What is Immediate Edge?

"Immediate Edge" is another name that is commonly associated with the world of online cryptocurrency trading platforms. Similar to "British Bitcoin Profit," Immediate Edge is advertised as a software that enables users to trade cryptocurrencies, and it often claims to use advanced algorithms or artificial intelligence to predict market movements and execute profitable trades on behalf of the user.

However, as with any automated trading platform, particularly those in the cryptocurrency space, it is critical to approach them with a high level of skepticism. Here are some reasons why:

-

Promises of Easy Profits: Many of these platforms claim to offer a way to make significant profits with little effort by using their system. However, the reality is that trading, especially in the highly volatile cryptocurrency market, involves substantial risk.

-

Lack of Transparency: Some of these platforms may not provide clear information about their fee structure, the risks involved, or the logic behind their trading algorithms.

-

Regulatory Concerns: Platforms like Immediate Edge often operate in regulatory gray areas. They may not be licensed or regulated by any recognized financial authority, which puts users at risk.

-

Potential for Scams: The cryptocurrency space has been targeted by numerous scams, and some trading platforms have turned out to be fraudulent schemes designed to take users' money.

-

Reviews and Testimonials: Often, the testimonials and reviews presented by such platforms can be misleading or completely fabricated. They should not be taken at face value without independent verification.

If you're considering using Immediate Edge or any similar platform, it's crucial to do your due diligence:

- Research the platform thoroughly.

- Look for independent reviews and user experiences.

- Check if the platform is regulated or recognized by any financial authority.

- Never invest more than you can afford to lose.

- Be skeptical of promises that sound too good to be true.

Always remember that while technology has indeed advanced, and there are legitimate automated trading systems used by professional traders, the promise of consistent, easy profits with little to no risk is not realistic in any financial trading environment.

Where did the idea of Immediate Edge Originate?

The idea behind "Immediate Edge" and other similar cryptocurrency trading platforms likely originated from the broader concept of automated trading systems, which have been used in various forms for decades in financial markets. These systems, also known as algorithmic trading or trading bots, execute trades based on pre-programmed instructions without the need for human intervention.

Here's a brief history of how the idea evolved:

-

Algorithmic Trading: In traditional financial markets, algorithmic trading has been around since the 1970s. It began gaining popularity in the 1980s with the advent of more powerful computers and has become increasingly sophisticated over time.

-

Retail Trading Software: With the rise of online trading in the 1990s, software became available to retail investors, not just institutional ones. This included programs that could automate trading decisions based on technical analysis or other criteria.

-

Cryptocurrency Boom: The cryptocurrency market explosion in the 2010s, particularly during the Bitcoin boom, created a new frontier for trading bots. The market's volatility and 24/7 operation made it an ideal candidate for automated systems, which can operate around the clock and react faster than humans.

-

Accessibility and Marketing: As interest in cryptocurrencies grew, so did the number of people looking to make money from trading them. This led to a surge in platforms like "Immediate Edge," which are marketed to everyday consumers as a way to participate in crypto trading without needing deep expertise.

-

Promises of AI and Machine Learning: With advancements in AI and machine learning, many trading platforms began claiming to use these technologies to predict market movements and execute profitable trades. Whether these claims are valid or not varies widely, and such technologies are often used more as marketing terms than accurate descriptions of the platform's capabilities.

The exact origin of "Immediate Edge" as a brand or a specific platform is unclear, but it fits within this larger narrative of the evolution of trading technology. It presents itself as an innovative tool for profiting from the new and exciting world of cryptocurrency, which appeals to many would-be traders. However, many of these platforms exploit the allure of new technology and the promise of easy money, and some are not legitimate.

Given this context, it is essential for anyone interested in such platforms to exercise caution, conduct thorough research, and maintain realistic expectations about the risks and potential rewards of using automated trading systems in the cryptocurrency market.

What does the Name 'Immediate Edge' Mean?

The name "Immediate Edge" for a trading platform seems designed to convey the idea that the platform can provide its users with an immediate advantage or "edge" in the trading market. In the context of trading and investing, having an "edge" refers to possessing a set of conditions or tools that give a trader a superior position compared to others in the market, potentially leading to more successful trades.

Here are a few connotations of the name:

-

Speed: "Immediate" suggests a platform that operates with great speed, which could be appealing in the fast-paced world of cryptocurrency trading where market conditions can change rapidly.

-

Advantage: "Edge" implies a competitive advantage, suggesting that the platform might provide insights, information, or methods of execution that are superior to what one might achieve trading without it.

-

Innovation: Together, "Immediate Edge" suggests a technologically advanced system that could outperform other market participants through faster or more informed decision-making.

The name is marketing-oriented, aiming to appeal to potential users who are looking for quick and advantageous ways to trade, particularly in markets as volatile as cryptocurrencies. However, as with all marketing, the name of a platform doesn't guarantee its performance or legitimacy. It's always important for users to critically assess the platform's actual capabilities and to look for independent verification of any claims made by its providers.

Would Immediate Edge Really be Accepted by Traders or Brokers?

Whether a trading system like "Immediate Edge" would be accepted by traders or brokers depends on several factors, including the system's legitimacy, performance, ease of use, regulatory compliance, and the overall market reputation. Here are some considerations that traders and brokers might weigh:

-

Performance and Reliability: Traders would evaluate how well the system performs in live trading conditions, including its ability to execute trades quickly and accurately, as well as its track record for profitability.

-

Regulatory Compliance: Brokers and professional traders need to ensure that any system they use complies with local and international trading regulations. If "Immediate Edge" were not compliant, it would be rejected by regulated brokers.

-

Reputation: The trading community is often skeptical of systems that promise quick profits with minimal effort. If "Immediate Edge" is marketed with over-the-top promises, it may damage its credibility among seasoned traders.

-

Security: Both traders and brokers must be assured of the system's security features to protect against hacking and fraud.

-

Transparency: There should be transparency about the system's functionality, fees, and any associated risks. Lack of transparency would be a red flag for both traders and brokers.

-

User Experience: The platform must have a user-friendly interface that integrates well with existing trading workflows. Clunky or confusing interfaces would deter professional use.

-

Due Diligence: Before adopting any new trading system, due diligence is essential. This includes verifying the company's background, the developers' expertise, and user reviews.

-

Demo or Trial Period: Many traders and brokers would expect to be able to test the system through a demo or trial period before committing real capital.

-

Independent Verification: Claims made by the system would need to be independently verified, typically by looking at unbiased user reviews or industry expert analyses.

In the real world, automated trading systems are used widely, especially by institutional traders and serious individual traders. However, the adoption of any particular system, especially in the retail trading sector, would depend on the credibility and performance of the system itself. Given the prevalence of scams and exaggerated marketing claims in the cryptocurrency space, traders and brokers would approach a new system like "Immediate Edge" with caution, conducting thorough research and tests before deciding whether to trust and use it.

If Immediate Edge is So Good Why Is it Not on the Cover of Forbes?

The presence of a product or service like a trading platform on the cover of a prestigious publication like Forbes is typically a reflection of widespread recognition and significant impact on the market or society, not necessarily an endorsement of its quality or effectiveness. There are several reasons why a trading platform such as "Immediate Edge" might not be featured in such a high-profile way:

-

Market Saturation: The financial technology sector is crowded with numerous trading platforms and tools, many claiming to offer unique advantages. It would take a particularly significant differentiator or a major success story to stand out.

-

Verifiable Success: Forbes and similar publications often feature companies or services with proven success and established reputations. A platform would likely need a track record of verifiable and significant results for users over time to be considered for a feature.

-

Journalistic Scrutiny: Reputable magazines conduct thorough journalistic scrutiny before featuring any service or product. Unless "Immediate Edge" has undergone such scrutiny and passed rigorous checks for legitimacy and impact, it would not be featured.

-

Editorial Policies: The editorial policies of publications like Forbes might prevent them from featuring certain types of businesses, especially those in highly speculative markets like cryptocurrency trading, due to the high risk involved for their readers.

-

Promotional and Advertising Strategies: Sometimes, a feature in a major publication is the result of strategic public relations efforts and not just organic newsworthiness. If the makers of "Immediate Edge" haven't engaged in a substantial PR campaign, it's unlikely that the platform would receive such attention.

-

Regulatory and Ethical Considerations: Given the regulatory scrutiny around cryptocurrency trading platforms, especially those that promise quick profits with minimal effort, a reputable publication would likely avoid featuring such a service unless it was absolutely certain of its legitimacy and compliance with financial regulations.

-

Scam Concerns: Many platforms promising quick profits in the crypto space have turned out to be scams or have had questionable business practices. Forbes would likely avoid featuring any company unless it was certain that it is legitimate and not risking its readers' trust.

In short, while media coverage can lend credibility and visibility to a trading platform, the absence of such coverage is not necessarily an indicator of the platform's quality or effectiveness. Investors should always perform their own due diligence rather than relying on media appearances as a sign of trustworthiness.

If Immediate Edge Makes Money for Novices, Where does the Money Come From?

When a trading platform like "Immediate Edge" claims to make money for novices, it's important to understand the source of the profits within the context of trading. In any trading scenario, profits are generally derived from successfully predicting market movements and executing trades that capitalize on these movements. Here’s how it typically works:

-

Market Movements: The basic premise of trading is to buy low and sell high. Profits come from the price differences in buying and selling assets like cryptocurrencies. If a novice trader or an automated system can successfully predict when the price of an asset will rise or fall, and trades are executed accordingly, profits can be made from these transactions.

-

Liquidity Pools: In the markets, there are always buyers and sellers. The money made by one party is often coming from another party's loss within the market. This is part of the zero-sum nature of trading: one trader's gain is another's loss. In reality, markets aren't purely zero-sum because they can also reflect underlying economic growth, and in the case of cryptocurrencies, market valuations can rise and fall significantly, affecting all participants.

-

Market Participants: Novices using platforms like "Immediate Edge" would be participating in markets alongside a wide range of other traders, including retail investors, professional traders, and institutional players. The profits that novices could potentially make would come from other market participants who are buying when the novice is selling at a higher price, and vice versa.

-

Spread and Commission: Some trading platforms earn money from the spread (the difference between the buy and sell price of an asset) or from commissions on trades. This means that part of the money that traders make or lose goes to the platform itself.

-

Speculative Nature: Cryptocurrency markets are highly speculative. The value of cryptocurrencies can be influenced by a range of factors, including market sentiment, investor behavior, regulatory news, and technological developments. This speculative nature can create opportunities for profit (as well as for loss).

-

Volatility: The high volatility of cryptocurrencies means there is potential for large profits, but also for large losses. Profits for novices or any traders are not guaranteed and can be wiped out by sudden market moves.

-

Risks and Losses: It’s critical to understand that while profits are possible, they are never guaranteed, especially in cryptocurrency trading. Novices are often at risk of losing their money due to inexperience, market volatility, or if the platform itself is not trustworthy or uses ineffective trading algorithms.

In reality, the claim that a system can consistently make money for novices without risk is misleading. All trading involves significant risk, and while automated systems can assist in making trading decisions, they cannot eliminate the inherent risks of the market. Users of such systems should be wary of claims that sound too good to be true and should approach trading with caution, recognizing that they could lose money as well as potentially make it.

So If Immediate Edge Works, Professional Traders Work Harder?

If a trading system like "Immediate Edge" were to work as advertised — that is, providing a reliable, automated way to make profitable trades — it wouldn't necessarily mean that professional traders would have to work harder, but rather that they might need to adapt their strategies to remain competitive.

Professional traders often have a deep understanding of the market dynamics, and they employ a wide range of tools and strategies to make profitable trades. These can include fundamental analysis, technical analysis, sentiment analysis, and more sophisticated trading algorithms of their own.

Here are some points to consider regarding professional traders in the context of an effective trading system like "Immediate Edge":

-

Adaptation: Professional traders are used to adapting to new technologies and methods. If a new system proved to be effective, they might incorporate it into their existing strategies or develop counter-strategies.

-

Skepticism: Many professionals would approach a new system with skepticism until it has a proven track record. They rely on their expertise and experience to make trades and might not easily trust an automated system.

-

Competitive Edge: Professional traders often seek any competitive edge they can find. If "Immediate Edge" provided such an advantage, it could be adopted by professionals as one of many tools they use.

-

Market Impact: The widespread use of a successful automated trading system could potentially change market dynamics. For example, if many traders use a system that tends to make the same trades at the same time, it could reduce the effectiveness of those trades.

-

Regulatory and Ethical Considerations: Professional traders and institutions are usually bound by stricter regulatory and ethical considerations, which might limit their use of certain automated trading systems.

-

Complementing Skills: A tool is only as good as the person using it. Professionals might use automated systems to handle routine tasks while they focus on more complex trading strategies that require a human touch.

-

Market Noise: Professionals are also adept at distinguishing "market noise" from meaningful trends. While an automated system might generate profits in certain conditions, it may not handle market noise or unexpected events as adeptly as a seasoned trader.

In reality, the efficacy of automated trading platforms in consistently outperforming the market, especially in volatile environments like cryptocurrency, is a subject of much debate. Professional traders understand that there's no "holy grail" in trading and that successful trading requires a combination of tools, experience, discipline, and sometimes, a bit of luck. It's also worth mentioning that if a trading system was extraordinarily successful, it would be a significant industry disruptor, and its effectiveness might be lessened as more people use it (a phenomenon known as "alpha decay" in finance).

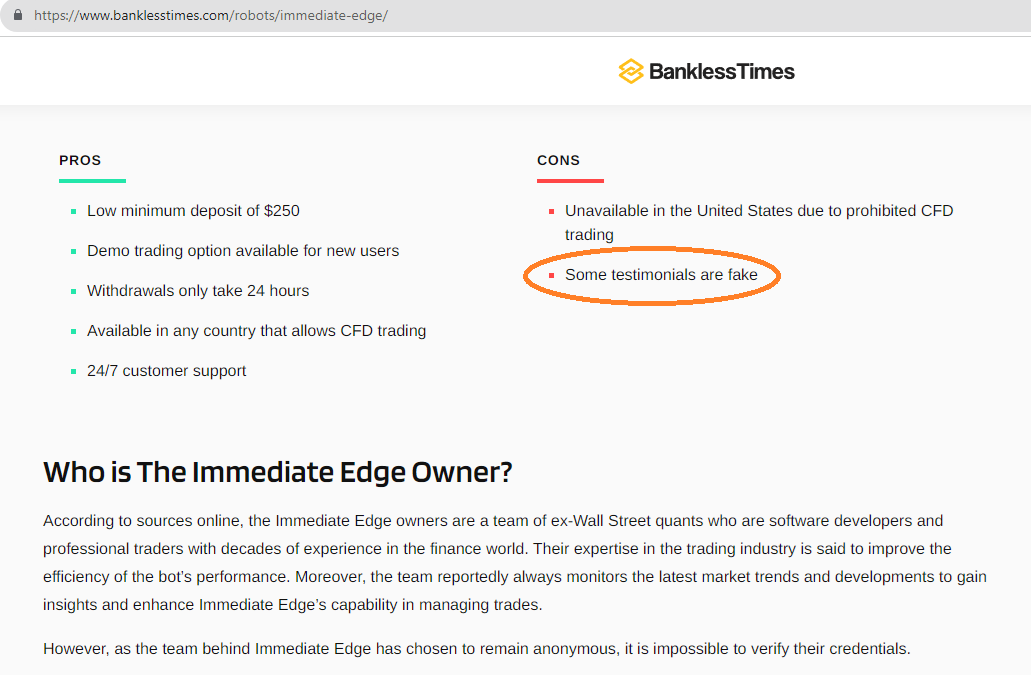

Are Online Reviews of Immediate Edge Faked?

The authenticity of online reviews, whether for products, services, or platforms like "Immediate Edge," can vary greatly. Some reviews may be genuine, reflecting the actual experiences of users, while others could be fabricated or exaggerated. In the world of online trading platforms, especially those claiming to offer significant profits with little effort, there is a higher risk of encountering misleading or fake reviews for several reasons:

-

Affiliate Marketing: Some positive reviews may be written by affiliates who earn a commission for referring new users to the platform, which can bias their reviews.

-

Paid Reviews: Companies may pay for fake reviews to improve their image and attract customers.

-

Marketing Tactics: As part of their marketing strategy, a company might create or commission fake testimonials and reviews that make the system seem more successful or reliable than it is.

-

Selective Presentation: Sometimes, a company might selectively present only positive reviews while hiding or deleting negative feedback.

It's important to approach reviews with a critical eye, especially if they are found on websites with unclear affiliation or on the platform's own marketing materials. Here are some tips to help you evaluate the authenticity of reviews:

-

Check Multiple Sources: Look for reviews across various independent platforms, forums, and websites. If reviews are largely positive on one site but overwhelmingly negative on others, this discrepancy could be a red flag.

-

Look for Detail and Specificity: Genuine reviews often contain specific details about the user's experience. Vague or overly enthusiastic reviews that lack detail may not be trustworthy.

-

Evaluate the Review Website's Credibility: Some websites are known for hosting more reliable reviews than others. Sites that verify purchases or have a robust system for detecting fake reviews are generally more reliable.

-

Be Skeptical of Extremes: Be cautious of overly negative or positive reviews. Both can be signs of manipulation — either by competitors or by the platform itself.

-

Examine Reviewer Profiles: On some platforms, you can click on reviewers' profiles. If a profile shows a pattern of only leaving positive reviews for products from a single company, or if the profile seems new or inactive, the review could be fake.

-

Consistency Across Reviews: If many reviews share the same language or phrases, it may be an indication that they were written by the same person or generated by a template.

-

Regulatory Warnings: Check if there have been any warnings from financial regulators about the company or its practices.

For a decision as significant as investing in a trading platform, it's best to look beyond reviews and conduct thorough research, including the platform's regulatory status, track record, transparency, and the plausibility of the claims it makes. If something seems too good to be true, it very well might be. It's also advisable to consult financial experts or trusted sources before making any investment.

If Affiliates Condone Scams, They are Collecting Part of the Fraud Money

Yes, if affiliates are aware that they are promoting a scam and continue to do so, they are complicit in the fraudulent scheme. Affiliates have a responsibility to conduct due diligence on the products or services they promote. By knowingly marketing a scam, an affiliate could be considered as aiding the scam's operations and potentially could be legally liable for their role in perpetuating the fraud.

Here are a few points regarding affiliate responsibility and legal implications:

-

Legal Liability: Affiliates who knowingly promote fraudulent schemes may face legal consequences. This could include being charged with fraud themselves, especially if they have made false claims to persuade others to join the scheme.

-

Ethical Conduct: Ethical affiliates should verify the legitimacy of a service or product before promoting it. Reputable affiliate programs often conduct their own vetting of products to protect their own credibility and to ensure they are not misleading their audience.

-

Consumer Protection Laws: Most countries have consumer protection laws that can hold affiliates liable if they engage in deceptive marketing practices.

-

Reputation: Affiliates who promote scams risk damaging their reputation, which can have long-term negative effects on their ability to earn income from affiliate marketing in the future.

-

Financial Consequences: Beyond legal issues, affiliates could also be subject to financial consequences, such as fines or being required to pay restitution to victims.

-

Regulatory Action: Regulators in many jurisdictions actively pursue fraudulent activities, including those involved in promoting such schemes. This can result in enforcement actions against affiliates.

For consumers, it's important to approach endorsements and promotions with a critical eye, especially when it comes to investment opportunities or financial products. If the product or service is being marketed primarily through affiliate networks with over-the-top promises and scant evidence, this could be a red flag.

Affiliates, on their part, should prioritize promoting products and services that are credible and beneficial for their audience to maintain trust and avoid legal troubles.