Illegal?

Get rich quick schemes can be illegal if they involve fraud, false advertising, or other deceptive practices that violate laws and regulations. These schemes typically promise quick and easy wealth through various means, such as investing in a secret or exclusive opportunity, participating in a pyramid scheme, or selling a product or service with exaggerated or false claims.

The legality of a particular get-rich-quick scheme depends on the specific laws and regulations that apply to it. In many countries, there are laws that prohibit deceptive and unfair trade practices, which can include false advertising and misrepresentation. Pyramid schemes, in which participants are promised large returns for recruiting others into the scheme, are illegal in many countries.

It's important to be cautious and do your research before investing your time or money in any get-rich-quick scheme. If something sounds too good to be true, it probably is, and you should be skeptical of any promises of quick and easy wealth. Always check the credibility of the scheme and the people behind it before investing any money, and consult with a financial advisor or lawyer if you have any doubts or concerns.

Who Should I Contact about False Advertising Online?

If you come across false advertising online, there are several organizations and authorities that you can contact to report it. Here are some options:

1. Federal Trade Commission (FTC): The FTC is a US government agency that enforces laws related to consumer protection and false advertising. You can file a complaint with the FTC through their website at ftc.gov/complaint. The FTC investigates complaints of false and deceptive advertising and takes action against violators.

2. Better Business Bureau (BBB): The BBB is a non-profit organization that helps consumers resolve disputes with businesses. They maintain a database of businesses and their complaints, which can be accessed through their website at bbb.org. You can also file a complaint against a business through their website.

3. Advertising Standards Authority (ASA): The ASA is an independent regulator of advertising in the UK. They investigate complaints of misleading, harmful or offensive advertising, and take action against advertisers who breach the advertising codes. You can file a complaint with the ASA through their website at asa.org.uk.

4. Your local consumer protection agency: Many countries have consumer protection agencies that investigate complaints of false advertising and other deceptive practices. Check your local government's website for information on how to file a complaint.

When reporting false advertising, it's important to provide as much information as possible, including the name of the advertiser, the nature of the false claim, and any evidence you have to support your complaint.

Can the ASA Stop an Advert on an Overseas Website?

The Advertising Standards Authority (ASA) is an independent regulator of advertising in the UK and has no jurisdiction over overseas websites or businesses. However, if the advertiser is based in the UK or if the product or service is available in the UK, the ASA can investigate the ad, even if it appears on an overseas website.

The ASA has agreements with some overseas regulators, such as the European Advertising Standards Alliance (EASA), to coordinate and exchange information on cross-border advertising complaints. This means that if a complaint is made to the ASA about an overseas ad, they may be able to work with the relevant regulator in that country to address the issue.

In addition, if an advertiser is found to be in breach of the advertising rules, the ASA can take action to prevent the ad from appearing in the UK. This can include working with search engines and social media platforms to remove the ad, or issuing an advertising ban or injunction.

However, the ASA's ability to enforce its rulings on overseas businesses is limited, and it may be difficult to take legal action against an overseas advertiser. It's important to note that the rules and regulations around advertising may vary from country to country, so it's always a good idea to do your own research and seek legal advice if you have concerns about an overseas ad.