Using Bitcoin Code or similar cryptocurrency trading platforms to generate a second income is an idea that requires careful consideration due to the risks involved. Here's a guide to approach it cautiously and wisely:

-

Understand the Platform: Research what Bitcoin Code is and how it works. It's advertised as an automated trading software that trades cryptocurrencies on behalf of its users. Understand the technology behind it and the trading strategies it employs.

-

Start with a Demo Account: If available, use a demo account to familiarize yourself with the platform without risking real money. This will help you understand how the platform works and the dynamics of cryptocurrency trading.

-

Invest What You Can Afford to Lose: The cryptocurrency market is highly volatile. Only invest money that you can afford to lose. It's not advisable to invest money that you need for essential expenses.

-

Set Realistic Expectations: Beware of any platform that promises guaranteed returns. In trading, especially in the volatile crypto market, there are no guarantees. Set realistic expectations about potential profits and losses.

-

Educate Yourself About Cryptocurrency Trading: Having a basic understanding of cryptocurrency markets, trading principles, and risks can help you make more informed decisions. Knowledge about market trends, technical analysis, and risk management is crucial.

-

Use Risk Management Techniques: Implement risk management strategies, like setting stop-loss orders, to limit potential losses. Diversify your investments to spread risk.

-

Regularly Monitor Your Investments: Even with automated trading, it’s important to regularly monitor your investments and stay informed about market conditions. Adjust your trading strategies as needed.

-

Be Wary of Scams: Be cautious and do thorough research to ensure that the platform is legitimate. There are many scams in the cryptocurrency space. Verify the credibility of Bitcoin Code before investing.

-

Withdraw Profits Periodically: If you start making profits, consider withdrawing them periodically to secure part of your earnings.

-

Stay Updated: The cryptocurrency market is constantly evolving. Stay updated on market news, technological developments, and regulatory changes.

-

Consult a Financial Advisor: Before making any investment, it’s a good idea to consult with a financial advisor, especially if you are new to investing or not well-versed in cryptocurrencies.

Remember, while some people have successfully generated income through cryptocurrency trading, it comes with significant risks, and many others have incurred substantial losses. Always approach such investments with caution and due diligence.

I Have Already Checked Review Sites and they Say it is Fine

If review sites are indicating that Bitcoin Code or similar platforms are legitimate and safe, it's still important to exercise due diligence and maintain a healthy level of skepticism for several reasons:

-

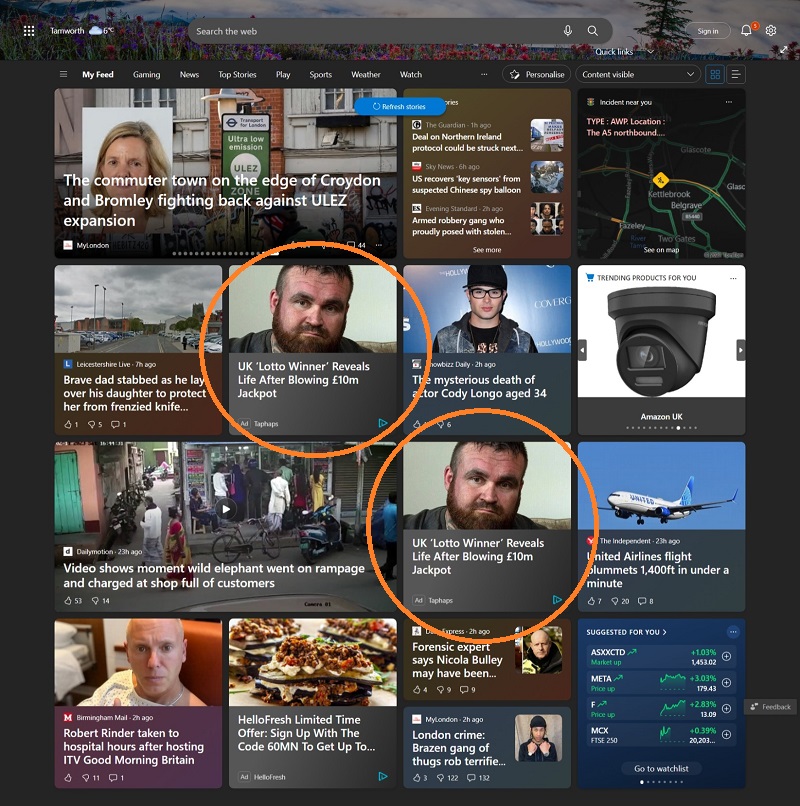

Potential Bias of Review Sites: Some review sites may have affiliations or financial incentives (like affiliate marketing) that could bias their reviews. They might receive compensation for directing users to sign up for certain platforms, which can influence the objectivity of their assessments.

-

Inherent Risks in Crypto Trading: Regardless of what review sites say, cryptocurrency trading is inherently risky due to its high volatility. Automated trading systems, no matter how sophisticated, cannot completely mitigate these risks.

-

Lack of Regulation in Crypto Space: The cryptocurrency market is less regulated compared to traditional financial markets. This lack of oversight can sometimes lead to the emergence of fraudulent platforms.

-

Importance of Independent Verification: It's crucial to seek out independent, unbiased sources of information. Look for user testimonials on various platforms, and check community forums or social media for more diverse opinions.

-

Verifying Claims and Features: Review the claims and features touted by the platform. Are the promised returns realistic? Is there transparency about the algorithms used, the fees charged, and the company behind the platform?

-

Regulatory Warnings and Compliance: Check if there have been any warnings from financial regulatory authorities about the platform. Also, verify whether the platform complies with the regulatory standards of your jurisdiction.

-

Personal Risk Tolerance and Investment Goals: Consider your own risk tolerance and investment goals. What works for others may not align with your personal financial situation.

-

Technological Understanding: Having a basic understanding of how automated trading software works can help you make a more informed decision about using such platforms.

-

Diversification of Investment: Avoid putting all your investment in one platform or asset class. Diversification can help mitigate risks.

-

Stay Cautious and Updated: The cryptocurrency market is constantly evolving. Stay informed about market trends and news, which can impact your investment decisions.

In summary, while positive reviews on certain sites can be a useful source of information, they should not be the sole basis for making an investment decision. It's important to combine this information with your own research, a clear understanding of the risks involved, and possibly the advice of a financial expert.

How Can I Verify a Review Site as Unbiased?

Verifying the unbiased nature of a review site, especially in the context of cryptocurrency platforms or investment opportunities, requires a multi-faceted approach. Here are some steps and tips to help you assess the objectivity and reliability of review sites:

-

Check for Affiliate Links or Disclaimers: Many review sites use affiliate links, where they earn commission if you sign up through their link. An ethical site should clearly disclose these relationships. Presence of such links doesn’t inherently mean bias, but non-disclosure can be a red flag.

-

Diversity of Reviews: Look for a range of reviews, both positive and negative, about a variety of products or services. Sites that offer only glowing reviews or seem to push certain products aggressively might not be entirely objective.

-

Research the Site's Reputation: Look for information about the review site itself. How long has it been around? What do other users or independent sources say about its credibility? Sometimes forums or social media can provide insights into the site’s reputation.

-

Cross-Reference Reviews: Check multiple review sites and sources. If the information about a particular product or service is drastically different across various sites, it may require deeper investigation.

-

Quality of the Reviews: Are the reviews detailed and informative, providing both pros and cons? Or are they vague and overly promotional? Quality, detailed reviews that discuss various aspects of a product or service are more likely to be unbiased.

-

Expertise and Transparency: Does the site provide information about its review process? Do they explain how they evaluate products or services? Sites that are transparent about their methodologies are often more reliable.

-

Regulatory Compliance and Ethical Standards: Legitimate review sites comply with legal requirements, such as those regarding advertising and affiliate marketing. Check if the site adheres to these standards.

-

Investigate the Reviewers: If possible, learn about the individuals who write the reviews. Are they experts in the field? Do they provide their real identities, or do they use pseudonyms?

-

Look for Fact-Checking and References: Good review sites often back up their claims with references, data, or comparisons. This level of detail can be a sign of a more objective approach.

-

Observe the Response to Criticism: How does the site respond to criticism or negative feedback? A site willing to acknowledge and address criticism can be more trustworthy.

-

Ads and Sponsored Content: Notice the amount and type of advertisements on the site. An abundance of ads, especially for the very products being reviewed, can sometimes indicate a revenue-driven bias.

Remember, even the most comprehensive review sites can have some level of bias, as they are often influenced by their own experiences, perspectives, and, in some cases, financial incentives. It's always wise to use review sites as just one of several resources in your research process.

OK So InsideBitcoins Says: "This website is free for you to use but we may receive commission from the companies we feature on this site." Does That Mean I Cannot Trust it?

The disclaimer from InsideBitcoins stating, "This website is free for you to use but we may receive commission from the companies we feature on this site," is an acknowledgment of their participation in affiliate programs. While this doesn't automatically mean you cannot trust the reviews on the site, it does indicate that you should consider the potential for bias when evaluating their content. Here's how to approach such sites:

-

Understand Affiliate Relationships: The fact that a site receives commissions for referrals can influence the content of its reviews. They might be more inclined to present the products or services in a positive light to encourage clicks on their affiliate links.

-

Look for Comprehensive Reviews: Check if the reviews on the site are thorough and balanced, presenting both positives and negatives. Sites that provide detailed, well-rounded reviews are often more trustworthy, even if they have affiliate links.

-

Cross-Reference Information: Don’t rely solely on one review site. Look for information on other websites, forums, and user testimonials. If the general consensus aligns with what InsideBitcoins says, the information might be more reliable.

-

Transparency is Key: The site’s willingness to disclose its affiliate relationships is a positive sign of transparency. It shows that they are upfront about their potential biases, which is a good practice.

-

Critical Evaluation: Always critically evaluate the information presented. Are the reviews overly promotional? Do they make unrealistic promises? A critical approach will help you sift through potential biases.

-

Use Multiple Sources: Supplement the information from InsideBitcoins with other sources, including independent reviews, user experiences, and professional advice if necessary.

-

Look for Specifics and Data: Trustworthy reviews often include specific data, user experiences, and practical details rather than just general praise.

-

Be Cautious with High-Risk Investments: Remember that cryptocurrency investments are inherently risky. Be cautious with any platform or investment that promises high returns with little or no risk.

In summary, while a site’s participation in affiliate programs necessitates a cautious approach, it doesn’t automatically render the site untrustworthy. It's about balancing the information they provide with other sources and maintaining a critical mindset.

OK at the Bottom of the BitcoinCode.io Website it Says: "The Financial Conduct Authority (‘FCA’) has issued a policy statement PS20/10, which prohibits the sale, promotion, and distribution of CFD on Crypto assets." Is it Illegal in the UK?

The disclaimer on the BitcoinCode.io website referencing the Financial Conduct Authority (FCA) policy statement PS20/10 provides important information about the regulatory environment in the UK concerning Contracts for Difference (CFDs) on crypto assets. Here's what it means:

-

FCA's Stance on CFDs on Crypto Assets: The FCA, which is a financial regulatory body in the UK, issued policy statement PS20/10, which bans the sale, marketing, and distribution of CFDs on crypto assets to retail consumers. This policy came into effect in January 2021.

-

Implications for BitcoinCode.io in the UK: If BitcoinCode.io is offering CFDs on crypto assets, then, according to this policy, promoting or selling these products to retail consumers in the UK is prohibited. The disclaimer seems to be a way to inform users from the UK about this regulatory stance.

-

Legal Status: The ban doesn't mean that BitcoinCode.io itself is illegal in the UK, but it does mean that offering, promoting, or distributing certain types of crypto-based financial products (like CFDs) to retail consumers is prohibited. The platform can still operate legally if it complies with other relevant regulations and does not offer banned services.

-

Risk to Consumers: The FCA’s decision to ban CFDs on crypto assets for retail consumers is based on the high risks associated with these products, which include extreme volatility in crypto asset price movements, the inherent difficulty in valuing crypto assets reliably, and the increased risk of financial crime.

-

Your Protection as a Consumer: If you are a UK resident, this regulation is designed to protect you from the high risks associated with trading CFDs on crypto assets. Engaging in such activities might not only be risky but also could put you at odds with the regulatory framework.

-

For Non-UK Residents: If you're not a UK resident, different regulations may apply to you, depending on your country's laws regarding cryptocurrency trading and CFDs.

In conclusion, the mention of the FCA’s policy statement is a significant piece of information for UK residents considering using BitcoinCode.io, especially if they are interested in CFDs on crypto assets. It's crucial to be aware of and understand the legal and regulatory environment of your country before engaging in cryptocurrency trading or related activities.

A Significant Piece of Information Meaning What?

The mention of the FCA's policy statement PS20/10 on the BitcoinCode.io website is a significant piece of information for several reasons:

-

Regulatory Compliance: It indicates that BitcoinCode.io acknowledges the regulatory environment in the UK, specifically the FCA's ban on the sale, marketing, and distribution of CFDs on crypto assets to retail consumers. This awareness and disclosure suggest a level of compliance or at least recognition of local financial regulations.

-

Consumer Protection: The FCA’s policy is aimed at protecting retail consumers from the high risks associated with trading CFDs on crypto assets. By mentioning this policy, BitcoinCode.io is indirectly informing UK users that engaging in such trading activities carries recognized risks and is subject to regulatory restrictions in the UK.

-

Risk Awareness: It serves as a warning to potential users, particularly in the UK, about the risks associated with cryptocurrency CFDs. The FCA’s stance is based on concerns about price volatility, valuation difficulties, and financial crime risks associated with crypto assets.

-

Legal Implications for UK Residents: For users in the UK, this information is crucial as it highlights that engaging in trading CFDs on crypto assets through platforms like BitcoinCode.io might conflict with FCA regulations. This can have legal implications and might limit the protection available to them under UK financial laws.

-

Decision Making for Users: Knowing about the FCA's ban can help users, especially those in the UK, make more informed decisions regarding whether or not to use platforms like BitcoinCode.io for trading CFDs on crypto assets.

-

Indication of Market Limitations: The disclaimer might also imply that BitcoinCode.io does not offer certain services, like CFDs on crypto assets, to users in the UK, aligning their offerings with the local regulatory framework.

In summary, the inclusion of this information is significant as it highlights regulatory compliance, consumer protection concerns, and the legal implications of trading CFDs on crypto assets, particularly for UK residents. It's an important factor for potential users to consider when evaluating the platform and their involvement in crypto asset trading.

Well the Site is in English - Who is it Meant for?

If the BitcoinCode.io website is in English and references regulations specific to the UK, such as the Financial Conduct Authority (FCA) policies, it suggests a few potential target audiences:

-

UK Residents: The mention of the FCA regulation indicates that the site is addressing UK residents, as this regulation directly affects them. The site may be catering to this audience by providing relevant legal information, which is a sign of compliance and responsibility.

-

English-Speaking Countries: English is widely spoken and understood globally. A website in English can cater to users from various parts of the world, including the United States, Canada, Australia, New Zealand, and other countries where English is either a primary or a widely spoken language.

-

Global Audience with English Proficiency: English is often used as a lingua franca in business and international communication. Therefore, an English-language site can also target a global audience that, while not necessarily native English speakers, are proficient in the language.

-

Expatriates and International Investors: The site might also target English-speaking expatriates and international investors who are interested in cryptocurrency trading and are comfortable using English-language platforms.

The choice to include specific regulatory information pertinent to the UK could be a strategy to build trust and credibility by showing awareness of and compliance with relevant financial regulations. This could be particularly reassuring for users who are cautious about the legality and regulation of online trading platforms.

However, it's essential for users from any country to consider their local regulations and the platform's compliance with those regulations. Cryptocurrency laws and financial regulations vary greatly across different countries, and what is legal and compliant in one jurisdiction may not be so in another.

So If I Hadn't Read the Small Script Would I Be Liable?

If you hadn't read the fine print or small script on a website like BitcoinCode.io and engaged in activities that are restricted or regulated in your jurisdiction, the question of liability can be complex and depends on several factors:

-

User Responsibility: Generally, as a user, you are responsible for your actions and for ensuring that you comply with local laws and regulations. This includes understanding the terms of service, any relevant disclaimers, and the legal implications of using a particular platform.

-

Regulatory Environment: If you are in a jurisdiction where certain activities related to cryptocurrency trading are regulated or banned (like CFD trading in the UK, as per FCA regulations), engaging in these activities can potentially expose you to legal risks, even if you were unaware of the regulations.

-

Ignorance of the Law: In most legal systems, ignorance of the law is not typically considered a valid defense. This principle implies that individuals are expected to be aware of their legal obligations.

-

Platform’s Duty to Inform: While platforms have a responsibility to provide clear information about their services, including any restrictions or compliance requirements, the final responsibility to understand and adhere to local laws rests with the user.

-

Potential Consequences: The consequences of not adhering to regulations can vary. They might include financial losses, legal penalties, or difficulties in legal recourse in the event of disputes or fraud.

-

Seek Legal Advice: If you're unsure about the legality of using a particular trading platform in your jurisdiction or the implications of not adhering to the fine print, it's advisable to seek legal advice. A qualified legal professional can provide guidance based on your specific situation and local laws.

-

Consumer Protection Laws: Depending on the jurisdiction, there may be consumer protection laws that could offer some level of protection or recourse. However, this can be complex in the case of international online platforms and cryptocurrency trading.

In summary, while not reading the fine print can place you at a disadvantage, it is generally the user's responsibility to understand and comply with the terms of use and local laws when engaging with online trading platforms. Being proactive about understanding these aspects is crucial in navigating the online investment landscape safely and legally.

But if BitcoinCode.io is Pretending to be Autotrading Crypto When it is Actually CFDs and Only Admits this in the Small Print, am I Liable?

If BitcoinCode.io or similar platforms are presenting themselves as cryptocurrency trading systems but are actually offering Contracts for Difference (CFDs) and this is only disclosed in the small print, several issues arise concerning liability and responsibility:

-

Misrepresentation and Transparency: If a platform is not transparent about the nature of its services and only discloses critical information in fine print, it could be seen as engaging in misleading or deceptive practices. This lack of transparency and potential misrepresentation is a serious concern.

-

User Liability: As a user, you are generally responsible for understanding the terms and conditions of any service you use, including those in fine print. However, if the service was misrepresented, and this led you to engage in activities you otherwise would have avoided, the issue becomes more complex. In such cases, the platform may bear some responsibility.

-

Regulatory Framework: The legal and regulatory framework in your jurisdiction plays a crucial role. If CFD trading is regulated or restricted in your country (as it is in the UK, for instance), engaging in it unknowingly due to misrepresentation could potentially lead to legal complications. However, regulatory bodies may also take action against platforms that mislead users.

-

Seeking Recourse: If you feel that you were misled into engaging in a service under false pretenses, you might have grounds for seeking legal recourse. This would typically involve consulting with a legal professional to explore your options based on consumer protection laws and regulations pertaining to financial services and advertising in your area.

-

Platform's Duty of Care: Financial service providers have a duty of care to provide clear, accurate, and transparent information about their products and services. Failure to do so can result in regulatory actions against them, especially in jurisdictions with strict financial service regulations.

-

Consumer Protection: In many countries, consumer protection laws exist to safeguard individuals from deceptive and unfair business practices. These laws might provide some level of protection or means of recourse for consumers who are misled.

-

Documentation and Evidence: If pursuing any form of complaint or legal action, document all interactions, disclosures, and representations made by the platform, as this information can be crucial.

In summary, while users have a responsibility to understand the terms and conditions of services they engage with, platforms also have a responsibility to be transparent and not misleading in their representations. If the core service offered is significantly different from what is advertised, and this is only clarified in fine print, the platform could be held accountable under various consumer protection and financial regulations, depending on the jurisdiction. If you find yourself in such a situation, seeking legal advice is recommended to understand your rights and options.

There is no Sign of Who They Are or Even Which Country they are Based in - How Could I Take Legal Action Against Bitcoin Code?

Taking legal action against an entity like Bitcoin Code can be challenging, especially if there's a lack of transparency about the company's identity or location. Here are some steps and considerations for pursuing legal action or seeking recourse:

-

Gather All Documentation: Collect any information and documentation related to your interactions with Bitcoin Code, including website URLs, terms and conditions, email correspondences, transaction records, and any representations or promises made.

-

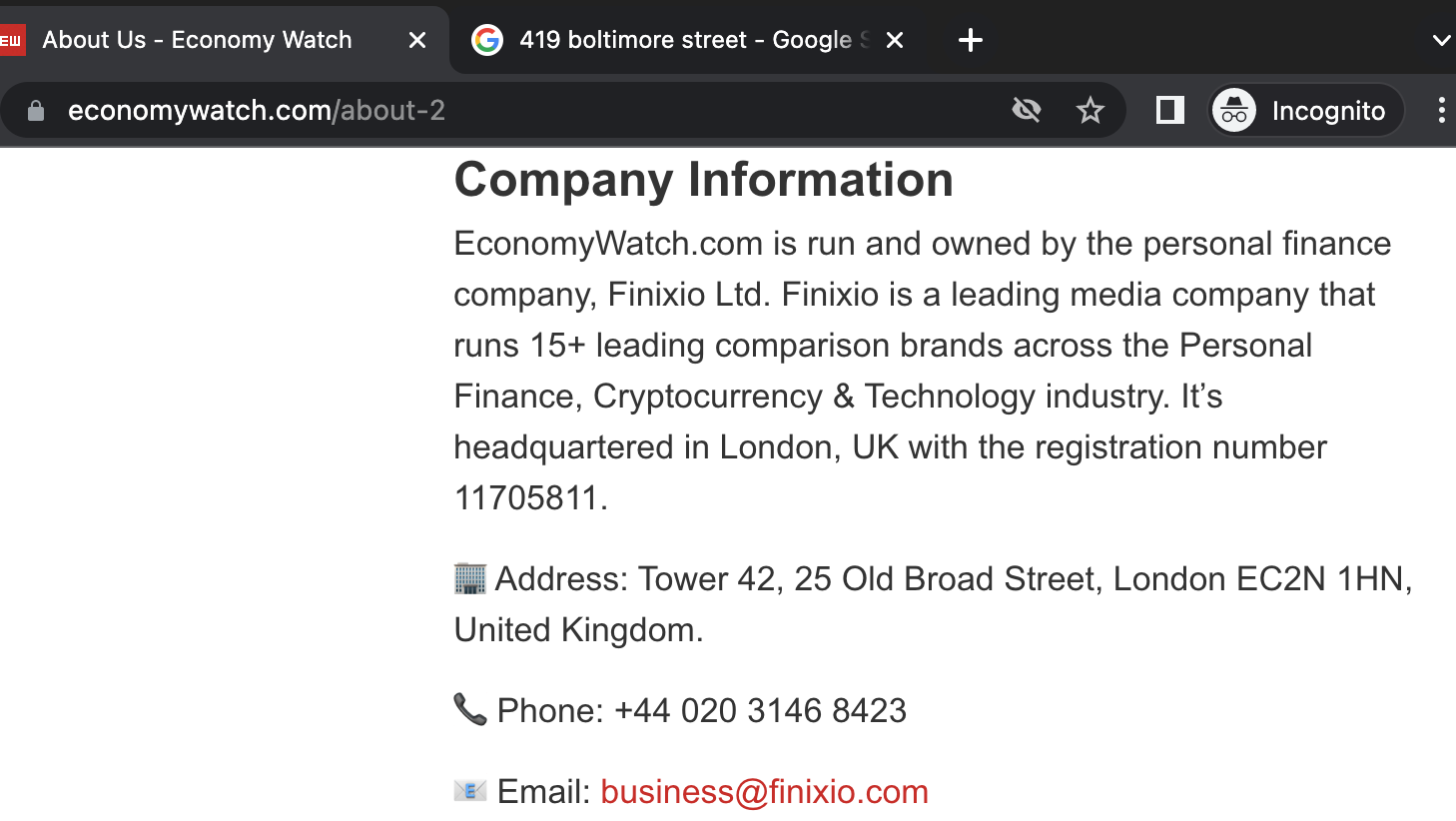

Identify the Legal Entity: Try to find any available information about the company behind Bitcoin Code. This might include checking the website's Terms of Service, Privacy Policy, or any contact information provided. Sometimes, a deeper online search or lookup of domain registration details (WHOIS search) can reveal more about the entity.

-

Seek Legal Advice: Consult with a legal professional, particularly one experienced in international law and financial regulations. They can advise you on the feasibility of legal action, the appropriate jurisdiction for filing a lawsuit, and the potential challenges involved.

-

Report to Financial Authorities: Report your experience to financial regulatory authorities in your jurisdiction. For example, in the UK, this would be the Financial Conduct Authority (FCA). Even if they cannot take direct action on your behalf, they can investigate and potentially take broader actions if the entity is conducting illegal activities.

-

Consumer Protection Agencies: Contact consumer protection agencies or organizations in your country. They can provide advice, and in some cases, may be able to offer assistance or direct you to the appropriate channels for complaints.

-

Online Fraud Reporting: Report the platform to online fraud and scam reporting websites and authorities. This might not result in direct legal action but can help warn others.

-

International Jurisdiction Issues: If Bitcoin Code operates across borders, this adds a layer of complexity due to varying laws and jurisdictions. A legal expert can provide advice on how to navigate these challenges.

-

Class Action Possibility: If there are many others who have been similarly affected, a class action lawsuit might be a possibility. Such actions can sometimes be more effective in dealing with fraudulent online entities.

-

Manage Expectations: Be aware that legal action can be time-consuming, expensive, and might not always lead to a satisfactory outcome, especially if the entity is based in a different jurisdiction or if there’s a lack of clear legal pathways.

-

Public Awareness: Sometimes, public awareness campaigns via social media or collaboration with consumer advocacy groups can be effective in highlighting the issues with platforms like Bitcoin Code, thereby warning potential users.

Unfortunately, the anonymous and cross-border nature of many online cryptocurrency platforms can make legal recourse challenging. It's often more effective to focus on prevention, such as thorough due diligence and consulting with legal and financial advisors before engaging with such platforms.

So What You're Saying is, Don't Invest Unless You Know Their Address

That's a prudent approach. Knowing the address or the specific legal details of the company behind an investment platform is crucial for several reasons:

-

Accountability: A known physical address or legal entity information ensures that there is a degree of accountability. It allows you to verify the legitimacy of the company and provides a point of contact for any legal or official correspondence.

-

Legal Recourse: In case of disputes, fraud, or other issues, knowing the company’s address and legal identity is essential for pursuing legal action or making formal complaints to regulatory bodies.

-

Transparency and Legitimacy: A legitimate investment platform should be transparent about its business information, including where it is registered and operates. Lack of this information is often a red flag.

-

Regulatory Compliance: Knowing the company's location can help determine the regulatory framework it falls under. Different countries have different regulations for financial and investment services, and a company's compliance with these regulations is a key factor in its legitimacy.

-

Due Diligence: Part of conducting due diligence before investing is verifying the company's existence and operational status. This process includes checking their address, registration, and regulatory compliance.

-

Risk Assessment: Understanding where a company is based can help assess the risk, as different jurisdictions have varying levels of investor protection and financial regulation.

While having a physical address or clear legal information does not guarantee that an investment is risk-free, it is a fundamental part of assessing the credibility and trustworthiness of an investment platform. Always exercise caution and consider seeking advice from financial advisors or legal professionals before making significant investments, especially in the volatile and often complex world of cryptocurrency.

I've Scoured the bitcoin code website and even registered to see what happens but No Address...

No address, no country, no registration number, only an email address: [email protected].

It also says at the bottom 'The video is for commercial presentation and illustration purposes only, and all participants are actors.' that can't be good can it?

The disclaimer indicating that the video on the Bitcoin Code website is for "commercial presentation and illustration purposes only" and that "all participants are actors" is indeed a significant point to consider. Here's what it implies and why it might be a cause for concern:

-

Lack of Authentic Testimonials: The use of actors suggests that the testimonials or demonstrations in the video are not from genuine users. This raises questions about the authenticity of the claims made in the presentation.

-

Marketing Over Substance: When a platform relies on staged presentations rather than real user experiences or verifiable data, it suggests that the marketing material might be prioritizing persuasion over factual accuracy.

-

Potential Misrepresentation: Using actors in promotional videos is a common marketing practice, but in the context of investment platforms, it can be misleading. It might give a false impression of the effectiveness or reliability of the service.

-

Questionable Credibility: Such disclaimers can erode the credibility of the platform. Prospective users may wonder why the platform needs to resort to using actors if their service is genuinely successful and beneficial.

-

Critical Evaluation Needed: This kind of disclaimer should encourage potential users to critically evaluate the claims made by the platform. It’s important to seek out additional, independent sources of information rather than relying solely on the platform’s promotional material.

-

Importance of Transparency: Genuine and trustworthy investment platforms typically focus on transparency, providing potential investors with clear, factual information. The use of actors in place of real testimonials does not align well with this principle.

-

Regulatory Compliance: While using actors for promotional purposes is not illegal (provided it is disclosed, as in this case), it does place a greater responsibility on the viewer to seek out additional, unbiased information before making investment decisions.

In summary, while using actors for a promotional video is not uncommon in advertising, it is a practice that requires careful consideration in the context of financial investment platforms. It highlights the need for potential users to conduct thorough research, verify claims independently, and approach such platforms with a heightened level of scrutiny.

Surely that is Preparing themselves for the Backlash of Misrepresentation?

Yes, the inclusion of a disclaimer stating that the video content is for illustrative purposes only and features actors can indeed be seen as a precautionary measure by the platform against potential backlash or accusations of misrepresentation. Here's why this is significant:

-

Managing Legal Risks: By stating upfront that the promotional material uses actors and is for illustration only, the platform might be attempting to mitigate legal risks. This disclaimer can be a way to protect themselves if users claim they were misled by the promotional content.

-

Acknowledging Lack of Authentic Testimonials: This kind of disclaimer indirectly acknowledges that the success stories or endorsements presented may not be from real customers. It suggests that the platform is aware that their promotional content might not accurately represent user experiences.

-

Transparency and Ethical Concerns: While using actors in promotional materials is a common practice, in the context of financial investment services, it raises ethical concerns. Potential investors might expect promotional content to be based on real user experiences and outcomes, especially when it comes to financial returns.

-

Implications for Trust and Credibility: Such disclaimers can impact the perceived trustworthiness and credibility of the platform. Savvy investors might view this as a red flag and question the validity of the platform’s claims.

-

Consumer Awareness: This practice highlights the importance of consumer awareness and due diligence. Potential users should critically evaluate promotional materials, seek out independent reviews, and verify claims before making investment decisions.

-

Regulatory Compliance: Depending on the jurisdiction, there might be regulatory standards governing how investment services can be advertised. Disclaimers like this could be an attempt to comply with such regulations while still using persuasive marketing techniques.

In summary, while the disclaimer might be an attempt to preemptively address potential accusations of misrepresentation, it also raises questions about the authenticity and reliability of the platform's claims. It underscores the need for potential users to conduct thorough research and seek out objective information before investing in such platforms.

FACT CHECKED: BITCOIN CODE IS A SCAM AND THE ONLY WAY TO GAIN A SECOND INCOME IS NOT TO USE IT