Introduction: | Section 1: understanding bitcoin loophole and its rise | 1.1 the basics of bitcoin and cfd trading | 1.2 introduction to bitcoin loophole | 1.3 the appeal: offshore brokers and promise of high returns | 1.4 the dark side: boiler rooms and scammers | Section 2: the risks involved in bitcoin loophole | 2.1 the pressure tactics of scammers | 2.2 untraceable transactions in cryptocurrency | 2.3 is bitcoin loophole legal? | 2.4 offshore brokers: lack of regulation and accountability | Section 3: how to spot a bitcoin loophole scam | 3.1 red flags to watch out for on websites | 3.2 researching the broker: due diligence is key | 3.3 true investments vs. get-rich-quick schemes | Section 4: protecting yourself from bitcoin loophole scams | 4.1 secure investment options: regulated exchanges and platforms | 4.2 staying informed: staying ahead of scammers | 4.3 seeking professional advice: consulting financial advisors | 4.4 reporting scams: taking action against fraudsters | Section 5: conclusion and final thoughts

Introduction:

Top of Page

Over the past decade, the world of cryptocurrency has witnessed rapid advancements and widespread adoption. Bitcoin, being the pioneering player, has gained immense popularity, attracting both legitimate investors and scam artists. Among the latter, there's a notorious term that often emerges: Bitcoin Loophole. In this article, we will delve into the inner workings of Bitcoin Loophole, expose its risks, and guide you in making informed decisions when it comes to trading cryptocurrencies.

Section 1: Understanding Bitcoin Loophole and its Rise

Top of Page

"Bitcoin Loophole" is often associated with a type of online trading platform that claims to automate the trading of Bitcoin and other cryptocurrencies. These platforms suggest that users can make significant profits in a short time with little effort. However, it's important to approach such claims with caution, as many of these platforms have been identified as scams or at the very least, misleading in their marketing.

How did it emerge?

- Rise of Cryptocurrency: With the growing popularity of Bitcoin and other cryptocurrencies, there was a surge in interest from the general public in making profits from cryptocurrency trading.

- Demand for Automated Solutions: Recognizing the complexity of the crypto market and the desire for easy profits, developers and opportunists started promoting automated trading solutions. These platforms claimed to use algorithms that could predict market movements and make profitable trades on behalf of users.

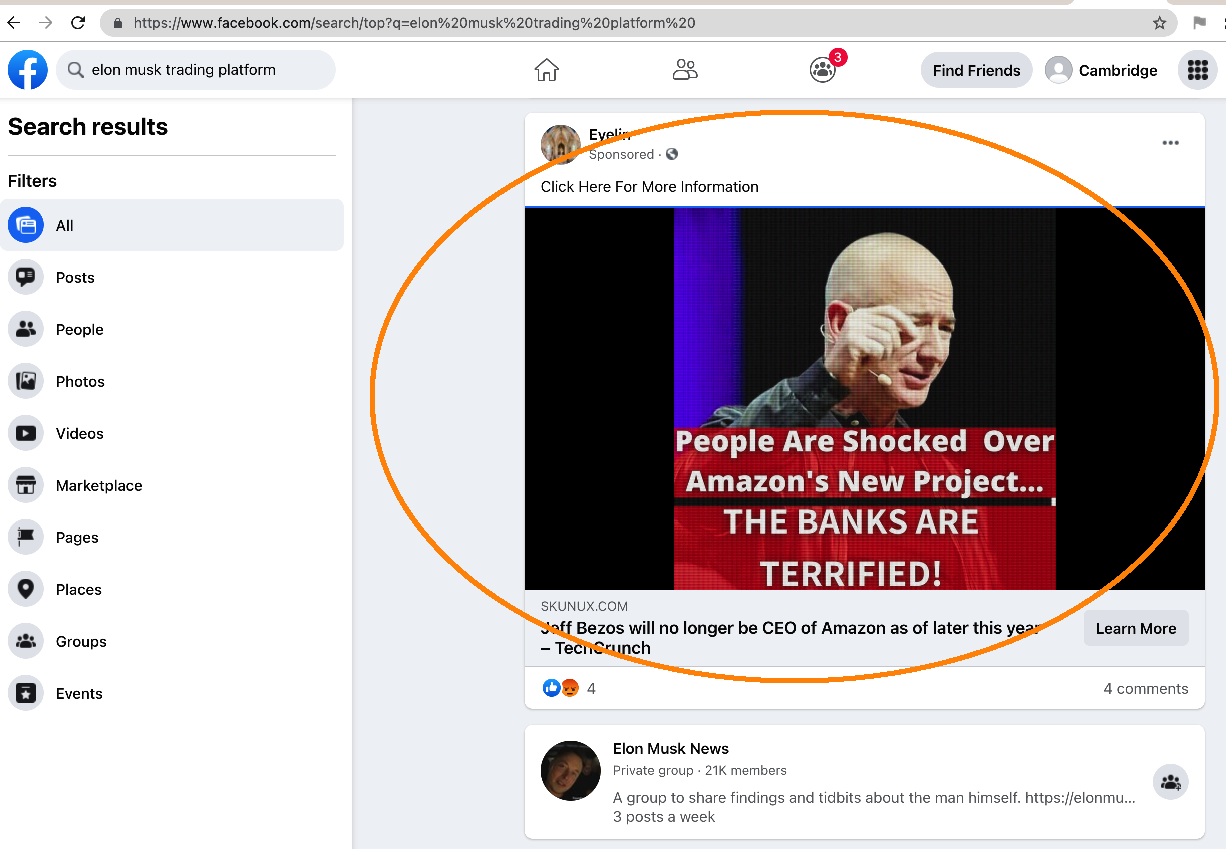

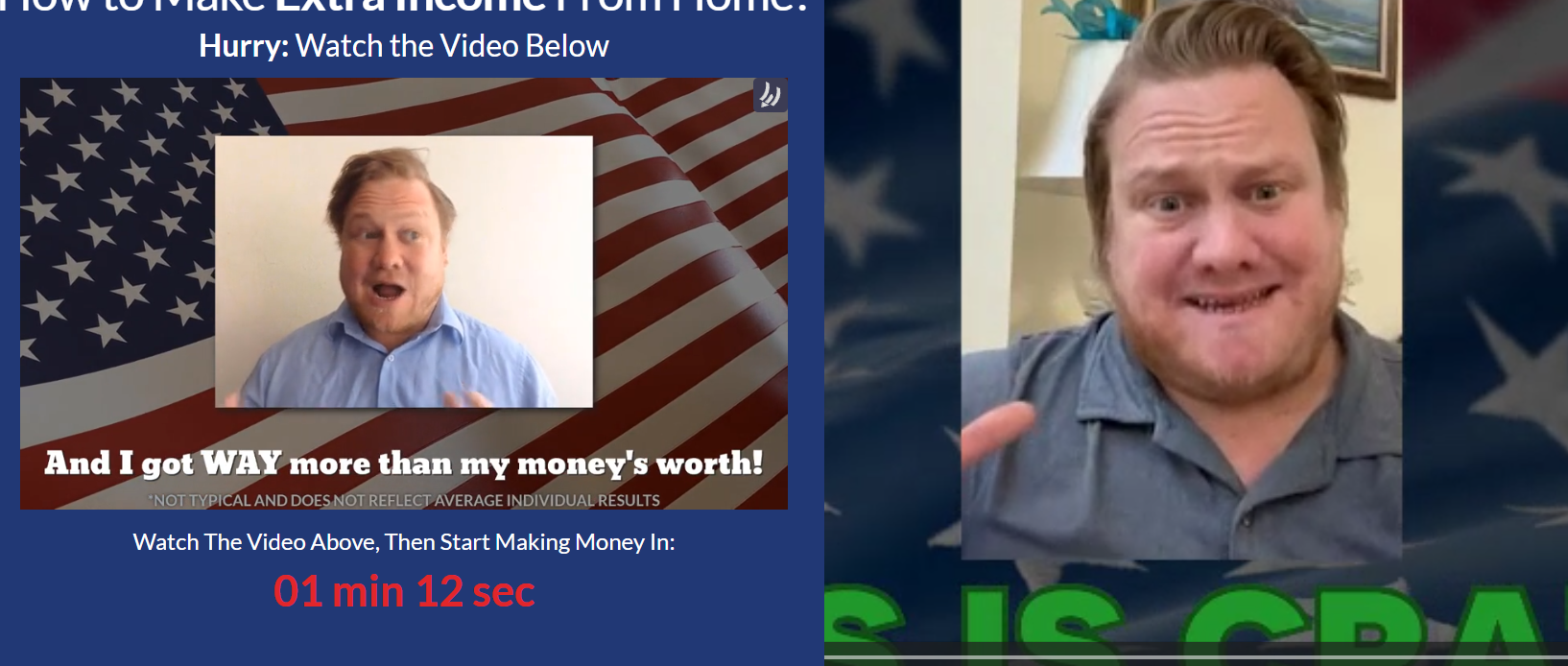

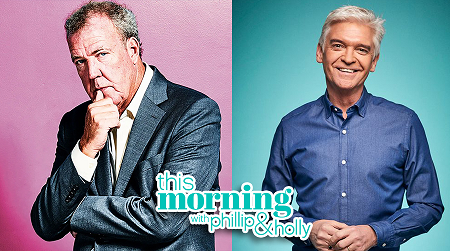

- Viral Marketing: Many of these platforms, including those named "Bitcoin Loophole", used aggressive marketing tactics. Testimonials from supposed users claiming to have made significant profits, celebrity endorsements (many of which turned out to be false), and high-pressure sales tactics became common.

- Regulatory Attention: As complaints about lost investments piled up, many of these platforms came under scrutiny from financial regulatory bodies. Some were found to be outright scams, while others operated in a legal gray area.

It's essential to understand that while algorithmic and automated trading is a legitimate and widely-used practice in the financial world, the promise of guaranteed or unusually high returns is a significant red flag. Always do thorough research and due diligence before investing in any platform or scheme, and be wary of anything that sounds too good to be true.

1.1 The Basics of Bitcoin and CFD Trading

Top of Page

-

The Basics of Bitcoin:

- What is Bitcoin? Bitcoin is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries. Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain.

- How does it work? Every bitcoin transaction is stored on a digital ledger called the blockchain. Miners use powerful computers to solve complex mathematical problems, and when solved, the transaction is added to the blockchain. For their efforts, miners are rewarded with newly created bitcoins, a process known as "mining."

- Why is it valuable? Bitcoin's value comes from its limited supply (there will only ever be 21 million bitcoins) and its decentralized nature. It's not controlled by any government or organization, making it immune to government interference or inflation.

- How is it stored? Bitcoins are stored in a digital wallet, which can be hardware-based or software-based. Each wallet has a private key, which is a secret number that allows bitcoins to be spent.

-

CFD Trading:

- What is CFD Trading? Contract for Difference (CFD) trading allows you to speculate on the rising or falling prices of fast-moving global financial markets, such as forex, indices, commodities, shares, and treasuries. It's a contract between a trader and a broker where the difference between the opening and closing trade prices is settled in cash.

- How does it work? Instead of owning the actual asset, CFD traders open a position by depositing a fraction of the total trade value – this is known as 'margin'. Profits or losses are realized based on the movement of the underlying asset relative to the position taken, even though the asset itself is not owned.

- What are the advantages? CFDs allow for high leverage, meaning you can start trading with a small amount of capital. They also offer the opportunity to profit from both rising and falling markets, as you can choose to buy ('go long') or sell ('go short') a market.

- What are the risks? CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. It's essential to understand how CFDs work and whether you can afford the high risk of losing your money.

Always remember to do thorough research and consult with financial advisors before engaging in any form of trading or investment.

1.2 Introduction to Bitcoin Loophole

Top of Page

"Bitcoin Loophole" is an online platform that claims to offer automated cryptocurrency trading services. The platform markets itself as a tool that can provide users with significant profits from Bitcoin trading with little to no effort required on their part. By leveraging advanced algorithms, Bitcoin Loophole purports to identify profitable trading opportunities in the crypto market and execute trades on behalf of its users.

Key Points about Bitcoin Loophole:

- Automated Trading: The platform suggests that it uses sophisticated algorithms to scan the market, detect trends, and make trading decisions. This means that even those without any knowledge of cryptocurrency trading can use the platform.

- High Profit Claims: Bitcoin Loophole often advertises that users can make substantial profits in a short time. These claims are often backed by testimonials from purported users and sometimes even alleged endorsements from celebrities.

- User Interface: The platform typically offers a user-friendly interface that allows users to set their trading parameters, deposit funds, and withdraw their earnings.

- Controversy and Skepticism: There's significant skepticism surrounding Bitcoin Loophole. Many financial experts and reviewers have raised concerns about the platform's marketing tactics and the legitimacy of its operations. Some claim that it might be a scam or, at the very least, an exaggeration of potential returns.

- No Guaranteed Returns: Like all investments, cryptocurrency trading involves risks. No platform can guarantee returns, and it's crucial for potential users to be aware of this.

- Regulatory Concerns: Due to the high number of complaints and concerns, some regulatory bodies have issued warnings about Bitcoin Loophole and similar platforms.

In conclusion, while automated trading platforms exist and can be legitimate tools for traders, it's essential to approach platforms like Bitcoin Loophole with caution. Always conduct thorough research and due diligence before investing money, and be wary of platforms that promise guaranteed or unusually high returns.

1.3 The Appeal: Offshore Brokers and Promise of High Returns

Top of Page

Offshore brokers often attract traders and investors for various reasons, with the promise of high returns being one of the primary appeals. Here's a breakdown of why offshore brokers can be attractive and the allure of high returns:

1. Regulatory Arbitrage: - Less Stringent Regulations: Offshore brokers often operate in jurisdictions with less stringent financial regulations. This can mean fewer restrictions on trading practices, leverage, and financial products offered. - Privacy and Anonymity: Some offshore jurisdictions offer higher levels of privacy for account holders, which can be attractive to those who prioritize discretion in their financial dealings.

2. High Leverage: - Many offshore brokers offer significantly higher leverage than brokers in more regulated jurisdictions. High leverage allows traders to control a larger position with a smaller amount of capital. While this can amplify profits, it also significantly increases the risk of substantial losses.

3. Diverse Product Offerings: - Offshore brokers might offer a broader range of financial products and instruments that might not be available or are restricted in more regulated markets.

4. Tax Benefits: - Some traders and investors are drawn to offshore brokers due to potential tax advantages. Certain offshore jurisdictions have favorable tax regimes, with low or even zero tax rates on capital gains.

5. Promise of High Returns: - Marketing and Advertisements: Offshore brokers often employ aggressive marketing tactics, highlighting stories of traders who achieved significant profits in a short period. - Attractive Bonuses: Some offshore brokers offer bonuses and promotions to entice new account holders, promising deposit bonuses or risk-free trades. - Psychological Appeal: The potential for high returns plays on the human psychology of greed and the desire for quick wealth. The idea of turning a small amount of capital into a substantial sum in a short time can be irresistible to some.

6. Lower Costs: - Some offshore brokers might offer lower fees and transaction costs compared to their counterparts in more regulated jurisdictions.

7. Access for Restricted Residents: - Traders from countries where certain types of trading or financial products are restricted might turn to offshore brokers to gain access to those markets.

Caution: While there are legitimate offshore brokers that provide valuable services, the sector is also rife with potential pitfalls. The promise of high returns can sometimes be a red flag, indicating potential fraud or misleading practices. Traders should exercise caution, conduct thorough research, and be aware of the risks before engaging with offshore brokers. The lack of robust regulation can mean fewer protections for investors, making due diligence even more crucial.

1.4 The Dark Side: Boiler Rooms and Scammers

Top of Page

"The Dark Side" in the context of finance and investments typically refers to the unethical, deceptive, and often illegal practices employed by certain entities to defraud investors or manipulate markets. Among these malicious practices are "boiler rooms" and various scam tactics. Let's delve into these:

1. Boiler Rooms: - Definition: A boiler room is an operation, often an office, where high-pressure salespeople use aggressive and sometimes misleading tactics to sell securities that the brokerage owns and wants to get rid of. The securities they sell are often speculative and are usually not suitable for the investor. - Tactics: Salespeople in boiler rooms are typically under immense pressure to sell. They might make false claims about a stock's prospects, lie about information, or rush investors into making decisions. - Objective: The goal of a boiler room is often to offload overpriced or even worthless shares onto unsuspecting investors to make a profit for the fraudsters. - Outcome: Once the shares are sold and the operators of the boiler room achieve their profit, they often disappear, leaving investors with worthless stocks.

2. Scammers: - Pump and Dump: This is a scheme where fraudsters boost the price of a stock (often a "penny stock") through false or misleading statements (the "pump"), only to sell off their shares at the elevated price and then let the stock fall dramatically (the "dump"), causing significant losses for investors who bought in during the "pump." - Advance Fee Fraud: Here, investors are promised high returns on an investment, but they must first pay an upfront fee. Once the fee is paid, the scammer disappears, and the promised returns never materialize. - Ponzi Schemes: Named after Charles Ponzi, this involves taking money from new investors to pay returns to earlier investors, creating the illusion of a profitable business. It collapses when not enough new investors come in or when too many existing investors cash out. - Fake Investment Seminars: Scammers lure individuals with free seminars promising investment strategies or opportunities that are too good to be true. Attendees are then pressured into buying products or services that are worthless or nonexistent. - Phishing and Online Frauds: Scammers use fake emails, websites, or social media profiles to get individuals to provide personal financial information. They then use this information for identity theft or unauthorized transactions.

Protection Against the Dark Side: To protect oneself from these dark practices, it's crucial to: - Conduct thorough due diligence before investing. - Be skeptical of "too good to be true" offers. - Avoid making rushed investment decisions, especially under pressure. - Verify the credentials of brokers and investment firms. - Be cautious about sharing personal or financial information online. - Stay informed about common scams and deceptive tactics in the financial world.

Always remember: If it sounds too good to be true, it probably is. It's essential to be vigilant, informed, and cautious to safeguard one's investments and avoid falling victim to the dark side of the financial world.

Section 2: The Risks Involved in Bitcoin Loophole

Top of Page

Bitcoin Loophole, like many other online trading platforms that promise automated high returns, comes with a set of risks. If you're considering using such a platform, it's essential to be aware of the following potential dangers:

1. Lack of Regulation: - Platforms like Bitcoin Loophole often operate in jurisdictions with limited financial oversight. This can mean less protection for users if things go wrong.

2. Potential for Scams: - There have been allegations and concerns regarding the legitimacy of Bitcoin Loophole, with some critics labeling it as a potential scam. It's essential to verify the authenticity of such platforms before investing.

3. False Marketing Claims: - Platforms like Bitcoin Loophole often use aggressive marketing tactics, promising high returns with little risk. Such promises can be misleading, leading investors to have unrealistic expectations.

4. High Volatility of Cryptocurrency: - The cryptocurrency market is known for its extreme volatility. Even if the platform's algorithms are legitimate, there's no guarantee of profits due to the unpredictable nature of crypto prices.

5. Loss of Investment: - Like all investments, there's a risk of losing capital. Platforms that promise guaranteed returns can give a false sense of security, leading users to invest more than they can afford to lose.

6. Data and Privacy Concerns: - Given the digital nature of the platform, there's a risk of data breaches or hacks, potentially compromising users' personal and financial information.

7. Lack of Transparency: - Automated trading platforms often lack transparency regarding their trading algorithms, strategies, and operations. This makes it challenging to assess the platform's legitimacy and effectiveness.

8. Dependency on Automation: - Relying solely on automated trading can lead to a lack of understanding and knowledge about the market. This can be detrimental if users want to make informed decisions outside the platform.

9. Potential Legal Repercussions: - In some jurisdictions, using platforms that aren't regulated or are deemed scams can lead to legal consequences for users, even if they weren't aware of the platform's illegitimacy.

10. Withdrawal Issues: - Some users of platforms like Bitcoin Loophole have reported difficulties when trying to withdraw their funds, either facing long delays or not receiving their money at all.

In conclusion, while the allure of easy profits can be tempting, it's crucial to approach platforms like Bitcoin Loophole with caution and skepticism. Conduct thorough research, understand the risks involved, and consider seeking advice from financial professionals before making any investment decisions.

2.1 The Pressure Tactics of Scammers

Top of Page

Boiler room scammers employ a variety of high-pressure tactics to manipulate and deceive potential investors into making hasty decisions. These tactics are designed to exploit human psychology, create a sense of urgency, and push individuals to part with their money. Some of the common pressure tactics used by boiler room scammers include:

1. Time Pressure: - Scammers may claim that an investment opportunity is available for a limited time only, urging the investor to act quickly before it's "too late."

2. False Promises of High Returns: - Potential investors are lured with promises of high returns, often described as "guaranteed" or "risk-free," even though no investment can genuinely offer such guarantees.

3. Exaggerated or Fake Credentials: - The salespeople may tout their alleged expertise, experience, and successful track record to gain trust.

4. Isolation: - Scammers may discourage potential investors from seeking advice or opinions from others, insisting that outsiders wouldn't understand the unique opportunity at hand.

5. Downplaying Risks: - While highlighting the potential rewards, scammers often minimize or omit mentioning the associated risks.

6. Using Technical Jargon: - By using complex financial terms or jargon, scammers can confuse potential investors, making them feel uninformed or left out, and more likely to rely on the scammer's "expertise."

7. Fake Testimonials: - Scammers might present false testimonials or references from alleged satisfied investors who have supposedly earned significant returns.

8. Sense of Exclusivity: - Potential investors might be told they're among the "lucky few" to be offered this unique opportunity, playing into the desire to be part of an exclusive group.

9. Frequent Communication: - Scammers often engage in frequent communication, bombarding potential investors with calls, emails, or messages to keep the pressure on.

10. Aggressive Behavior: - If an investor shows hesitation or skepticism, the scammer might become aggressive, using guilt, insults, or threats to push for a decision.

11. Follow-up Offers: - Even if an investor initially falls for the scam, they might be targeted again with offers to invest more money, often under the guise of "doubling down" to recover initial losses.

12. Fake Documentation: - Scammers might present forged or fake documents, such as certificates, reports, or contracts, to appear legitimate.

It's essential to be aware of these tactics and remain skeptical of any investment opportunity that seems too good to be true. Always take the time to research, consult with trusted financial advisors, and avoid making hasty decisions under pressure.

2.2 Untraceable Transactions in Cryptocurrency

Top of Page

Bitcoin and other cryptocurrencies have become tools of choice for various illicit activities, including scams, due to their perceived anonymity and decentralized nature. Here's how boiler room scammers and other fraudsters might capitalize on Bitcoin and the untraceable nature of cryptocurrency transactions:

1. Anonymity and Privacy: - Bitcoin transactions don't directly link to personal identities, making it harder to trace the parties involved. While all transactions are recorded on the blockchain, they are associated with alphanumeric addresses rather than personal information.

2. Global Reach: - Bitcoin and other cryptocurrencies can be sent and received anywhere in the world, allowing scammers to target victims outside their jurisdiction, making legal recourse more challenging.

3. Immediate and Irreversible Transactions: - Once a Bitcoin transaction is confirmed, it can't be reversed. This differs from traditional banking systems where transactions (like credit card chargebacks) might be reversed in cases of fraud.

4. Capitalizing on Lack of Understanding: - Many people don't fully understand how cryptocurrencies work. Scammers exploit this lack of knowledge, making false claims or promises related to Bitcoin investments.

5. Fake Investment Platforms: - Scammers might set up fake cryptocurrency investment platforms, promising high returns. Victims are often asked to deposit Bitcoin or other cryptocurrencies, which the scammers then steal.

6. Payment for Illicit Goods or Services: - In boiler room schemes, scammers might ask for payment in Bitcoin under the pretext of it being a legitimate investment medium or to purchase alleged "inside information" or other illegal services.

7. Laundering Illicit Gains: - Cryptocurrencies can be used to launder money. Scammers might move stolen funds through multiple Bitcoin addresses, use tumblers/mixers, or convert Bitcoin into other cryptocurrencies to obfuscate the trail.

8. Avoiding Traditional Financial Oversight: - Bitcoin transactions bypass traditional banking systems, allowing scammers to avoid the scrutiny and regulations that banks and financial institutions typically provide.

9. Promotion of Fake ICOs (Initial Coin Offerings): - Scammers might promote fake or fraudulent ICOs, asking investors to contribute Bitcoin or other cryptocurrencies for tokens of a new, often non-existent, crypto project.

10. Ransom and Extortion: - Some scams involve threats or ransomware attacks, where victims are instructed to pay in Bitcoin due to its perceived anonymity.

While Bitcoin and cryptocurrencies offer many legitimate and innovative use cases, their features can be exploited by malicious actors. It's crucial for individuals to exercise caution, educate themselves about cryptocurrency, and be wary of any investment opportunity that seems too good to be true.

2.3 Is Bitcoin Loophole Legal?

Top of Page

No, the tactics employed by Bitcoin Loophole, boiler room scammers, and similar fraudulent schemes are illegal in many jurisdictions. They deceive individuals, exploit their trust, and often result in significant financial losses for the victims. However, these scammers employ various strategies to evade detection and prosecution, making them challenging for authorities to tackle:

1. Jurisdictional Challenges: - Scammers often operate from countries with weak or limited financial regulations. They target victims in different jurisdictions, making it difficult for law enforcement agencies to coordinate investigations or take legal action. 2. Use of Cryptocurrencies: - As mentioned previously, cryptocurrencies like Bitcoin provide a level of anonymity, making it harder to trace the flow of illicit funds. This makes it difficult for authorities to track and seize assets. 3. Constantly Shifting Operations: - Boiler room operations frequently change their names, locations, and contact information. This constant rebranding makes them harder to trace and shut down. 4. Use of Shell Companies: - Scammers might hide behind shell companies or use multiple layers of corporate structures to obscure ownership and operations, further complicating investigations. 5. Exploiting Lack of Knowledge: - The complex nature of cryptocurrencies and the lack of understanding among the general public make it easier for scammers to deceive individuals without raising immediate suspicion. 6. Misleading Marketing and False Information: - Many scammers use professional-looking websites, fake testimonials, and counterfeit documents to appear legitimate, making due diligence challenging for potential investors. 7. Avoiding Traditional Communication Channels: - Scammers might avoid using traceable communication channels, opting for encrypted messaging apps, temporary phone numbers, or anonymous email services. 8. Quick Shutdown: - Once they have defrauded a certain number of victims, scammers might quickly shut down their operations, only to reopen under a different name or in a different location.

While authorities worldwide are becoming more aware of such scams and are taking measures to combat them, the decentralized and global nature of cryptocurrencies presents significant challenges. It's essential for individuals to remain vigilant, conduct thorough research, and approach investment opportunities with skepticism. If an offer seems too good to be true, it likely is.

Jeremy Clarkson on 'This Morning' Scam Image

2.4 Offshore brokers: Lack of Regulation and Accountability

Top of Page

Offshore brokers play a significant role in the boiler room scam landscape, often providing the infrastructure that allows these scams to thrive. The appeal of offshore brokers, especially in the context of boiler room scams and similar fraudulent schemes, stems from the lack of regulation and accountability in certain offshore jurisdictions. Here's how they fit into the boiler room scam framework:

1. Lax Regulatory Environment: - Some offshore jurisdictions have more lenient financial regulations, making it easier for unscrupulous entities to set up brokerage firms. These lax regulations can be a magnet for scammers looking to exploit the system without facing stringent oversight.

2. Anonymity and Privacy: - Offshore jurisdictions often provide higher levels of corporate anonymity. This makes it difficult for victims and authorities to identify the real owners or operators behind a scam.

3. Operational Flexibility: - Offshore brokers can offer financial products and services that might be restricted or heavily regulated in other countries. This flexibility can be used to create complex and misleading investment schemes.

4. Difficult Legal Recourse: - Victims defrauded by offshore brokers face challenges in seeking legal recourse. The cross-border nature of these operations, combined with differing legal systems, can make it hard for victims to recover lost funds or hold scammers accountable.

5. Marketing High Returns: - Offshore brokers, especially those involved in scams, often promise unusually high returns to lure investors. These promises are typically backed by false or misleading information.

6. Manipulation of Trading Platforms: - Some fraudulent offshore brokers might manipulate their trading platforms to create artificial losses or to prevent clients from withdrawing funds.

7. Integration with Boiler Room Operations: - Boiler rooms might act as the aggressive sales arm for offshore brokers. They cold-call potential investors, use high-pressure sales tactics, and push victims to deposit funds with the associated offshore broker.

8. Misleading Branding and Professional Appearance: - To gain trust, many offshore brokers invest in creating professional-looking websites and branding, sometimes even falsely claiming to be regulated or licensed.

9. Use of Intermediaries: - To further distance themselves from their illicit activities, some offshore brokers might employ intermediaries or third-party firms to handle client acquisition, payments, or other operations.

In summary, the lack of regulation and accountability offered by certain offshore jurisdictions provides an environment conducive to fraudulent activities. Offshore brokers, when linked to boiler room scams, act as the platform where victims' funds are channeled, manipulated, and often lost. It's crucial for investors to conduct thorough due diligence before engaging with any broker, especially those based in offshore locations.

Section 3: How to Spot a Bitcoin Loophole Scam

Top of Page

Spotting a Bitcoin Loophole boiler room scam or any similar fraudulent scheme requires vigilance, skepticism, and awareness of common red flags. Here are some key indicators and steps to help identify these scams:

1. Unsolicited Contact: - Be wary if you receive unsolicited phone calls, emails, or messages promoting investment opportunities, especially if you never signed up for such information.

2. Too Good to Be True: - Promises of high returns with minimal or no risk are classic red flags. If an investment sounds too good to be true, it likely is.

3. High-Pressure Sales Tactics: - Scammers often use aggressive sales tactics, urging potential victims to invest immediately, citing limited-time offers or opportunities.

4. Lack of Transparency: - Be skeptical of brokers or platforms that don't provide clear information about their operations, ownership, or regulatory status.

5. Unverifiable Claims: - Watch out for claims of endorsements by celebrities, testimonials from supposed successful investors, or mentions of partnerships with reputable companies. Always verify such claims independently.

6. Avoiding Questions: - If the broker or representative avoids answering questions, provides vague answers, or tries to divert the conversation, it's a warning sign.

7. Complex Jargon: - Scammers might use complex financial jargon to confuse potential victims and make their scheme seem legitimate.

8. Check Regulatory Status: - Always verify if the broker or platform is registered with relevant regulatory bodies in your country or their country of operation.

9. Misleading Marketing and Web Presence: - Scammers often use professional-looking websites to appear legitimate. However, inconsistencies, spelling errors, or generic stock photos might hint at a scam.

10. Difficulty Withdrawing Funds: - If you've already invested and encounter issues withdrawing your money or face unexpected fees, it might be a scam.

11. Payment Methods: - Be cautious if you're asked to make payments using unconventional methods, such as gift cards, wire transfers to obscure banks, or cryptocurrencies.

12. Research Online: - Look for reviews, complaints, or discussions about the broker or scheme online. Victims often share their experiences to warn others.

13. Verify Contact Information: - Check the provided contact information, such as phone numbers, addresses, and emails. Scammers might use fake addresses or temporary phone numbers.

14. Educate Yourself: - Understanding the basics of Bitcoin and other cryptocurrencies can help you identify inconsistencies in what the scammers are offering.

15. Trust Your Instincts: - If something feels off or makes you uncomfortable, it's better to be safe and avoid the investment.

To protect yourself and others, always report suspected scams to relevant authorities or consumer protection agencies. They can take action, and your report might prevent others from falling victim.

3.1 Red Flags to Watch Out For On Websites

Top of Page

When considering investing through a website, especially one that deals with banking or financial services, it's crucial to ensure its legitimacy. Here are the ways to verify the authenticity of such websites:

1. SSL Certificate: - Check for "https://" in the website's URL, which indicates a secure connection. A padlock symbol next to the URL also denotes a secure site. 2. Domain Registration: - Use domain lookup services like WHOIS to check when the domain was registered, by whom, and other related details. Recent registrations for supposedly established companies can be suspicious. 3. Regulatory Licensing: - Legitimate investment platforms and banks will mention their regulatory status and licensing details. Cross-check these details with the respective regulatory bodies' official websites. 4. Physical Address: - Verify the physical address provided on the website. Google Maps or a quick search can help. Be cautious of P.O. Box addresses or those that lead to residential areas. 5. Contact Details: - Genuine companies provide multiple contact methods, including phone numbers and email addresses. Test them to ensure they're functional. 6. Clear About Us and Terms of Service Pages: - Legitimate sites usually have detailed "About Us" and "Terms of Service" pages that provide insights into the company's background, mission, and operational terms. 7. Customer Reviews: - Check third-party review websites, forums, and social media for feedback from other users. While a few negative reviews are common, numerous complaints are a red flag. 8. Consistent Branding: - Look for consistent branding across the website, including logos, color schemes, and fonts. Inconsistent branding might hint at a hastily set-up scam site. 9. Professional Design and Functionality: - Legitimate banking and investment websites invest in professional design and functionality. Glitches, broken links, or poor design can be warning signs. 10. Transparent Fee Structure: - Genuine investment platforms provide clear information about fees, charges, and other related costs. 11. Educational Content: - Reputable investment platforms often offer educational resources for their users, such as articles, webinars, or tutorials. Lack of such content can be suspicious. 12. Privacy Policy: - Legitimate sites have a comprehensive privacy policy detailing how user data is collected, used, and protected. 13. External Verifications: - Some websites may display badges or certificates from cybersecurity companies, BBB (Better Business Bureau) ratings, or other industry recognitions. However, ensure these badges are genuine and not just copied images. 14. Social Media Presence: - Established companies usually have an active presence on major social media platforms. Check their profiles for regular updates and user engagement. 15. Check with Financial Authorities: - Depending on your region, financial authorities or associations (like FINRA in the U.S.) may provide tools to check the legitimacy of investment platforms or warn about potential scams.

Always adopt a cautious approach when considering online investments. If in doubt, it's advisable to consult with a financial advisor or expert before committing funds.

3.2 Researching the Broker: Due Diligence is Key

Top of Page

Once ensnared by dubious brokers, individuals may feel overwhelmed and pressured, making it harder to think clearly. However, there are distinct red flags that can serve as undeniable indicators of a broker's nefarious intentions:

- High-Pressure Sales Tactics: If the broker is incessantly pushing for more investments, especially with promises of "once-in-a-lifetime" opportunities that need immediate action, be wary. Legitimate brokers will give you time to consider your options.

- Guaranteed Returns: No investment can guarantee returns. If a broker promises consistent and high profits with no risk, it's likely too good to be true.

- Withholding Funds: If you face consistent delays, excuses, or high fees when trying to withdraw your money, it's a major red flag. Legitimate brokers facilitate smooth withdrawals.

- Unsolicited Calls: Receiving unexpected calls from brokers offering investment opportunities can be a sign of a scam. Established brokers don't usually cold call potential clients.

- Changing Account Managers: If you're frequently shuffled between different account managers who give inconsistent advice or pressure for more investments, be cautious.

- Lack of Transparency: If the broker is evasive about their fees, commissions, or the specifics of an investment, it's suspicious. Genuine brokers are transparent about costs and potential risks.

- Manipulated Trades: If you notice that trades are executed at prices or times you didn't specify, or there are mysterious and unexplained losses, the broker might be manipulating your account.

- Inconsistent Information: If the details provided by the broker contradict what's available on their website or in public financial news, it's a warning sign.

- Unlicensed or Unregulated: Brokers operating without a license or outside of regulatory oversight are a significant risk. Always verify their regulatory status with relevant authorities.

- Lack of Clear Communication: If the broker avoids answering questions, provides vague responses, or is unreachable when you need them, it's concerning.

- Pushing for More Personal Information: If brokers demand more personal or financial information than necessary, especially without clear reasons, they might have ulterior motives.

- Recommendation of Over-leveraging: If a broker encourages using excessive leverage without explaining the risks, they might be more interested in earning commissions than safeguarding your investments.

- Bad Reviews and Complaints: Numerous negative reviews, especially those related to withdrawals or account manipulations, are indicative of untrustworthy brokers.

- Too Good to Be True Offers: Promotions like bonuses that seem excessively generous often come with hidden conditions or are used to lure victims.

- Offshore Operations: If the broker operates from a location known for lax financial regulations and insists on overseas wire transfers, be extra cautious.

- Remember, in the world of investments, if something seems too good to be true, it probably is. Always trust your instincts, and when in doubt, seek advice from trusted financial advisors or professionals.

3.3 True Investments vs. Get-Rich-Quick Schemes

Top of Page

Differentiating between genuine investments and get-rich-quick schemes is crucial to protect your finances. Here's a breakdown of key differences and how to spot them:

True Investments:

Top of Page

- Time Horizon: Genuine investments often require a longer time horizon. They aim for gradual wealth accumulation over months, years, or even decades.

- Researchable: Authentic investment opportunities are usually backed by tangible assets, research, or a clear business model. Investors can independently verify information.

- Transparency: Legitimate investment firms or platforms provide clear information about their operations, fees, and any associated risks.

- Regulated: Authentic investments are often overseen by regulatory bodies, ensuring they adhere to specific standards and practices.

- Risk Disclosure: True investments always come with risks, and reputable firms are upfront about these risks. They don't guarantee returns.

- Consistent Returns: While returns can vary, genuine investments typically don't promise or deliver astronomically high returns in short periods.

- Professional Management: Legitimate investment platforms or opportunities often involve experienced professionals in finance, business, or other relevant fields.

- Reputation: Established investments or platforms usually have a track record and can be vetted through reviews, testimonials, or historical data.

Get-Rich-Quick Schemes:

Top of Page

- Immediate High Returns: These schemes often lure victims with promises of high returns in a very short time.

- Vagueness: They may lack clarity on how the investment works or how returns are generated.

- Pressure Tactics: Scammers frequently pressure potential investors to act quickly, leveraging FOMO (Fear of Missing Out).

- Unsolicited Offers: Be wary of unexpected investment offers, especially via email, phone calls, or social media.

- Lack of Regulation: Many such schemes operate outside of regulatory oversight or in regions with lax financial regulations.

- Overemphasis on Recruitment: If returns primarily depend on recruiting new participants rather than genuine investment or sales of products, it's a red flag (e.g., Ponzi or pyramid schemes).

- Too Good to Be True: Any investment that sounds too perfect likely is.

- Limited Time Offers: Scammers often create a sense of urgency, claiming the "opportunity" is available for a short time.

- Minimal Risk Disclosures: They'll often downplay or even completely ignore the risks involved.

- Unclear Business Model: If it's hard to understand how money is made, be cautious.

General Tips:

Top of Page

- Research: Always conduct thorough research before investing. 2. Seek Expert Advice: Consult with financial advisors or professionals. 3. Avoid Emotional Decisions: Don't let emotions, especially greed or fear, dictate investment choices. 4. Start Small: If considering a new investment avenue, start with a small amount to test the waters.Trust Your Instincts: If something feels off, it's okay to walk away.

- In essence, genuine investments are grounded in reality, backed by research, and don't promise unrealistically high returns. Get-rich-quick schemes, on the other hand, rely on high-pressure tactics, vague promises, and often operate in the shadows of the financial world.

Section 4: Protecting Yourself from Bitcoin Loophole Scams

Top of Page

Before diving into research regarding any investment, including those like Bitcoin Loophole, it's essential to establish a solid foundation and approach to ensure you're making informed decisions. Here are some steps to take:

1. Educate Yourself: - Understand the basics of investing and the financial markets. - Familiarize yourself with common investment terminologies and concepts.

2. Set Clear Investment Goals: - Define what you hope to achieve with your investment, whether it's long-term wealth accumulation, generating regular income, or other specific objectives. - Determine your risk tolerance. Are you comfortable with high-risk, high-reward investments, or do you prefer more stable, lower-return assets?

3. Use Reputable Sources: - Rely on well-established financial news outlets, journals, and publications. - Consider subscribing to industry newsletters or magazines that provide in-depth analyses.

4. Check Regulatory Websites: - Websites of regulatory bodies often list licensed brokers, firms, and sometimes warnings about unregulated entities or known scams. - In the U.S., for instance, you can check with the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC).

5. Verify Claims: - Cross-reference information from multiple sources. If a website makes a specific claim about an investment, see if this claim is echoed by trusted financial news sources. - Be skeptical of promises of high returns with little to no risk.

6. Look for Reviews and Testimonials: - Beyond the company's website, check for independent reviews or testimonials. Sites like Trustpilot or even forums can be useful. - Be cautious, though; some positive reviews might be fabricated. Look for patterns in reviews, both good and bad.

7. Avoid Pressure: - Legitimate investment opportunities won't disappear overnight. Be wary of high-pressure tactics urging you to invest immediately.

8. Understand the Technology or Principle: - If considering tech-based investments like cryptocurrencies, strive to understand the underlying technology. In this case, learn about blockchain and how cryptocurrencies function.

9. Consult Professionals: - Consider consulting a financial advisor or someone knowledgeable in the field. They can offer personalized advice based on your financial situation and goals.

10. Practice Safe Browsing: - Ensure the website starts with "https://" and has a padlock symbol, indicating it's secure. - Be cautious with downloads or links from untrusted sources.

11. Start Small: - If after your research you still want to proceed, consider starting with a small amount to minimize potential losses.

12. Stay Updated: - The financial world is dynamic. Continuously update yourself on market trends, news, and any changes related to your investments.

Remember, investing always comes with risks. While thorough research can help mitigate these risks, it's essential to be prepared for potential losses. It's a red flag if any investment claims to be entirely risk-free, especially with promises of high returns.

Top of Page

Finding and verifying regulated exchanges and platforms is a crucial step to ensure the safety of your investments, especially in the world of cryptocurrencies and online trading. Here's a step-by-step guide:

1. Start with National Regulatory Bodies: - Most countries have financial regulatory bodies that oversee and license financial institutions, including online trading platforms and exchanges. - In the U.S., you can check with the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC). - In the U.K., the Financial Conduct Authority (FCA) is the primary regulatory body. - For the EU, the European Securities and Markets Authority (ESMA) plays a similar role.

2. Search for Lists of Regulated Exchanges: - These regulatory bodies often provide lists of licensed or regulated exchanges and platforms on their official websites. - They might also provide lists of platforms that have been flagged or are operating without a license.

3. Visit the Exchange or Platform's Website: - Reputable exchanges will usually prominently display their licensing or regulatory information on their website. - Look for terms like "licensed," "regulated," or "registered," followed by the name of the regulatory body.

4. Verify with the Regulatory Body: - After identifying the claimed regulatory body from the exchange's website, visit the regulator's official site. - Many regulators offer online search tools where you can input the name of the exchange or platform to verify its regulatory status.

5. Check for Additional Certifications or Memberships: - Some exchanges might be members of industry associations or have received certifications from independent organizations. While not a substitute for official regulation, these can be additional indicators of reputability.

6. Research Reviews and Feedback: - While doing your research, it's beneficial to look at reviews and feedback from other users. - Be cautious of both overly positive and negative reviews, as some can be fake. Instead, look for consistent patterns and well-explained experiences.

7. Secure Connection: - Ensure the platform's website uses HTTPS (look for the padlock symbol in the address bar). This indicates that the site encrypts any data you input, adding a layer of security.

8. Consider the Platform's Transparency: - Trustworthy exchanges often provide details about their operating status, financial health, and other relevant business activities. They might also provide regular audits or transparency reports.

9. Beware of Too-Good-To-Be-True Promises: - As with any investment, if an exchange or platform promises guaranteed high returns with no risk, it's a significant red flag.

10. Stay Updated: - Regulations can change, and exchanges' statuses might vary over time. Regularly check back with regulatory bodies and stay informed about any changes.

By following these steps, you can significantly reduce the risk of falling victim to fraudulent exchanges or platforms. However, remember that all investments carry inherent risks, even on reputable platforms. Always do your due diligence and consider consulting with financial professionals before making significant investment decisions.

Top of Page

"Staying Informed: Staying Ahead of Scammers" is a good, proactive approach emphasizing the importance of continuous learning and vigilance in the face of ever-evolving scams and fraudulent schemes. Here's a breakdown of this idea:

1. The Dynamic Nature of Scams: - Scammers are always evolving their tactics. What was a common scam method five years ago might be well-known and easily avoidable today, but new methods emerge regularly. 2. Benefits of Staying Informed: - Awareness: Being knowledgeable about the latest scams allows individuals to recognize red flags and avoid falling victim. - Empowerment: Knowledge equips people with the confidence to make informed decisions, reducing the power that scammers have to manipulate or deceive. - Sharing with Community: An informed individual can educate their friends, family, and community, creating a ripple effect of awareness.

3. Ways to Stay Informed: - Regular Research: Periodically review reputable news sources or websites dedicated to scam alerts. - Subscribe to Newsletters: Many regulatory bodies and cybersecurity firms offer newsletters that highlight the latest scams and preventive measures. - Participate in Webinars/Workshops: Many organizations offer sessions on cybersecurity and scam prevention. - Engage in Online Communities: There are forums and online groups where members share their experiences and alert others about new scam methods.

4. The Role of Technology: - Use advanced security software that can detect phishing sites or malicious software. - Ensure all software, including operating systems and applications, are regularly updated to benefit from the latest security patches.

5. Critical Thinking and Skepticism: - Even with all the information, it's crucial to maintain a level of skepticism, especially when dealing with unsolicited communications or too-good-to-be-true offers. - Always double-check information, especially when it comes to financial transactions or sharing personal data.

6. Report and Share: - If you encounter a scam or even a suspected scam, report it to the appropriate authorities. This not only helps in possible actions against the scammers but also increases awareness. - Share your experiences with your community. Your story might prevent someone else from becoming a victim.

In conclusion, "Staying Informed: Staying Ahead of Scammers" is an empowering mantra that emphasizes the importance of continuous education and vigilance in a world where scams are a persistent threat. By staying updated and sharing knowledge, individuals can protect themselves and their communities from potential financial and emotional harm.

4.3 Seeking Professional Advice: Consulting Financial Advisors

Top of Page

Seeking professional advice is a wise step when considering investments or when you're unsure about the legitimacy of a financial opportunity. Here are some key bodies or organizations you can approach for advice, along with guidance on how to find them:

1. Financial Advisors and Planners: - Role: They can provide personalized financial advice based on your goals, financial situation, and risk tolerance. - Where to Find: Check with national or regional regulatory bodies that oversee financial advisors. In the U.S., for instance, the Financial Industry Regulatory Authority (FINRA) has a 'BrokerCheck' feature to help you research the background of financial brokers and firms.

2. Certified Public Accountants (CPAs): - Role: They can provide advice on tax implications related to investments. - Where to Find: National and regional CPA organizations often have directories of their members. The American Institute of CPAs (AICPA) is an example for the U.S.

3. Securities and Exchange Commission (or equivalent in your country): - Role: They regulate securities markets and protect investors. - Where to Find: Visit the official website of the SEC or the equivalent body in your country. They often have investor education sections and lists of registered firms and brokers.

4. Consumer Protection Agencies: - Role: They can provide information on common scams and how to avoid them. - Where to Find: Most countries have national or regional consumer protection agencies. In the U.S., the Federal Trade Commission (FTC) plays this role.

5. Banking and Financial Ombudsman Services: - Role: They can assist in resolving disputes between consumers and financial firms. - Where to Find: Search for the ombudsman service related to financial disputes in your country. They often have online directories and resources.

6. Local and National Investment Clubs: - Role: These are groups where individuals meet to discuss investment strategies, and they can be a source of advice and support. - Where to Find: Search online or check with local community centers or educational institutions.

7. Industry Associations: - Role: Associations related to financial planning, investment, and banking often have resources and directories of professionals. - Where to Find: Examples include the Financial Planning Association (FPA) and the CFA Institute.

8. Legal Counsel: - Role: If you're considering a significant investment, especially in a startup or private venture, consulting with an attorney who specializes in securities or investment law can be beneficial. - Where to Find: National or regional bar associations often have directories of lawyers by specialization.

When approaching any professional or organization for advice: - Verify their credentials: Ensure they are registered with the relevant regulatory bodies. - Check for any disciplinary actions or complaints against them. - Understand their fee structure: Know whether they earn commissions on products they recommend or if they charge a flat fee or hourly rate.

- Seek referrals: Ask friends, family, or colleagues for recommendations based on their experiences.

Remember, while professional advice can be invaluable, always do your due diligence and ensure that the advice aligns with your financial goals and risk tolerance.

4.4 Reporting Scams: Taking Action Against Fraudsters

Top of Page

Taking action against boiler room fraudsters, especially those leveraging the anonymity of Bitcoin and other cryptocurrencies, can be challenging due to their covert operations and the borderless nature of their scams. However, if you or someone you know has been targeted or fallen victim to such schemes, here are some steps you can take:

1. Document Everything: - Keep records of all communications, including phone calls, emails, and other messages. - Note down names, phone numbers, email addresses, and any other details provided by the scammers. - Save any transaction receipts, bank statements, or cryptocurrency transfer details.

2. Report to Law Enforcement: - Contact your local police or law enforcement agency and provide them with all the details. - In many countries, there are specialized units that handle cybercrimes and financial fraud.

3. Report to Regulatory Bodies: - Notify the securities regulator in your country. In the U.S., this would be the Securities and Exchange Commission (SEC). - Alert your country's financial intelligence unit. In the U.S., this is the Financial Crimes Enforcement Network (FinCEN).

4. Contact Consumer Protection Agencies: - They can provide guidance on the next steps and may also have resources to assist victims of scams. - They can issue warnings to the public about specific scams based on your report.

5. Notify Your Bank and Credit Card Companies: - They might have measures in place to assist victims of fraud. - They can monitor your accounts for any suspicious activity.

6. Cybersecurity Measures: - If you believe your devices have been compromised, consult with a cybersecurity expert to check and secure your devices. - Change all passwords, especially for banking and other financial platforms.

7. Educate and Spread Awareness: - Share your experience on social media, community forums, and with friends and family to alert others about the scam. - The more people are aware, the less likely they are to fall for such schemes.

8. Seek Legal Counsel: - Consult with an attorney to explore any legal remedies available to you, especially if you've suffered significant financial loss.

9. Engage with Online Communities: - There are several online forums and communities where victims of scams share their experiences and provide support to one another. Engaging with these communities can provide additional resources and avenues to pursue action.

10. Stay Updated: - Scammers evolve their tactics. By staying informed about the latest scams and tactics, you can better protect yourself and others.

Locating and Identifying Scammers: - Given the borderless nature of the internet and cryptocurrencies, locating and identifying these fraudsters can be very challenging. - Many operate from jurisdictions with lax regulations or where local authorities may not prioritize such cases.

- They often use VPNs, fake identities, and other methods to conceal their true location and identity.

While it's crucial to take action and report these scams, it's equally important to prioritize prevention. By educating yourself and others about the warning signs and red flags associated with these schemes, you can reduce the risk of falling victim in the first place.

Section 5: Conclusion and Final Thoughts

Top of Page

In the world of cryptocurrencies, one must always stay alert to scams like Bitcoin Loophole. By understanding the risks involved, recognizing the warning signs, and opting for secure investment options, you can safeguard your hard-earned money while participating in the innovative world of cryptocurrency.

For further information and resources, check out these recommended sources:

We welcome your thoughts, experiences, and insights on Bitcoin Loophole and related scams. Let's have a discussion below and share this article with others to create awareness and protect the community from falling into these traps.

Remember, education and vigilance are the keys to staying one step ahead of scammers in the cryptocurrency market.

Join the conversation, share your views, and help protect others from falling victim to Bitcoin Loophole and similar scams. Together, we can make the cryptocurrency world a safer place for everyone.