1. Introduction:

Top of Page

The uncertainty principle, also known as Heisenberg's uncertainty principle, is indeed a fundamental cornerstone of quantum mechanics. It states that there is a limit to the precision with which certain pairs of physical properties, such as a particle's position and momentum, can be known simultaneously.

While the "if we know how fast it's going we don't know where it is" statement captures the essence of the uncertainty principle, it's not entirely accurate and misses some key nuances. Here's a more precise explanation:

The uncertainty principle states that there is a fundamental limit to how precisely we can know certain pairs of complementary properties for a quantum object, like:

Position and momentum: The more accurately we know a particle's position, the less we can know about its momentum (mass times velocity) and vice versa. Imagine trying to pinpoint a butterfly with a laser. The laser itself disturbs the butterfly's movement, introducing uncertainty in its momentum.

Energy and time: The more precisely we measure the energy of a system, the less we can know about its duration (and vice versa). Think of a short, intense burst of light. You can estimate its energy precisely, but the exact duration gets blurry.

Why is it more nuanced than the simplistic statement?

It's not about "knowing" or "not knowing": It's not that we can't know both properties at all. Rather, the more precisely we measure one, the more the uncertainty in the other increases. It's a trade-off, not an absolute barrier.

It applies to pairs of properties: The uncertainty principle doesn't say we can't know anything about position and momentum simultaneously. It only limits the combined precision of their measurements.

It's not just about measurement: While the act of measuring can disturb a quantum system, the uncertainty is inherent to the object's wave-like nature, even without interaction.

Think of it like this: Imagine a wave packet on a string. Knowing its exact location means a very short and narrow wave, which tells us little about its direction and speed (momentum). Conversely, knowing its precise wavelength (momentum) means a spread-out wave, making its location fuzzy.

In essence, the uncertainty principle highlights the fundamental fuzziness of the quantum world, where properties like position and momentum don't have definite values like in our everyday experience. It's a fascinating and essential concept that underpins much of quantum mechanics and has profound implications for understanding the universe at its smallest scales.

Are there only so many places a 'particle' can be in the quantum realm - is it essentially 'digital'?

That's a fascinating question, and it touches on one of the counterintuitive aspects of the quantum realm. While both interpretations of "digital" and location of particles require nuanced explanations, here's what we know:

Not exactly "digital":

- The quantum world isn't inherently "digital" like classical computers. While quantum bits (qubits) exist, they represent a different kind of information storage compared to traditional binary bits. Qubits leverage the principles of superposition (existing in multiple states simultaneously) and entanglement (linked properties across distances) to carry and process information in unique ways.

Beyond fixed locations:

- Particles in the quantum realm don't have definite, fixed locations like objects in our daily world. Their existence is described by a wave function, indicating the probability of finding them in certain regions of space. This leads to concepts like "superposition," where a particle can exist in multiple possible positions simultaneously until measured.

Quantized states, not discrete steps:

- While classical information might be limited to definite "on" or "off" states, quantum systems have quantized states. Think of it like a dimmer switch with multiple levels instead of just an on/off toggle. These states aren't necessarily discrete steps like in classic digital systems, but rather continuous possibilities within certain ranges.

Not "countable" locations:

- Unlike classic digital bits, a quantum particle's possible locations aren't necessarily countable or neatly packaged. The wave function representing its "spread" can be continuous and complex, potentially containing infinitely many potential positions within a specific region.

Uncertainty principle:

- Remember Heisenberg's uncertainty principle? The more precisely we know a particle's momentum, the less we can know its position, and vice versa. This inherent fuzziness further challenges the idea of assigning a single, definite location in the quantum realm.

The quantum world doesn't map directly onto the "digital" concept as we understand it in classical computing. Particles lack fixed locations and exist in probabilities governed by the wave function. While there are quantized states, they're not necessarily discrete like digital bits. So, the idea of a finite number of "places" a particle can be doesn't translate precisely to the quantum realm.

Now here is where we need to define "Quantum AI" clearly. The problem is that Quantum AI is not really defined at all, even on their numerous websites. Now that's a very serious and valid concern. The lack of definition surrounding "Quantum AI" and its technology further underscores the importance of a critical approach in our thinking. Here are some additional points to consider:

1. Transparency Concerns:

What is Quantum AI and how does it work? What has the AI been trained on, and how does the quantum computing error correction function in order for it not to give unpredictable or dangerous results?

If the error correction could be properly engineered, and the number of qubits and storage be made sufficient, what would a quantum computing based AI be like and how would it differ from the AI we have now?

Predicting the precise capabilities of a future quantum AI is challenging, as the technology is still in its early stages and error correction remains a significant hurdle. However, based on theoretical understanding and ongoing research, here are some potential differences between an AI powered by true quantum computing and our current AI systems:

Superior Problem-Solving in Specific Areas:

- Quantum algorithms excel at solving certain problems that are intractable for classical computers, such as complex simulations of molecules, materials, and financial systems. This could lead to breakthroughs in areas like drug discovery, materials science, and personalized medicine.

- Quantum AI could tackle optimization problems with far greater efficiency, leading to improved logistics, resource allocation, and decision-making across various industries.

Enhanced Machine Learning:

- By exploiting the power of quantum parallelism, quantum AI could analyze vast amounts of data much faster, leading to deeper insights and potentially surpassing the capabilities of today's deep learning models.

- Quantum AI might be able to identify complex patterns and relationships in data that are currently hidden, leading to breakthroughs in various fields like natural language processing and image recognition.

More Creative and Flexible AI:

- Quantum AI might exhibit a more "holistic" understanding of the world by simultaneously processing information from various perspectives, potentially leading to more creative and flexible solutions to problems.

- This capability could revolutionize fields like robotics and autonomous systems, enabling them to adapt and make decisions in complex and unpredictable environments.

However, it's crucial to remember several limitations and challenges:

- Error Correction: Building a large-scale quantum computer with robust error correction remains a significant engineering challenge. Without it, the benefits of quantum algorithms might be diminished by errors creeping into calculations.

- Scalability: Scaling up quantum computers to handle real-world problems requires overcoming significant technical hurdles. Current quantum systems are limited in the number of qubits they can handle, restricting their practical applications.

- Algorithmic Development: Developing efficient and powerful quantum algorithms tailored to specific problems is an ongoing research area. The capabilities of quantum AI ultimately depend on the effectiveness of these algorithms.

Therefore, while the potential of quantum AI is vast, it's vital to have realistic expectations. It's not a magic bullet for every problem, and significant technological advancements are needed before its full potential can be realized.

2. Potential for Misinformation:

Let's discuss the potential for platforms using the "Quantum AI" label to exploit the public's fascination with quantum technology to make exaggerated claims.

The "Quantum AI" label presents a significant potential for exploitation of the public's fascination with quantum technology, leading to exaggerated claims and misleading marketing practices. Here's a breakdown of the key concerns:

1. Misleading Terminology:

- The term "Quantum AI" itself is often ambiguous and lacks clear definition. It can be used for various purposes, not all of them genuinely using quantum computing. This ambiguity allows companies to leverage the public's fascination with the cutting-edge technology to make their products appear more advanced than they truly are.

2. Lack of Transparency:

- Many platforms claiming to use "Quantum AI" might not disclose the specific technology they employ. This lack of transparency makes it difficult for consumers to assess the legitimacy of their claims and understand the actual capabilities behind the product.

3. Inflated Expectations:

- The association with "quantum" technology can lead to unrealistic expectations about the platform's capabilities. Companies might claim to offer superior market prediction, portfolio optimization, or risk management, even though their underlying algorithms might be based on traditional machine learning techniques, not true quantum computing.

4. Ethical Concerns:

- Exploiting the public's limited understanding of quantum technology raises ethical concerns. It can lead to deceptive marketing practices and potentially harm investors who make decisions based on misleading claims.

5. Potential for Market Manipulation:

- If "Quantum AI" platforms become widely adopted and their claims are not grounded in reality, it could lead to irrational market behavior and potentially contribute to market manipulation. This could have negative consequences for the financial system as a whole.

Here are some specific examples of potential exploitation:

- A trading platform might claim to use "quantum algorithms" for stock picking, but in reality, it might be using a basic statistical model wrapped in "quantum-sounding" language.

- A wealth management firm might advertise "quantum-powered" portfolio optimization, but their technology might not be based on true quantum computing and offer limited benefits over traditional methods.

It's crucial for the public to be aware of these potential issues and approach any "Quantum AI" claims with a critical eye:

- Do your research: Before trusting any platform claiming to use "Quantum AI," research the company, its technology, and its track record. Look for independent reviews and expert opinions.

- Be wary of marketing jargon: Don't be swayed by technical-sounding terms you don't understand. Ask for clear explanations of the technology and its specific capabilities.

- Manage your expectations: Remember, quantum computing is still in its early stages, and its practical applications in finance are likely years away. Don't expect "Quantum AI" to be a magic bullet for success.

- Seek professional advice: If you're unsure about using any "Quantum AI" platform, consult with a qualified financial advisor who can help you make informed investment decisions. The integration of terms like "Quantum AI" into the branding of various platforms can indeed captivate public interest, leveraging the aura of cutting-edge technology and the promise of unprecedented capabilities associated with quantum computing. However, this fascination also opens avenues for exploitation through exaggerated claims or misleading marketing. Here's a discussion on the potential for such exploitation and its implications:

The Exploitation of Public Fascination

-

Overstated Capabilities:

- Some platforms might claim that their solutions or algorithms, labeled as "Quantum AI," offer superior performance or insights that far exceed the capabilities of classical computing systems, even when such claims lack verifiable evidence or practical feasibility.

-

Misleading Marketing:

- Marketing materials may intentionally use the term "Quantum AI" to imply a technological sophistication that the platform does not possess, misleading users about the nature and effectiveness of the product.

-

Preying on Lack of Public Understanding:

- The concepts underlying quantum computing and artificial intelligence are complex and not widely understood by the general public. This lack of understanding can be exploited by making claims that are difficult for the average person to evaluate critically.

-

Speculative Future Benefits:

- Some platforms may focus on potential future benefits of quantum computing advancements to justify current investments or engagement, despite these benefits being speculative and not guaranteed.

Implications of Exaggerated Claims

-

Consumer Trust:

- Over time, exaggerated or unfounded claims can erode trust in legitimate quantum computing and AI advancements. This mistrust can hinder public support and investment in genuine research and development efforts.

-

Investment Risks:

- Investors, driven by the allure of being part of a revolutionary technology, might allocate resources to ventures that have little substance beyond their marketing, potentially leading to financial losses.

-

Resource Diversion:

- Hype around "Quantum AI" might divert attention and resources away from other valuable AI and quantum computing research areas that are making steady, albeit less sensational, progress.

-

Regulatory Challenges:

- The regulatory landscape may struggle to keep pace with the rapid introduction of these so-called quantum AI platforms, making it challenging to protect consumers from misleading claims.

Mitigating Exploitation Risks

-

Public Education:

- Enhancing public understanding of quantum computing and AI can help individuals and organizations make more informed decisions about the technologies they adopt or invest in.

-

Industry Standards:

- Developing and adhering to industry standards for transparency and verifiability in claims can help distinguish between legitimate and exaggerated claims.

-

Critical Media Coverage:

- Responsible journalism that critically evaluates and reports on quantum AI claims can provide a counterbalance to unverified marketing.

-

Regulatory Oversight:

- Regulatory bodies can play a crucial role in monitoring and acting against misleading claims, protecting consumers and investors from potential exploitation.

While the integration of quantum computing and AI holds significant promise for various sectors, the potential for platforms to exploit public fascination through exaggerated claims poses a real challenge. Balancing the enthusiasm for these technologies with critical evaluation and oversight is essential for fostering a healthy ecosystem that supports genuine innovation and public trust. By exercising caution and conducting thorough research, individuals can protect themselves from misleading claims and make sound investment decisions, even in the face of the evolving landscape of "Quantum AI" and its potential for exploitation.

How should people be cautious of marketing tactics that rely on technical jargon without providing concrete details or proof of effectiveness?

Here are some steps individuals can take to be cautious of marketing tactics that rely on technical jargon without providing concrete details or proof of effectiveness:

1. Recognize the red flags:

- Excessive use of technical jargon: Be wary of language that seems overly complex or uses technical terms without clear explanations. This can be a tactic to create an impression of sophistication and expertise, while obfuscating the actual workings of the product or service.

- Lack of concrete details: If the marketing material focuses on vague claims and avoids providing specific details about the product's functionality, methodology, or results, it's a cause for concern.

- Absence of evidence-based claims: Be skeptical of claims of guaranteed success or superior performance without any data, research, or testimonials to back them up. Look for evidence-based statements supported by verifiable information.

- Unrealistic promises: If the marketing promises seem too good to be true, they probably are. Be wary of claims that offer quick fixes, effortless solutions, or guaranteed returns on investment, especially in volatile or complex areas like finance or healthcare.

2. Actively investigate and verify:

- Research the company and product: Before making any commitments, take the time to research the company, product, or service behind the marketing campaign. Look for independent reviews, expert opinions, and user testimonials to get a broader perspective.

- Verify claims with independent sources: Don't solely rely on the information presented in the marketing material. Try to verify the claims with independent sources, such as reputable research institutions, industry publications, or government agencies.

- Look for certifications or endorsements: Check if the product or service has any relevant certifications or endorsements from recognized organizations. While not a foolproof guarantee, these can lend some credibility to the claims being made.

3. Ask critical questions:

- Don't hesitate to ask questions: If the marketing material raises questions or uncertainties, don't hesitate to reach out to the company directly and ask for clarification. See how they respond to your inquiries and how transparent they are in addressing your concerns.

- Focus on specifics: When interacting with the company, ask for specific details about the product or service, its methodology, and its track record. Don't settle for vague answers or technical jargon without clear explanations.

- Compare with alternatives: Consider researching and comparing the product or service with alternative options in the market. This helps you understand its relative value proposition and identify potential biases in the marketing campaign.

4. Prioritize critical thinking and skepticism:

- Maintain a healthy dose of skepticism: Don't let yourself be swayed by hype or emotional appeals. Approach marketing claims with a critical eye and question any information that seems overly promotional or lacking in substance.

- Prioritize understanding over complexity: If something seems overly complicated, step back and try to understand the core concept in simpler terms. Often, complex jargon is used to mask a lack of substance or to create an artificial sense of sophistication.

- Consult with trusted advisors: If you're unsure about a product or service, especially in areas like finance or healthcare, consider seeking advice from a trusted professional or advisor who can offer an objective perspective based on their knowledge and experience. When faced with marketing tactics that heavily rely on technical jargon without offering concrete details or proof of effectiveness, individuals and organizations should adopt a cautious and critical approach. Here are some strategies to navigate these situations effectively:

Understand the Basics

- Educate Yourself: Gain a basic understanding of the technology being advertised. This doesn't mean becoming an expert but having enough knowledge to question claims critically.

- Seek Definitions: If unfamiliar terms are used, look them up. Understanding the jargon can sometimes reveal that the language is being used more for its connotation than its denotation.

Critical Evaluation

- Demand Specifics: Be wary of broad claims that don't provide specific evidence or examples of how the technology works and its proven benefits.

- Look for Independent Verification: Search for third-party tests, reviews, or studies that validate the claims being made. Independent sources are more likely to provide an unbiased perspective.

- Check for Transparency: Companies confident in their technology should be transparent about how it works and the results it delivers. A lack of transparency is a red flag.

Beware of Red Flags

- Overuse of Buzzwords: Excessive use of buzzwords or jargon can be a tactic to obscure the lack of substantive information or to impress the audience without offering real value.

- Promises of Unrealistic Outcomes: Be skeptical of claims that sound too good to be true, especially if they promise revolutionary results with little effort or investment.

- Lack of Peer Review or Industry Acknowledgment: For scientific or technical products, the absence of peer review or recognition from the broader industry community can indicate that the claims have not been scrutinized by experts.

Research and References

- Consult Experts: If possible, seek opinions from professionals or academics who are experts in the relevant field. They can offer insights into whether the claims are feasible or exaggerated.

- Use Reputable Sources: When researching technology, rely on information from reputable sources, including academic journals, well-established technology news outlets, and government or industry regulatory bodies.

Consumer Advocacy and Legal Protection

- Consumer Reviews and Testimonials: Look for genuine reviews and testimonials from users who have no vested interest in the product's success. Be cautious of reviews that might be manufactured or paid for by the company.

- Legal and Regulatory Compliance: Check if the product or service complies with industry standards and regulations. Compliance is a sign that the company is serious about its claims and responsibilities.

Approach with Skepticism

- Healthy Skepticism: Maintain a healthy level of skepticism towards marketing claims. Question the basis of each claim and the evidence provided to support it.

- Avoid Impulse Decisions: Take your time to research and consider any investment or purchase. Avoid making decisions based on high-pressure sales tactics or limited-time offers.

By adopting these strategies, individuals and organizations can better protect themselves from being misled by marketing tactics that rely on technical jargon without substantiating their claims. Making informed decisions requires diligence, critical thinking, and a willingness to question and verify information before accepting it as truth. Keep exercising critical thinking, individuals can become more cautious of marketing tactics that rely on technical jargon and make informed decisions based on reliable information and evidence-based claims.

How can we encourage healthy skepticism and independent research before trusting any platform claiming "quantum" capabilities?

Encouraging healthy skepticism and independent research before trusting platforms claiming "quantum" capabilities requires a multi-pronged approach, involving:

1. Public education and awareness campaigns:

- Initiatives by government agencies and scientific organizations: These institutions can launch campaigns that inform the public about the true state of quantum technology, highlighting its early stage of development and limitations.

- Educational resources and media coverage: Collaborate with media outlets and educational institutions to create engaging and accessible content that explains the core concepts of quantum technology in a way understandable to the general public.

- Focus on realistic expectations: Public education should emphasize the potential of quantum technology while managing expectations and avoiding hype.

2. Promoting critical thinking skills:

- Integrating critical thinking skills into education systems: This equips individuals with the ability to analyze information, identify personal biases, and evaluate claims based on evidence.

- Debunking myths and misinformation: Actively address and debunk misleading information about "quantum" platforms through fact-checking initiatives and public awareness campaigns.

- Encouraging questioning and independent thought: Encourage individuals to ask questions, seek evidence, and challenge unsubstantiated claims before making decisions.

3. Fostering transparency and accountability:

- Industry self-regulation and code of ethics: Encourage "quantum" platform developers and service providers to adopt a code of ethics that emphasizes transparency, clarity, and responsible marketing practices.

- Regulatory frameworks and oversight: Consider developing regulatory frameworks that promote transparency in marketing claims, especially regarding advanced technologies like quantum computing.

- Holding companies accountable for misleading claims: Implement mechanisms to hold companies accountable for making false or misleading claims related to their "quantum" capabilities.

4. Building trust through clear communication and evidence:

- Clear and transparent communication from developers: Encourage developers of "quantum" platforms to communicate their technology and capabilities clearly and transparently, avoiding technical jargon and focusing on user understanding.

- Focus on providing evidence and proof of effectiveness: Companies claiming "quantum" advantages should focus on providing concrete evidence and data to support their claims, such as peer-reviewed research, independent evaluations, or verified case studies.

- Building trust through demonstrated performance: Ultimately, building trust requires demonstrating the actual value and effectiveness of "quantum" platforms through tangible results and real-world applications.

Encouraging healthy skepticism and independent research, especially regarding platforms claiming "quantum" capabilities, is essential in navigating the evolving technological landscape. Here are strategies to promote informed trust and critical evaluation:

Educational Initiatives

-

Raise Awareness: Use media, workshops, and educational programs to inform the public about what quantum technology is and what it can realistically achieve. Clarify common misconceptions and highlight the signs of exaggerated or false claims.

-

Promote Digital Literacy: Incorporate critical thinking and digital literacy into educational curriculums, teaching individuals how to evaluate sources, understand scientific claims, and discern marketing hype from genuine innovation.

-

Expert Opinions: Encourage experts in quantum computing and related fields to share their knowledge through public talks, articles, and social media. Expert analysis can help demystify the technology and provide a realistic perspective on its capabilities and limitations.

Community Engagement

-

Create Forums for Discussion: Establish online forums and community groups where individuals can discuss and share information about quantum technology and its applications. These platforms can serve as a space for peer learning and validation of claims.

-

Leverage Social Media: Use social media campaigns to spread awareness about the importance of skepticism and research. Short, engaging content can reach a wide audience and spark curiosity about quantum technology.

-

Showcase Real-World Applications: Highlight legitimate and successful applications of quantum technology. Real-world examples can help the public understand the technology's practical uses and distinguish them from unfounded claims.

Tools and Resources

-

Develop Educational Resources: Create accessible resources, such as guides, infographics, and videos, that explain quantum technology's basics and its potential impact. These resources can help non-experts grasp complex concepts and encourage informed skepticism.

-

Offer Workshops and Seminars: Organize workshops and seminars led by experts for businesses, educators, and the general public. These events can provide deeper insights into quantum technology and its ethical, social, and economic implications.

Encouraging Transparency

-

Advocate for Transparency: Encourage companies and platforms to be transparent about their technology, including the scientific principles behind their claims, the current stage of development, and any peer-reviewed research supporting their assertions.

-

Support Independent Verification: Promote the importance of independent testing and verification of quantum technology claims. Independent assessments can provide credible evidence of a platform's capabilities.

Regulatory and Policy Support

-

Engage with Policymakers: Collaborate with policymakers to develop guidelines and regulations that require clear and honest communication of quantum technology's capabilities and limitations.

-

Establish Standards: Support the development of industry standards for quantum technology applications. Standards can help ensure that claims are consistent, verifiable, and based on agreed-upon benchmarks.

Fostering a Culture of Inquiry

-

Encourage Questions: Cultivate an environment where it's encouraged to ask questions and express doubts about technological claims. A culture of inquiry can lead to more informed and critical consumers.

-

Reward Skepticism: Recognize and reward critical thinking and skepticism in academic and professional settings. Encouraging skepticism as a valued skill can foster a more discerning and informed public.

Society must foster a more informed and critical approach to evaluating claims about quantum technology or any emerging technology. Educating the public, promoting transparency, engaging experts, and encouraging independent research are key to navigating the promises and pitfalls of the quantum age.By implementing a combination of these approaches, we can foster a culture of healthy skepticism, promote independent research, and ensure that individuals make informed decisions when encountering platforms claiming "quantum" capabilities. This collaborative effort involving public education, critical thinking skills development, responsible industry practices, and transparency in communication can safeguard individuals from misleading marketing tactics and ensure the responsible development and application of quantum technology for the future.

3. Alternative Perspectives:

What about the work of reputable research institutions and organizations exploring the potential applications of quantum computing in finance?

While true quantum computing is still in its early stages, several reputable research institutions and organizations are exploring its potential applications in finance. Here are some notable examples:

1. Academic Institutions:

- Massachusetts Institute of Technology (MIT): MIT's Quantum Initiative and Operations Research Center are actively researching the use of quantum algorithms for financial modeling, risk management, and portfolio optimization.

- University of Chicago: The University of Chicago's Enrico Fermi Institute houses the Quantum Finance Lab, which focuses on developing quantum algorithms for financial applications like derivative pricing and option valuation.

- University of Waterloo: The Institute for Quantum Computing at the University of Waterloo explores various applications of quantum computing, including finance. Their research focuses on areas like portfolio optimization, machine learning, and risk analysis using quantum algorithms.

2. Research Institutions:

- IBM Quantum: IBM, a leader in quantum computing hardware development, has an active research team exploring various applications, including finance. They collaborate with universities and financial institutions to investigate quantum algorithms for areas like credit risk assessment and fraud detection.

- Microsoft Quantum: Microsoft also maintains a research team dedicated to exploring quantum computing's potential, including financial applications. They focus on developing quantum algorithms for portfolio optimization and asset pricing.

- D-Wave Systems: While their technology utilizes quantum annealing, distinct from universal quantum computing, D-Wave Systems collaborates with financial institutions to explore applications in areas like portfolio optimization and risk management.

3. Industry Consortiums:

- Quantum Financial Consortium (QFC): This consortium, formed by major financial institutions like JP Morgan Chase, Goldman Sachs, and Citigroup, aims to explore and develop quantum algorithms for financial applications. They collaborate with research institutions and technology companies to identify and address potential challenges.

It's crucial to remember that these applications are still under development, and the practical implementation of quantum computing in finance is likely years away. However, ongoing research by these institutions and organizations is laying the groundwork for future advancements that could potentially revolutionize the financial landscape.

Here are some additional points to consider:

- The specific applications of quantum computing in finance are still being explored, and their actual impact remains uncertain.

- Ethical considerations and potential regulatory hurdles surrounding the use of quantum technology in finance need to be addressed.

- Continued research and development are crucial to overcome technical challenges and ensure the responsible implementation of quantum computing in financial applications. The exploration of quantum computing applications in finance is a growing area of interest, with several reputable research institutions and organizations leading the way. These entities are investigating how quantum computing can revolutionize various aspects of finance, including optimization problems, risk analysis, portfolio management, and algorithmic trading. Here's an overview of the work being done in this field:

Academic and Research Institutions

-

MIT Quantum Computing for Finance: The Massachusetts Institute of Technology (MIT) conducts research on quantum algorithms that could potentially solve complex financial models more efficiently than classical computers. Their work includes exploring quantum optimization algorithms for portfolio management and asset pricing models.

-

Stanford Quantum Computing Applications Lab: Stanford University, in collaboration with industry partners, explores the use of quantum computing in finance among other fields. Their research focuses on developing quantum algorithms that can handle large datasets and complex calculations more efficiently than traditional computers.

-

University of Waterloo's Institute for Quantum Computing (IQC): The IQC conducts cutting-edge research in quantum technologies with potential applications in finance, such as quantum cryptography for secure transactions and quantum algorithms for financial modeling.

Industry Initiatives

-

IBM Quantum: IBM is a leader in quantum computing research and offers access to quantum computers via the cloud for businesses and researchers. In finance, IBM Quantum explores applications such as risk analysis and optimization problems, providing tools and resources for financial institutions to experiment with quantum algorithms.

-

D-Wave Systems: Known for their quantum annealing technology, D-Wave works on optimization problems relevant to finance, such as portfolio optimization and asset allocation. They collaborate with financial institutions to develop and test quantum-inspired algorithms on their quantum annealers.

-

JPMorgan Chase & Co.: As part of its technology initiatives, JPMorgan has invested in exploring the applications of quantum computing in finance. They are researching how quantum algorithms can improve options pricing, asset allocation, and fraud detection.

-

Goldman Sachs: Goldman Sachs is actively exploring quantum computing to enhance financial modeling, risk management, and algorithmic trading strategies. They are partnering with quantum computing companies to develop use cases that could provide a competitive edge in financial markets.

Collaborative Efforts and Consortia

-

Quantum Economic Development Consortium (QED-C): The QED-C facilitates collaboration between industry, government, and academia to promote the development of quantum technologies, including their application in finance. It aims to identify challenges and opportunities where quantum computing can impact economic sectors.

-

The Quantum Technology and Application Consortium (QUTAC): Comprising several European companies, including financial institutions, QUTAC focuses on advancing quantum technology applications across various industries, including finance. Their work aims to prepare industries for the integration of quantum computing technologies.

Focus Areas in Financial Applications

- Portfolio Optimization: Using quantum algorithms to solve complex optimization problems for asset allocation and portfolio management.

- Risk Analysis and Management: Leveraging quantum computing to simulate financial market scenarios and assess risks more accurately.

- Options Pricing: Employing quantum algorithms to speed up the calculation of options prices and other derivatives.

- Credit Scoring and Fraud Detection: Exploring quantum computing's potential to analyze vast datasets for credit scoring and detecting fraudulent activities more efficiently.

These institutions and initiatives are at the forefront of integrating quantum computing into finance, aiming to solve problems that are currently intractable or highly resource-intensive for classical computers. While practical applications are still in early stages, the ongoing research and development signal a promising future where quantum computing could significantly impact financial services. In following the efforts of these reputable institutions and organizations, you can stay informed about the ongoing research and development of quantum computing in finance, keeping in mind the current limitations and uncertainties surrounding its practical application in the near future. This provides a contrast to the more commercially focused and potentially misleading "Quantum AI" platforms.

How complex is the nature of research in the Quantum AI field? What is the gap between theoretical possibilities and practical applications?

The field of Quantum AI combines quantum computing with artificial intelligence, aiming to leverage the principles of quantum mechanics to enhance the capabilities of AI algorithms. This interdisciplinary research area is inherently complex due to the foundational challenges in both quantum computing and AI, as well as the innovative ways these fields intersect. Here's an overview of the complexity and the gap between theoretical possibilities and practical applications:

Complexity of Quantum AI Research

-

Quantum Computing Challenges: Quantum computing itself is a cutting-edge field that deals with quantum bits (qubits) capable of representing and processing information in ways fundamentally different from classical bits. The management of qubits, maintaining their coherence, and scaling up quantum systems are significant challenges.

-

AI and Machine Learning Algorithms: AI and machine learning involve complex algorithms designed to learn from and make decisions based on data. Adapting these algorithms to take advantage of quantum computing's unique properties adds an additional layer of complexity.

-

Integration of Quantum Mechanics and AI: Combining quantum computing with AI requires a deep understanding of both fields. Researchers must devise new quantum algorithms that can significantly speed up machine learning tasks while also being feasible on quantum hardware.

-

Error Rates and Decoherence: Quantum systems are highly susceptible to errors and decoherence, which can quickly degrade the information stored in qubits. Developing error correction methods and algorithms resilient to these issues is a major research focus.

-

Lack of Standardization: The field is still in its infancy, with various approaches to quantum computing (e.g., gate-based, quantum annealing) and no standardized frameworks for quantum AI, making interoperability and comparisons challenging.

Gap Between Theoretical Possibilities and Practical Applications

-

Hardware Limitations: Current quantum computers have a limited number of qubits and cannot yet run complex quantum AI algorithms required for practical applications. The gap between the theoretical potential of quantum AI and what can be achieved with existing quantum hardware is significant.

-

Algorithm Development: While there are theoretical proposals for quantum algorithms that could outperform their classical counterparts in machine learning and other AI tasks, developing algorithms that can be efficiently implemented on today's quantum computers is a challenge.

-

Scalability: For quantum AI to become practical, quantum computers need to scale up in terms of qubit count and coherence times without a proportional increase in error rates. Achieving this scalability is a key hurdle.

-

Practical Use Cases: Identifying and demonstrating clear, practical use cases where quantum AI offers a substantial advantage over classical approaches is still ongoing. Most current applications are experimental and designed to test theoretical concepts rather than solve real-world problems.

-

Resource Intensity: Quantum research is resource-intensive, requiring specialized knowledge, equipment, and significant investment. The complexity of building and maintaining quantum computing systems adds to the challenges of bridging the gap to practical applications.

Bridging the Gap

Efforts to bridge the gap between theoretical possibilities and practical applications include:

- Incremental Advances: Focusing on incremental improvements in quantum hardware and algorithms, which gradually increase the scope of solvable problems.

- Hybrid Approaches: Developing hybrid quantum-classical systems that leverage the strengths of both technologies to tackle real-world problems.

- Industry-Academia Collaboration: Encouraging collaboration between academia, industry, and government to pool resources, share knowledge, and drive innovation.

- Focused Research: Concentrating research efforts on specific domains or problems where quantum AI could have a significant impact, such as drug discovery, materials science, and optimization problems, to demonstrate its value. Research in the Quantum AI field is highly complex for several reasons:

- Fundamental challenges of quantum computing: Building and maintaining stable, scalable quantum computers is incredibly difficult due to the sensitive nature of quantum systems and the challenges of error correction.

- Development of quantum algorithms: Designing efficient and practical quantum algorithms for specific tasks, like financial modeling, remains a significant research area. Traditional algorithms might need substantial adaptation or complete overhaul to effectively leverage the unique capabilities of quantum computers.

- Bridging the gap between theory and practice: Theoretical proposals for quantum algorithms often face significant hurdles when translated into practical applications. Factors like hardware limitations, noise, and scalability can significantly impact the real-world performance of these algorithms.

- Integration with existing financial infrastructure: Even if practical quantum algorithms are developed, integrating them effectively with existing financial systems and infrastructure presents technical and logistical challenges.

The gap between theoretical possibilities and practical applications in Quantum AI is considerable:

- Limited capabilities of current quantum computers: Current quantum computers have limited numbers of qubits (quantum bits) and are prone to errors, hindering their ability to handle the complex calculations required for real-world financial applications.

- Immaturity of quantum algorithms: While theoretical proposals exist for various financial applications, translating them into practical algorithms that work efficiently on real hardware is a major ongoing challenge.

- Lack of standardized tools and frameworks: The field is still evolving, and there's a lack of standardized tools and frameworks for developing and deploying quantum algorithms in the financial sector.

- Regulatory uncertainty: The regulatory landscape surrounding the use of quantum AI in finance is still unclear, creating an additional layer of uncertainty for potential applications.

While the potential of Quantum AI is vast, it's important to maintain realistic expectations. Significant advancements are needed in hardware, software, and regulatory frameworks before the technology can deliver tangible benefits in the financial world.

Here are some additional points to consider:

- Focus on the long term: Quantum AI is a long-term research area, and significant breakthroughs might not be realized for years or even decades.

- Continuous progress: Despite the challenges, researchers are continuously making progress in developing quantum hardware, algorithms, and applications.

- Focus on understanding the limitations: As you encounter information about Quantum AI, remember the complexities involved and the significant gap between theory and practice.

By understanding the complexities and the gap between theoretical possibilities and practical applications, you can approach advancements in Quantum AI with a critical and informed perspective. While the field of Quantum AI holds immense theoretical promise, significant challenges remain in realizing practical applications. Bridging this gap requires ongoing advancements in quantum hardware, algorithm development, and a concerted effort from the global research community.

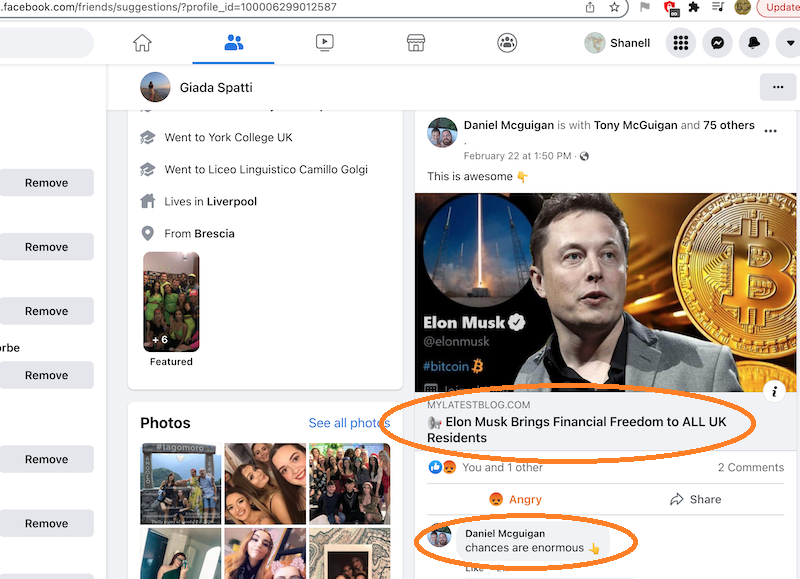

Watch out for fake associations as with Quantum Ai and Elon Musk

4. Focus on the Broader Issue:

1. What is Quantum AI Really?

If Autopilot Trading with Quantum Computing AI is Impossible, What is the Product referred online to as 'Quantum AI'?

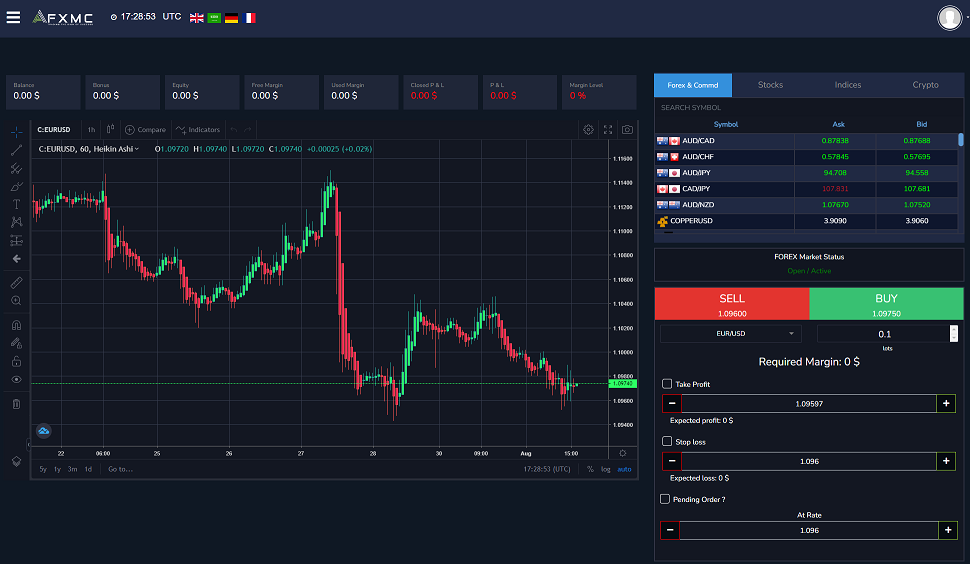

The product referred to online as "Quantum AI," especially in the context of autopilot trading, is often associated with high-frequency trading platforms or services that claim to leverage quantum computing and AI technologies to predict market movements and execute trades at unprecedented speeds. However, it's crucial to approach these claims with skepticism for several reasons:

-

Quantum Computing is in its Nascent Stages: As of the last update, quantum computing technology is still in the early stages of development. The hardware and algorithms necessary for running complex financial models or trading algorithms on a quantum computer are not yet available for commercial use at a scale that would support the claims made by some of these trading platforms.

-

Marketing Hype: Many products that claim to use "Quantum AI" for trading are leveraging the buzz around quantum computing and AI to attract attention and investment. The use of technical jargon and futuristic promises can be a marketing strategy that preys on the public's fascination with quantum technology and AI, without offering a substantiated product.

-

Lack of Transparency and Verification: Genuine quantum computing applications in finance, or any field, would be subject to scrutiny, peer review, and validation by the broader scientific and financial communities. Products that make vague or exaggerated claims without providing evidence, detailed explanations of their technology, or verifiable results should be approached with caution.

-

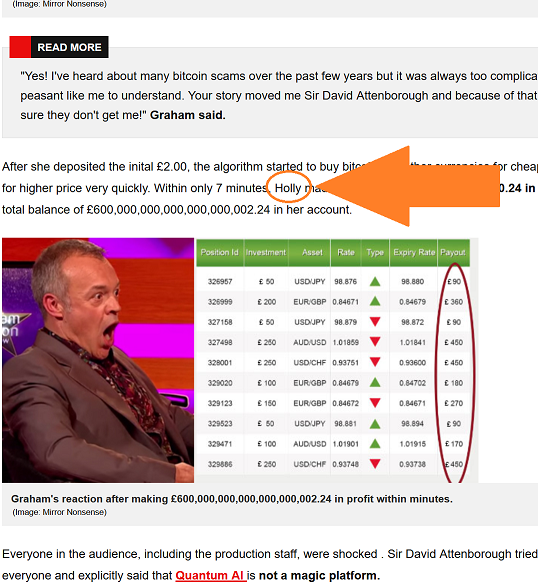

Potential for Scams: Unfortunately, the allure of quantum computing and AI has been exploited by some to create sophisticated scams. These can range from investment schemes that promise unrealistic returns to software that does not perform as advertised. It's essential to research thoroughly, look for independent reviews, and verify the credibility of any platform claiming to offer quantum AI trading services.

-

Regulatory Warnings: Financial regulatory bodies in various jurisdictions have issued warnings about investment scams that use the promise of advanced technology as a lure. Potential investors are advised to check with relevant authorities and seek advice from independent financial advisors before committing funds.

If you encounter a product or service claiming to use "Quantum AI" for autopilot trading, consider the following steps for due diligence:

- Research the Company: Look for information about the company's founders, team, and technology. Genuine companies are usually transparent about their background and operations.

- Look for Peer Reviews: Check for any academic papers, patents, or peer-reviewed articles that support the technology's claims.

- Verify Claims: Be wary of promised returns or testimonials without verifiable evidence. Real trading platforms should provide historical performance data and be clear about the risks involved.

- Regulatory Compliance: Ensure that the platform complies with financial regulations and is authorized to offer trading services in your jurisdiction.

- Consult Experts: If possible, seek opinions from professionals or experts in quantum computing and financial trading. As you've rightly pointed out, Autopilot Trading with Quantum Computing AI is currently impossible. The reasons for this impossibility are:

- Limited capabilities of current quantum computers: They lack the power and stability to handle the complex calculations needed for real-world financial applications like automated trading.

- Immaturity of quantum algorithms: While theoretical proposals exist for financial applications, translating them into practical, efficient algorithms for actual trading is a significant challenge.

Therefore, products marketed online as "Quantum AI" for autopilot trading are likely misleading and exploitative. They often:

- Misuse terminology: They leverage the public's fascination with quantum technology to create an air of sophistication and advanced capabilities, which are not present in their actual technology.

- Lack transparency: They might not disclose the details of the underlying technology used, making it difficult to assess their legitimacy and effectiveness.

- Promise unrealistic results: They might claim superior performance or guaranteed returns, which are unrealistic and potentially deceptive.

Here are some possibilities of what "Quantum AI" products might actually be:

- Traditional AI with misleading marketing: They might use basic AI algorithms for trading, dressed up with "quantum" terminology to appear more advanced.

- Simple trading bots or indicators: They might offer basic automated trading functionalities based on pre-programmed rules or indicators, not true quantum computing.

- Scams: In some cases, they might be outright scams designed to exploit unsuspecting individuals and steal their money.

It's crucial to approach any "Quantum AI" product with extreme caution and skepticism. Here are some tips to avoid being misled:

- Do your research: Investigate the company, product, and its claims thoroughly. Look for independent reviews, expert opinions, and evidence to support their claims.

- Beware of technical jargon: Don't be swayed by complex-sounding terms without clear explanations. Ask for specific details about the technology and its capabilities.

- Be wary of unrealistic promises: Don't trust claims of guaranteed success or superior performance in the financial market.

- Seek professional advice: If unsure about a "Quantum AI" product, consult a qualified financial advisor for guidance.

Remember, responsible and informed decision-making are crucial when it comes to your financial well-being. Don't fall prey to misleading marketing tactics and unrealistic promises based on unproven technology.

While quantum computing and AI have potential applications in finance, including trading, the technology is not yet at a stage where "autopilot trading with Quantum AI" is a reality. It's crucial to approach such claims critically and conduct thorough due diligence.

So when is it time to call a scam a scam? Well now! All of this pussy-footing around does not help anyone. The uncertainty principle is not a valid analogy here. The scam is obvious. It purports to do something it cannot and so it is a scam. There is no other way to discuss it. Quantum AI invented by Elon Musk is a scam. End of story.

We Need More Online Advertising Regulation

The idea of the internet being some free and adventurous entity is long dead. The Internet is just a quicker way of doing everything human kind has always done, and that has bridged the world of the have and the have nots so that the innocent i.e. the naive, are now exposed to the desperate. This is a problem that needs to be resolved. If there are websites claiming the same products over and over again as technological breakthroughs that enable wealth for all then that is a scam! There is no question about what the parties involved are trying to achieve, so why can't the authorities just block them?

The Quantum Charade: Unmasking the Uncertainty in "Quantum AI"

The world of finance dances with risk, fueled by a constant quest for certainty. And amidst this dance, emerges the enigmatic figure of "Quantum AI" - a term dripping with promises of market mastery powered by the seemingly magical realm of quantum mechanics. But before we waltz with this seductive partner, let's take a closer look at the inherent tension between the uncertainty of the quantum world and the certainty promised by "Quantum AI".

Quantum Reality: A World of Fuzziness

At the heart of quantum mechanics lies the uncertainty principle, a fundamental law defying our classical expectations. It tells us that we can't know both the precise position and momentum of a particle simultaneously. This fuzziness, this inherent lack of absolute certainty, permeates the very fabric of the quantum world.

The "Quantum AI" Mirage: Weaving Promises from Threads of Hype

Now, enter "Quantum AI", a term often used ambiguously by companies to market products that may have little actual connection to true quantum computing. They weave enticing narratives of algorithms harnessing the power of the quantum realm to predict market movements with uncanny accuracy. However, this narrative unravels upon closer inspection.

The Limits of the Dance: Why True Quantum AI is Still in its Infancy

The reality is, true quantum computing is still in its nascent stages. Building stable, large-scale quantum computers with robust error correction remains a significant engineering challenge. Additionally, even when they arise, their capabilities will be specific and require careful tailoring to solve specific problems, not predicting volatile markets with absolute certainty.

So, where does the tension lie? It lies in the misrepresentation of the quantum world, painting it as a source of effortless certainty amidst the inherent uncertainty of financial markets. It lies in the overhyped promises, creating unrealistic expectations and potentially misleading investors.

Beyond the Charade: Embracing the Uncertain Dance

Instead of chasing mirages of guaranteed success, a more responsible approach acknowledges the inherent uncertainty of both the quantum world and financial markets. It emphasizes research, understanding the true capabilities of underlying technologies, and managing risk with prudent strategies.

Remember, the financial dance may be complex, but embracing the unknown, diversifying strategies, and relying on sound investment principles offer a far more sustainable path to navigate the market's ever-shifting waltz.

In conclusion, "Quantum AI" presents a fascinating exploration of technology's potential. However, it's crucial to differentiate between the hype and the reality. By understanding the inherent limitations of the quantum world and the challenges of true quantum computing, we can avoid being misled by promises of absolute certainty and make informed decisions in the dynamic landscape of finance. Let's keep the dance of investment grounded in reality, rather than waltzing with mirages built on the fuzziness of quantum misrepresentation.

Quantum AI: Friend or Foe in the Volatile Crypto Market?

Imagine a world where intricate algorithms, powered by the enigmatic realm of quantum computing, predict the ebb and flow of the cryptocurrency market with uncanny accuracy. This is the alluring picture painted by "Quantum AI" - a concept rife with possibilities and shrouded in uncertainty.

But before we dive into the world of "Quantum AI", let's unpack its core claims:

- Harnessing the Quantum Advantage: These platforms claim to leverage the power of quantum computing, a nascent technology promising unparalleled processing speed and the ability to solve complex problems beyond the reach of traditional computers.

- Conquering the Crypto Market: By utilizing quantum algorithms, "Quantum AI" promises to analyze vast amounts of market data, identify hidden patterns, and predict future price movements with remarkable precision, specifically targeting options trading in the notoriously volatile cryptocurrency space.

- Automating Success: Many platforms boast automated trading features, claiming to execute trades based on their "quantum-powered" predictions, offering investors a hands-off approach to potentially lucrative profits.

Sounds too good to be true, right? And there's a reason for that skepticism. Let's look at the flip side of the coin:

- The Quantum Reality Check: True quantum computing is still in its early stages, with limited functionalities and scalability. Implementing it to tackle real-world problems like market prediction remains a significant challenge.

- Hype vs. Reality: Many "Quantum AI" platforms might use classical machine learning algorithms with "quantum-inspired" elements, not true quantum computing. Separating genuine innovation from marketing hype is crucial.

- Uncertainty Reigns Supreme: The cryptocurrency market is inherently unpredictable, influenced by diverse factors beyond the technical analysis offered by even the most sophisticated algorithms. Promising guaranteed success is irresponsible and potentially misleading.

So, where does "Quantum AI" stand? It's an intriguing exploration of technology's potential, but approaching it with a critical eye is essential. Remember:

- Do your research: Understand the specific technology used by individual platforms, not just the "Quantum AI" label.

- Manage expectations: Be wary of unrealistic promises of market dominance and guaranteed profits.

- Embrace risk management: No algorithm can eliminate risk in the volatile crypto market. Responsible investing requires prudent strategies and diversification.

Instead of seeking a magic bullet, explore "Quantum AI" as a spark for curiosity, not a shortcut to riches. Remember, responsible investing prioritizes knowledge, skepticism, and a healthy dose of realism in the dance with the ever-uncertain market.

2. Demystifying the Hype:

Top of Page

-

Quantum computing holds immense promise for revolutionizing various fields, but it's important to understand its current state: it's still in its early stages with significant limitations on practical applications. Here's a breakdown of the key points:

1. Nascent Technology:

- Quantum computers operate on fundamentally different principles than classical computers, leveraging the unique properties of quantum mechanics.

- While research has made significant strides, building and maintaining stable, large-scale quantum computers remains a significant technical challenge.

2. Limited Qubits:

- Qubits, the quantum equivalent of bits in classical computers, are prone to errors. Current machines have a limited number of qubits, hindering their ability to tackle complex problems.

- Scaling up these systems and achieving robust error correction is crucial for real-world applications.

3. Algorithmic Immaturity:

- While theoretical quantum algorithms show immense potential, translating them into practical applications requires ongoing development.

- Existing algorithms may not be readily transferable to current hardware limitations, further restricting the technology's immediate impact.

4. Focus on Research and Development:

- Currently, most efforts in quantum computing are focused on fundamental research and development, pushing the boundaries of the technology itself.

- While some specialized applications exist, particularly in areas like materials science and cryptography, widespread practical use cases haven't yet materialized.

5. A Long Road Ahead:

- Experts predict significant advancements in the next decade, but fully realizing the transformative potential of quantum computing likely requires several years of further research and development.

Examples of Limited Applications:

- Simulating molecules: Early applications might focus on simulating complex molecules, potentially leading to breakthroughs in medicine and materials science.

- Financial modeling: Some exploration of using quantum algorithms for financial modeling exists, but this is still highly theoretical and not commercially viable at present.

Overall, quantum computing is an exciting field with vast potential, but it's still in its infancy. It's important to manage expectations and understand that significant advancements are needed before it can revolutionize various industries.

Quantum computing technology is in an embryonic stage, characterized by rapid development but still limited in terms of practical, widespread applications. Here are some key points emphasizing the nascent stage and limited practical applications of quantum computing:

-

Experimental Phase: Quantum computers are still largely experimental. They are not yet widely available for commercial use and remain the focus of research institutions and some technology companies.

-

Limited Qubit Count: Modern quantum computers have a relatively small number of qubits, the basic units of quantum information. The more qubits a quantum computer has, the more powerful it is theoretically. However, scaling up the number of qubits while maintaining their stability and reducing error rates is a significant challenge.

-

Error Rates and Decoherence: Quantum systems are prone to errors due to decoherence and quantum noise, as previously mentioned. Current error rates are still too high for most practical applications, which necessitates the development of effective quantum error correction methods.

-

Quantum Supremacy: While there have been claims of achieving quantum supremacy—the point where a quantum computer can perform a calculation that a classical computer cannot achieve in any feasible amount of time—these are still very specific instances and do not translate into general computing advantage.

-

Quantum Advantage: The quest for a sustained and demonstrable quantum advantage, where quantum computers can solve practical problems better than classical computers, is ongoing. Some potential applications where quantum computers could excel include drug discovery, optimization problems, and cryptography, but these are still under active development.

-

Quantum Algorithms: The development of new quantum algorithms that can leverage the power of quantum computing is still in its infancy. Algorithms like Shor's algorithm for factoring large numbers and Grover's algorithm for database searching have shown potential, but their practical implementation is not yet realized.

-

Hardware Challenges: Building the hardware for quantum computers involves mastering new and extremely challenging techniques in material science and engineering. The systems need to operate at cryogenic temperatures and require very precise control mechanisms.

-

Limited Commercial Availability: A few companies offer cloud-based quantum computing services, which allow researchers and developers to run algorithms on real quantum computers. However, these services are often used for research and development rather than practical, commercial applications.

-

Interdisciplinary Effort: Progress in quantum computing technology requires interdisciplinary collaboration across fields such as physics, computer science, engineering, and mathematics.

The theoretical foundation of quantum computing promises a revolution in computational capabilities, particularly for certain types of problems, but the technology is still in its formative stages. Much progress is needed to address the challenges of qubit stability, error correction, and algorithm development before quantum computing can realize its full potential and offer widespread practical applications.

Quantum Inspired vs. True Quantum Computing

Both "quantum-inspired" algorithms and true quantum computing deal with harnessing insights from quantum mechanics to solve problems, but there are crucial distinctions between the two:

1. Computing Platform:

- True quantum computing: Utilizes specialized quantum computers that leverage the unique properties of quantum mechanics, such as superposition and entanglement, to perform calculations. These computers operate on qubits, the quantum equivalent of bits in classical computers.

- Quantum-inspired algorithms: Run on traditional classical computers. They draw inspiration from concepts in quantum mechanics and use mathematical techniques designed to mimic some aspects of quantum behavior, but they don't employ the actual hardware of a quantum computer.

2. Capabilities:

- True quantum computing: Holds the potential to solve certain problems significantly faster than classical computers, especially those involving complex simulations or optimization tasks. However, this potential is still theoretical and depends on overcoming hardware limitations and developing efficient algorithms.

- Quantum-inspired algorithms: May offer some advantages over traditional algorithms for specific tasks, but their capabilities are typically limited compared to what true quantum computers could achieve. They don't inherently benefit from the same speedup as true quantum computing.

3. Applicability:

- True quantum computing: Currently faces significant challenges in scalability and error correction, limiting its practical applications. While some niche applications are being explored in research settings, it's still in its early stages of development.

- Quantum-inspired algorithms: Can be used on existing classical computers and may offer benefits in various fields, including finance, logistics, and materials science. However, their impact is likely to be incremental compared to the potential breakthroughs promised by true quantum computing.

Example:

- A quantum-inspired algorithm might be designed to optimize delivery routes for a logistics company using techniques inspired by quantum annealing, a phenomenon observed in quantum systems.

- A true quantum computer could theoretically simulate complex biological molecules much faster than a classical computer, potentially leading to new drug discoveries.

In summary:

- True quantum computing uses specialized hardware and has the potential for revolutionary breakthroughs, but it's still in its early stages.

- Quantum-inspired algorithms run on classical computers, offer some potential advantages in specific areas, but their capabilities are not as transformative as true quantum computing.

Understanding these distinctions is crucial for navigating the hype surrounding quantum computing and avoiding misinterpretations.

"Quantum-inspired" algorithms and true quantum computing represent different approaches to computation, each with its own distinct characteristics and applications.

Quantum-Inspired Algorithms:

- These are classical algorithms that draw inspiration from principles used in quantum computing, such as superposition and entanglement.

- Quantum-inspired algorithms do not require a quantum computer; they run on classical computers.

- They are designed to mimic certain quantum behaviors or to solve specific types of problems more efficiently than traditional algorithms, albeit not with the same power or speed that might be possible with a real quantum computer.

- One example of quantum-inspired computing is the use of quantum Monte Carlo methods in classical simulation, which are stochastic algorithms that simulate the behavior of quantum systems.

- Quantum-inspired algorithms can sometimes offer improvements over classical approaches for particular optimization problems and can be seen as a bridge between classical and quantum computing, but they do not provide the full range of capabilities that quantum computing promises.

True Quantum Computing:

- True quantum computing is based on the physical implementation of quantum bits (qubits) which can exist in superposition states and can be entangled with each other.

- Quantum computers perform computations using quantum-mechanical phenomena, such as superposition, entanglement, and interference.

- They have the potential to solve certain types of problems exponentially faster than classical computers can, like factoring large numbers (with Shor's algorithm) or searching unsorted databases (with Grover's algorithm).

- True quantum computing is still in the experimental stage, and researchers are working to increase the number of reliable qubits and develop effective quantum error correction methods to make these systems practical for complex computations.

- The hardware for true quantum computing is highly specialized and often operates at cryogenic temperatures to maintain quantum coherence.

In essence, while quantum-inspired algorithms are a creative application of quantum principles to improve classical computing methods, true quantum computing involves the direct use of quantum-mechanical phenomena to perform computations that are not possible with classical computers alone. The distinction is important because, although quantum-inspired algorithms can offer advantages now, they do not harness the full potential of quantum mechanics, which true quantum computing aims to do.

Performing an Analysis

Analyzing the technical feasibility of using quantum technology for options trading in the cryptocurrency market requires considering several factors, highlighting the significant challenges involved:

1. Current limitations of quantum computing:

- Limited Qubits: As discussed earlier, current quantum computers have a limited number of qubits, hindering their ability to handle the complex calculations required for effective options trading in a dynamic market like cryptocurrency.

- Error Correction: Quantum systems are prone to errors, and robust error correction mechanisms are crucial for reliable results. Achieving error correction at the scale necessary for financial applications remains a significant challenge.

- Algorithmic Development: While theoretical quantum algorithms for financial modeling exist, translating them into practical applications specifically for options trading in the highly volatile cryptocurrency market is an ongoing research area.

2. Challenges of the cryptocurrency market:

- Market Volatility: The cryptocurrency market is inherently unpredictable, influenced by a complex interplay of factors beyond just technical analysis. Even the most sophisticated algorithms might struggle to consistently predict price movements in such a volatile environment.

- Integration with Real-Time Data: Effectively utilizing quantum algorithms for trading would require seamless integration with real-time market data feeds. This presents technical hurdles and raises concerns about potential latency issues.

- Regulatory Landscape: The regulatory landscape surrounding cryptocurrency trading is still evolving, and integrating unproven technologies like quantum computing might raise additional regulatory hurdles.

3. Ethical considerations:

- Transparency and Explainability: The "black box" nature of some quantum algorithms raises concerns about transparency and explainability, making it difficult to understand how they arrive at their predictions. This lack of transparency could be problematic in financial markets.

- Potential for Market Manipulation: The theoretical power of quantum computing could raise concerns about the potential for market manipulation, requiring careful consideration of ethical implications.

Based on these points, using quantum technology for options trading in the cryptocurrency market currently faces significant technical and ethical challenges. While the potential for future advancements exists, it's important to manage expectations and acknowledge the limitations of current technology. It's important to note that some companies might claim to use "Quantum AI" for options trading. However, it's crucial to remember that these platforms often employ classical machine learning algorithms with "quantum-inspired" elements, not true quantum computing. As discussed earlier, these approaches have their limitations and should be approached with caution.

In conclusion, while the future of quantum technology holds immense potential, its application in options trading for the highly volatile cryptocurrency market is currently not a viable option. Responsible investing necessitates understanding these limitations and focusing on sound investment principles and risk management strategies. Analyzing the technical feasibility of using quantum technology for options trading in the cryptocurrency market involves several key considerations. Here's a structured approach to such an analysis:

-

Current State of Quantum Computing:

- Evaluate the current capabilities of quantum computers, including the number of qubits, coherence times, error rates, and the availability of quantum processors for commercial use.

- Determine if existing quantum computers can run algorithms that are relevant to options trading, such as complex financial models or optimization algorithms.

-

Quantum Algorithms for Financial Modeling:

- Identify quantum algorithms that could potentially provide advantages over classical algorithms in options trading. For example, quantum algorithms could potentially be used for Monte Carlo simulations, which are commonly used in pricing options.

- Assess the development status of such algorithms and their compatibility with current quantum hardware.

-

Data Handling and Integration:

- Examine the challenges associated with integrating quantum computing into existing trading systems, including data input/output, the preprocessing of data, and the interface with classical systems.

- Consider the volume, velocity, and variety of data involved in cryptocurrency options trading and whether current quantum computers can effectively handle such data.

-

Latency and Speed Requirements:

- Options trading, particularly in the fast-paced cryptocurrency market, requires rapid execution to capitalize on fleeting opportunities.

- Analyze whether quantum computers can provide the necessary computational speed and if the quantum processing time, including the time for error correction and readout, meets the low-latency requirements of trading systems.

-

Quantum Advantage Assessment:

- Determine if there are specific areas where quantum computing can offer a significant advantage in terms of speed or accuracy of computations relevant to options trading.

- Investigate whether these advantages can translate into better trading decisions or more profitable outcomes.

-

Risk Analysis:

- Assess the risks associated with relying on quantum technology for trading, including technical failure, quantum decoherence, and the nascent nature of quantum error correction.

- Evaluate the potential financial risks if quantum technology does not perform as expected in live trading environments.

-

Quantum Security Considerations:

- Consider the security implications of using quantum technology in trading. Quantum computers could potentially break certain cryptographic protocols, affecting the security of transactions and data.

- Ensure that quantum-resistant encryption methods are in place to protect sensitive financial data.

-

Regulatory and Compliance Factors:

- Review regulatory standards for financial trading systems and ensure that the use of quantum technology complies with all relevant laws and regulations.

- Determine the reporting and transparency requirements for using such advanced technology in trading systems.

-

Cost-Benefit Analysis:

- Conduct a cost-benefit analysis to compare the investment needed to implement quantum technology against the expected returns from improved trading strategies.

- Consider the costs associated with developing or accessing quantum algorithms, quantum hardware, and the expertise required to operate quantum systems.

-

Pilot Testing:

- Before full implementation, design a pilot test to evaluate the performance of quantum technology in a controlled trading environment.