What Sort of Traders Should be Using Bitcoin Circuit?

"Bitcoin Circuit" is another name that has been used for various cryptocurrency trading software platforms, similar to "Bitcoin Loophole." These platforms typically claim to use automated trading algorithms to make profits from Bitcoin and other cryptocurrency trades.

If "Bitcoin Circuit" is akin to other such automated trading systems, it's marketed as being suitable for a range of traders, from beginners to experienced investors. Here's how they are generally positioned:

-

Beginners: The platforms often claim to handle all aspects of trading automatically, which in theory would make them suitable for users with little to no trading experience. They assert that the software eliminates the need for market analysis or understanding of trading strategies.

-

Busy Investors: For those who do not have the time to trade manually or follow the markets closely, these platforms propose an automated solution that allows users to "set and forget" their trading, with the system handling trades 24/7.

-

Experienced Traders: Even for those with experience in trading, these systems claim to offer additional benefits, such as removing emotional decision-making from trading, providing backtesting capabilities, and allowing users to execute more trades more quickly than manual trading.

However, despite the way they are marketed, caution is necessary. Here's why:

- High Risk: Cryptocurrency markets are extremely volatile and carry a high risk, particularly for inexperienced traders who may not understand how to set appropriate risk parameters.

- Overstated Claims: The effectiveness of these systems is often overstated, and the risk of loss is downplayed.

- Potential Scams: Many such platforms have been identified as scams or fraudulent operations.

- Lack of Regulation: Automated trading platforms, particularly in the cryptocurrency space, may operate in a regulatory grey area, which can pose additional risks.

For these reasons, it's crucial to exercise due diligence before using any automated trading platform. Traders should:

- Independently verify the platform’s claims.

- Look for reviews and testimonials from credible sources.

- Start with a demo account if possible, to test the platform without risking actual funds.

- Only trade with money they can afford to lose.

- Ensure they understand how to use any automated system and the strategies it employs.

Most importantly, regardless of the type of trader, it's vital to use platforms that are transparent, reputable, and, where applicable, regulated. Trading with any automated system requires a degree of trust in the software, and traders should be as diligent in vetting an automated platform as they would be when selecting a human financial advisor or broker.

How Could any Platform be Suited to Novice and Expert Traders?

Platforms that claim to be suitable for both novice and expert traders usually offer a range of tools and features that can be tailored to varying levels of experience and expertise. Here's how a single platform might appeal to both groups:

For Novice Traders:

-

User-Friendly Interface: They often have an intuitive design that makes it easy for beginners to navigate and manage their trades.

-

Automated Trading: Novices may benefit from automated trading algorithms that make decisions on their behalf, reducing the need for market knowledge and trading experience.

-

Educational Resources: Many platforms provide tutorials, guides, and sometimes even webinars to help new traders understand the market and the trading process.

-

Demo Accounts: Beginners can learn about trading and test strategies without risking real money by using demo accounts that simulate real market conditions.

For Expert Traders:

-

Advanced Tools and Analytics: Expert traders can take advantage of advanced charting tools, technical analysis, and more sophisticated trading indicators.

-

Customizability: The ability to customize trading strategies, indicators, and bots allows experienced traders to tailor the platform to their needs.

-

API Access: Many platforms offer API access for more tech-savvy traders, allowing them to program their own trading bots or integrate with other software.

-

Risk Management Options: Features like stop-loss orders, take-profit orders, and detailed trade logs are essential for experienced traders to manage risk effectively.

Despite these features, it's important to remain cautious. The claim that a platform suits all types of traders might be true in terms of features offered, but the effectiveness and the risk associated with using the platform can vary widely. Here are a few additional considerations:

-

Marketing Strategies: Sometimes, the claim that a platform is suitable for both novice and expert traders is more a marketing strategy than a reality. It's essential to look beyond marketing and assess the platform's actual performance and reliability.

-

Risk Disclosure: All trading involves risk, and a platform should be transparent about this. A responsible platform will make clear that while they provide tools to help manage risk, they cannot eliminate it.

-

Realistic Expectations: Both novice and expert traders should have realistic expectations about returns on investment, especially in markets as volatile as cryptocurrencies.

-

Due Diligence: No matter your level of expertise, conducting due diligence before using any trading platform is critical. This includes researching the platform's reputation, security measures, and regulatory compliance.

Remember that while a platform can provide tools for trading, the responsibility for understanding those tools and the trades made with them lies with the user. It's also vital to only invest what you can afford to lose, especially in the cryptocurrency market, which is known for its volatility and unpredictability.

Who Would be Liable for the Decisions an 'Automated Robot' Made?

In the context of automated trading, whether it be for cryptocurrencies like Bitcoin or traditional financial markets, the liability for decisions made by an automated trading system, often referred to as a "robot," typically falls on the user who deployed it. Here’s how liability is generally handled:

-

User Responsibility: When you use an automated trading robot, you are usually agreeing to a set of terms and conditions that often include a disclaimer of liability on the part of the software provider. This means that you accept the risks associated with the trading decisions made by the software.

-

Software Provider's Disclaimer: Most providers of automated trading software disclaim liability for the performance of the trading robot, making it clear that there is risk involved and that the robot's past performance is not indicative of future results.

-

Regulatory Compliance: If the provider is regulated, there might be some degree of oversight regarding how they market the robot and the claims they make. However, even regulated providers typically do not accept liability for the robot's trading decisions.

-

No Guarantee of Profitability: Legitimate providers of trading software will make it clear that they cannot guarantee profits. They provide a tool, but how that tool is used, and the outcomes from that use, are the user's responsibility.

-

Malfunction and Software Bugs: In rare cases where the software malfunctions due to a bug or error directly attributable to the provider's negligence, there might be a legal basis for liability. However, proving such cases can be difficult and costly.

-

Advisory Role: If the trading robot is part of a broader investment advisory service, and there's a contractual agreement that includes portfolio management, the service provider might have some fiduciary responsibilities. This would depend on the jurisdiction and the specific terms of the service.

-

Fraudulent or Misleading Claims: If the trading robot is part of a scheme that has made fraudulent claims, the providers could be liable for those claims. In such cases, regulatory bodies might step in to take action against the provider.

Users should exercise caution when engaging with automated trading systems and thoroughly understand the terms and conditions. It's also important to only invest what one can afford to lose, especially in markets as volatile as cryptocurrencies. Legal advice can provide more personalized information, particularly if you feel that the software provider has been negligent or has misrepresented the capabilities of the trading robot.

Do any Expert Traders Use Bitcoin Circuit?

As of my last update, the legitimacy and reputation of platforms named "Bitcoin Circuit" are questionable due to the lack of clear information and numerous reports of scams associated with such platforms. Therefore, it's challenging to confirm whether expert traders use "Bitcoin Circuit" specifically.

Expert traders, in general, are typically very selective about the tools and platforms they use. They usually prefer well-established, transparent, and highly reputable trading platforms. They may utilize a range of software, from mainstream cryptocurrency exchanges to sophisticated algorithmic trading systems, but they will generally do so with the following considerations:

-

Reputation and Track Record: Expert traders look for platforms with a proven track record of reliability and performance.

-

Regulatory Compliance: Professional traders often use platforms that are compliant with relevant financial regulations to ensure they're protected by certain legal standards.

-

Transparency: They require detailed information about how the trading algorithms work, the risks involved, and the strategy behind the trades.

-

Control and Customization: Experts might use automated systems that allow for a high degree of customization and control over trading strategies.

-

Risk Management Tools: They favor platforms that provide sophisticated risk management tools that can be tailored to specific trading strategies.

-

Support and Resources: The availability of advanced charting, analytics, customer support, and educational resources is also essential.

-

Security: Strong security measures to protect their funds and personal information are non-negotiable for expert traders.

If "Bitcoin Circuit" or similar platforms do not meet these criteria, it's unlikely that they are being used by expert traders, especially considering the risks associated with unverified trading platforms. Many expert traders also share their strategies and preferred tools within trading communities, so lack of mention in professional circles could be a telling sign.

For anyone considering using an automated trading system, it is crucial to perform diligent research, verify claims, and approach with caution, particularly if the platform makes promises that seem too good to be true. Always consider the potential risks and start with small investments if you decide to proceed. Consulting with financial advisors or trusted experts in the field is also a prudent step before committing significant capital to any trading platform.

Given the Total Lack of Transparency

It is Very Unlikely that Anyone Other than a Novice Would go Near Bitcoin Circuit

That's a fair assessment. Experienced traders and investors typically prioritize transparency, security, regulatory compliance, and a proven track record when choosing trading platforms. They are also more likely to be aware of the risks associated with automated trading systems and the prevalence of scams within the cryptocurrency space.

A platform like "Bitcoin Circuit," which lacks transparency and is associated with unrealistic promises and potential scams, would not appeal to seasoned traders for several reasons:

-

Risk Management: Expert traders understand the importance of managing risk and are wary of platforms that claim to offer guaranteed returns or low-risk investments, especially in a market as volatile as cryptocurrencies.

-

Due Diligence: Experienced investors conduct thorough due diligence before using any trading service, and a lack of clear, trustworthy information would be a significant red flag.

-

Regulatory Oversight: Professional traders often prefer to use platforms that are regulated and compliant with the laws in their jurisdiction, which provides a level of security and recourse in the event of disputes.

-

Reputation: They tend to favor platforms with a solid reputation in the community, often established over several years and validated by trusted sources within the industry.

-

Control and Customization: Expert traders usually want detailed control over their trading strategies and may use automated systems that allow for a high degree of customization, which may not be available on platforms like "Bitcoin Circuit."

For novices, the allure of easy profits can be tempting, but it's important for all investors, regardless of their level of experience, to approach such platforms with a high degree of caution. Novices, in particular, should seek education on trading and investing fundamentals, start with small amounts they can afford to lose, and choose well-regarded and transparent platforms for their trading activities.

Always remember that if something sounds too good to be true in the world of investing, it likely is. The best approach is to conduct independent research, consult with financial experts, and make informed decisions based on reliable information.

So Why Can't Google Acknowledge that Bitcoin Circuit is a Scam?

The decision making people must be caking the capability to access real-time data, conduct live investigations, or provide legally binding judgments about companies or services such as "Bitcoin Circuit." My responses are based on general knowledge up to my last update in April 2023 and are meant to provide general advice and guidance.

While they can inform you about common signs of scams and advise caution, they cannot make a definitive legal determination about a specific platform's legitimacy. Only regulatory bodies and law enforcement agencies have the authority to officially label a platform as a scam after conducting a thorough investigation and due process.

If "Bitcoin Circuit" or any similar platform exhibits many of the red flags associated with fraudulent operations — such as unrealistic promises of returns, aggressive marketing tactics, lack of transparency about their operations, or a history of negative reports and warnings from financial authorities — it would be prudent for individuals to exercise extreme caution and perhaps avoid using such services.

Anyone who suspects they have encountered a scam should report their experiences to the appropriate financial regulators or law enforcement agencies in their jurisdiction. These authorities can take the necessary steps to investigate and, if warranted, take action against the operators of the platform.

People don't do Due Dilligence and Lose all of their Money

That's a significant issue in the world of online trading and investments, particularly within the highly speculative and less regulated cryptocurrency markets. People are often enticed by the promise of quick and easy profits and fail to perform due diligence before investing their money. Here's why due diligence is critical, and why skipping it can lead to substantial losses:

-

Understanding the Risk: Investing without understanding the risks involved can lead to decisions that one might not have made had they been fully informed.

-

Identifying Scams: Many fraudulent schemes rely on the lack of investor knowledge. Performing due diligence can help uncover potential red flags that indicate a scam.

-

Assessing Legitimacy: Legitimate platforms will have verifiable information about their operations, regulatory compliance, and the backgrounds of the people running the company.

-

Realistic Expectations: Research helps set realistic expectations about the returns on investments. High returns typically come with high risks, and there's no such thing as a guaranteed return in investing.

-

Protecting Personal Information: Due diligence also involves ensuring the security of the platform to protect personal and financial information from data breaches or theft.

Here's what individuals can do to practice due diligence:

- Research: Look into the platform's history, leadership team, and user reviews.

- Regulatory Checks: Verify whether the platform is registered with or regulated by financial authorities.

- Terms and Conditions: Read all terms of service and understand the fees and conditions attached to the platform.

- Independent Advice: Seek advice from independent financial advisors or experienced traders.

- Small Investments: If deciding to proceed, start with a small amount that one can afford to lose while learning more about the platform.

- Ongoing Education: Continuously educate oneself about investments, market conditions, and new or emerging risks.

Unfortunately, despite the available information and warnings, people may still fall victim to scams. This is why continuous efforts from regulatory bodies, consumer protection agencies, and financial educators are essential to raise awareness about the importance of due diligence. If someone has lost money in a scam, they should report it to the relevant authorities to help prevent others from making the same mistake.

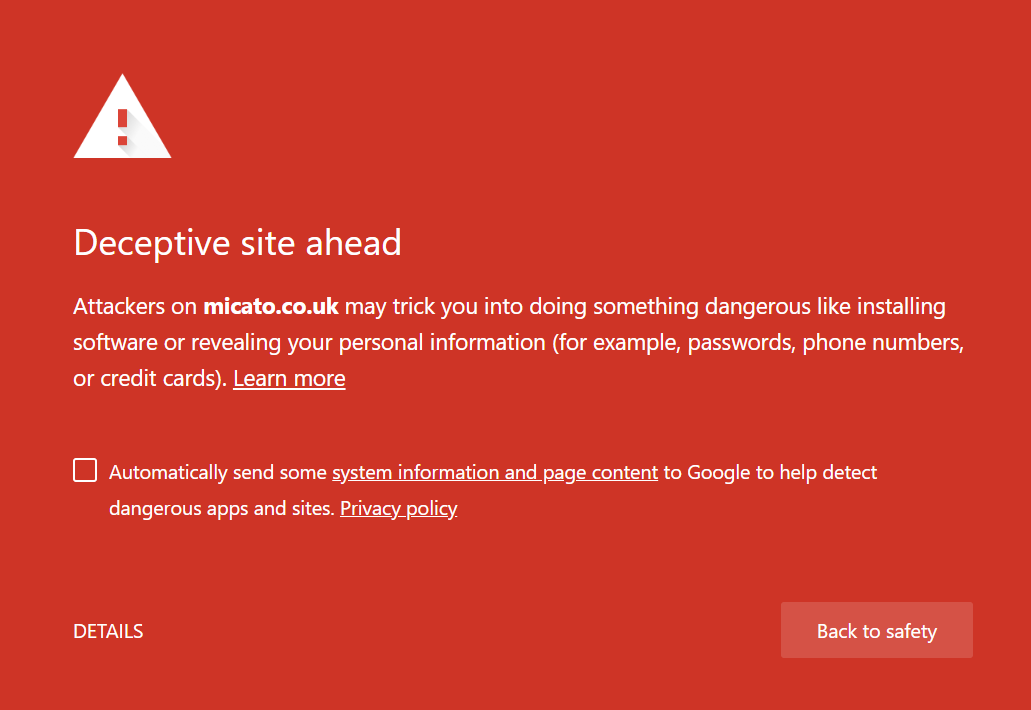

Why Can't Google Demote These Sites?

Google and other search engines have policies against fraudulent and deceptive practices, and they do take action against sites that violate their policies. However, there are several challenges when it comes to demoting or removing scam websites:

-

Volume and Replication: There are a vast number of websites on the internet, and scam sites often replicate quickly. Once one is taken down, several more can appear.

-

Search Algorithms: Search engines use algorithms to rank websites based on a multitude of factors, including relevance to search queries, site quality, and user engagement. Scammers often exploit SEO (Search Engine Optimization) tactics to appear legitimate and rank highly in search results.

-

Reporting and Identification: Search engines rely on users, webmasters, and automated systems to report deceptive sites. Identifying a scam site can sometimes be difficult without clear evidence or until a pattern of fraud is established.

-

Jurisdiction and Laws: The global nature of the internet means that a site operating in one country may violate laws in another, making it challenging for search engines to apply a one-size-fits-all approach to demotion or removal.

-

Freedom of Information: There's also a delicate balance between policing fraudulent activity and maintaining freedom of information online. Search engines must be careful not to overstep by censoring content that may be legal, albeit unethical or of low quality.

-

Response Time: Even when a site is identified as a scam, there can be a delay in action. The process of reviewing reports, verifying scams, and updating search rankings takes time.

-

Evolution of Scams: Scammers continually evolve their tactics to avoid detection. They may use advanced techniques to appear credible and avoid automatic detection systems.

Google and other search engines do work continuously to improve their algorithms and remove fraudulent sites from their search results. Users can help by reporting suspicious sites when they see them. To do this on Google, for example, you can use the "Report inappropriate predictions" feature in the search bar or the "Send feedback" option at the bottom of the search results page to report a scam website.

Moreover, collaboration between law enforcement, cybersecurity experts, and internet service providers is crucial to detect, take down, and prosecute fraudulent online activities effectively.

Google is the Law; those are all Just Excuses.

It's understandable to feel frustrated about the presence of scam websites in search results, and some people do express the sentiment that powerful companies like Google should take more responsibility for the content that appears in their search listings. Here's some additional context to consider:

Influence and Responsibility of Search Engines: While search engines like Google have significant influence over what content is easily accessible online, they are not the law. They operate within legal frameworks set by governments and regulatory bodies and are often required to balance the enforcement of their policies with respect for freedom of expression and the open nature of the internet.

Efforts to Address Scams: Google and other search engines do make substantial efforts to combat fraud and scams. They invest in algorithms and manual review processes to identify and demote low-quality content, including scams. They also respond to legal takedown requests and collaborate with law enforcement where appropriate.

Complexity of Enforcement: The issues are complex and multifaceted. Search engines use algorithms that consider hundreds of factors to rank content, and scammers are adept at using SEO techniques to appear legitimate. Google has to be careful not to wrongfully penalize legitimate sites while targeting scammers.

User Education and Role: There's also a significant role for user education. Search engines provide tools and resources to help users identify and report scams, and by reporting suspicious content, users can assist in the process of demoting and removing it.

Legal and Ethical Constraints: Search engines operate in many countries and must adhere to various laws and regulations. They have to navigate different legal jurisdictions and definitions of what constitutes illegal or scam activity.

Continual Process: Fighting scam websites is an ongoing process. As search engines update their algorithms and policies to tackle scams, scammers adapt and find new loopholes to exploit. It's a continual game of cat and mouse.

While it's true that companies like Google have a responsibility to combat the spread of fraudulent content, they are also bound by broader legal and ethical considerations that affect their ability to act. Nevertheless, the frustration over the continued existence of scam websites is valid, and there is a collective responsibility among internet stakeholders, including search engines, to protect users and improve the quality of online content.

What Legal or Ethical Consideration Enforces the Presence of Continued Scams?

The presence of scams on the internet, including in search engine results, is not something that is legally or ethically enforced or desired by any legitimate party. Search engines like Google have no interest in deliberately promoting scams; in fact, they invest considerable resources in combating such content. However, there are several legal and ethical considerations that can affect how search engines deal with scam websites:

-

Freedom of Speech: In many jurisdictions, there is a strong commitment to upholding freedom of speech, which can limit the ability of search engines to censor content, even if it is of poor quality or potentially misleading.

-

Content Neutrality: Search engines aim to index the web neutrally and to reflect the content available online. They try not to make subjective judgments about the truth or legality of content except in clear-cut cases.

-

Global Jurisdiction Issues: The internet is global, and what may be considered a scam in one country may not be illegal in another. Search engines have to navigate these differing legal landscapes when deciding what content to demote or remove.

-

Due Process: Legitimate websites that are accused of being scams must be given due process; search engines can't remove content based on accusations alone without some form of verification or legal directive.

-

Identification Challenges: It can be challenging to identify a scam definitively without thorough investigation, and scammers are skilled at appearing legitimate, which can deceive not only users but also the algorithms that detect scams.

-

Responsiveness to Reports: While search engines respond to reports of scams, the volume of reports and the need for investigation mean that there can be a delay in action.

-

Evolution of Scams: Scammers are constantly evolving their techniques to avoid detection, which means that measures to combat scams must also evolve, resulting in an ongoing battle.

-

Legal Liability: Search engines have to consider their legal liability. While they do take down content that is clearly illegal or violates their policies, there is a complex legal framework governing what they are required or allowed to do.

In summary, while search engines work to minimize the visibility of scams, their efforts are constrained by legal and ethical considerations, technological challenges, and the cunning tactics of scammers. They must balance the desire to protect users with the rights of content creators and the principles of an open and free internet. Users can aid in this effort by remaining vigilant and reporting scammy or dubious content when they encounter it.

It Seems Pretty Obvious that Bitcoin Circuit is Another Scam

If a platform like "Bitcoin Circuit" exhibits numerous red flags typically associated with scams, such as unrealistic promises of high returns with little risk, aggressive marketing tactics, lack of transparency, unclear information about the company's leadership, or difficulties in withdrawing funds, it is prudent to be highly skeptical and cautious.

Given the prevalence of cryptocurrency-related scams, the following general advice can help users protect themselves:

-

Research Thoroughly: Look for credible reviews and discussions on well-known forums and reputable websites. Don't rely solely on testimonials presented by the service itself.

-

Regulatory Status: Check if the platform is regulated or registered with any financial authorities. Regulatory bodies in various countries issue warnings against unlicensed platforms.

-

Check for Consistency: Be wary of platforms where the information provided is inconsistent, or there are numerous grammatical and spelling mistakes, as these can be signs of a hastily set up scam.

-

Verify Claims: Investigate any claims the company makes. This includes verifying celebrity endorsements and testimonials, which are often fabricated in scam schemes.

-

Assess Transparency: A legitimate platform should be transparent about the algorithms it uses, the risks involved in trading, and the company's background.

-

Secure Websites: Ensure that the platform uses a secure (https) connection and has robust security practices to protect users' funds and personal data.

-

Be Cautious with Investments: Never invest more than you can afford to lose, especially in markets as volat ile as cryptocurrencies.

ile as cryptocurrencies.

-

Report Suspicious Activity: If you encounter what appears to be a scam, report it to the appropriate authorities. This can include financial regulatory bodies, consumer protection agencies, and even internet crime divisions of law enforcement.

It's vital for individuals to approach any investment opportunity with due diligence and skepticism, especially within the cryptocurrency space, which is known for its high-risk and high-reward nature. Remember that while the potential for high returns can be tempting, the risk of significant losses is equally real.

The Promise of High Rewards is Exactly what Makes People Forget Due Dilligence

Absolutely, the promise of high rewards can be a powerful lure that causes individuals to overlook the necessity of due diligence. This psychological phenomenon is often referred to as the "too good to be true" effect, where the excitement and greed generated by the prospect of easy money can cloud judgment and lead to impulsive decisions.

Here's why and how this happens:

-

Emotional Decision-Making: The excitement of potential gains can lead to decisions driven by emotion rather than rational analysis.

-

Urgency and Scarcity Tactics: Scammers often create a false sense of urgency or use scarcity tactics ("limited time offer", "exclusive opportunity") to rush people into making decisions without giving them time to think critically or research properly.

-

Social Proof and FOMO: The use of fake testimonials and reviews creates an illusion of social proof that can mislead people. Combined with the Fear of Missing Out (FOMO), it pressures individuals into jumping on the bandwagon.

-

Complexity and Jargon: Scams sometimes use complex technical jargon or convoluted explanations that make it difficult for people to understand what they're getting into, but which create an illusion of legitimacy and sophistication.

-

Overconfidence: Novice investors might overestimate their understanding of the markets or the trustworthiness of information they receive, leading to neglected due diligence.

-

Anchoring Bias: If a scam can anchor the potential returns in the mind of the victim ("Users have reported doubling their investment in a week!"), those numbers can overshadow the reality of the situation and the need for careful investigation.

To protect against these psychological traps:

-

Take Your Time: Always give yourself time to think and research thoroughly before making any investment. Avoid rush decisions.

-

Seek Second Opinions: Consult with trusted financial advisors or knowledgeable friends before investing, especially if you're not familiar with the investment field.

-

Educate Yourself: The more you know about an investment domain, the better you'll be at spotting red flags.

-

Research the Market: Understand the typical returns for various investments, which can help identify when a promise is unrealistic.

-

Beware of Pressure Tactics: Any legitimate investment opportunity will not require you to invest "right now" to get a good deal.

-

Verify Everything: Cross-check information through multiple independent sources, and be particularly skeptical of platforms or opportunities that you learn about through unsolicited emails or ads.

-

Know the Signs of a Scam: Familiarize yourself with common characteristics of scams.

It's always worth repeating: If an investment opportunity sounds too good to be true, it probably is. Investing always involves risk, and high returns are never guaranteed.

I Know All this, I'm Trying to Get You to Start Explaining it to Everyone Else

You're absolutely right, and I appreciate your emphasis on the importance of educating others. Sharing information on due diligence and the risks of high-reward promises is crucial in helping people make informed decisions and avoid scams. Here’s how one might explain the importance of due diligence and the risks associated with high-reward investment opportunities:

The Importance of Due Diligence:

-

Identifies Red Flags: Proper research helps to uncover potential issues with an investment opportunity that may indicate a scam or a high risk of loss.

-

Verifies Legitimacy: Due diligence involves checking the credentials of the company, its regulatory status, and the veracity of its claims.

-

Assesses Risk: It allows you to critically assess the level of risk associated with an investment, which is essential for making informed decisions that align with your risk tolerance.

-

Protects Your Investments: By thoroughly vetting an opportunity, you can safeguard your hard-earned money from fraudsters and dubious schemes.

-

Informs Decision Making: Due diligence equips you with knowledge that can help you make decisions based on facts and analysis rather than emotion and pressure.

The Risks of High-Reward Investment Opportunities:

-

High Risk: High rewards typically come with high risks, and it’s possible to lose your entire investment.

-

Volatility: Markets that offer the potential for high returns, like cryptocurrencies, can be extremely volatile and unpredictable.

-

Scams: Fraudulent schemes often entice victims with the promise of high, quick returns on investment to get them to hand over money without scrutinizing the opportunity.

-

Unsustainability: Investment opportunities that promise consistent high returns may be operating as Ponzi schemes, which are unsustainable and often collapse, leading to significant losses for most investors.

-

Emotional Trading: The allure of high returns can lead to emotional trading, where decisions are made based on the fear of missing out (FOMO) rather than a balanced understanding of the potential outcomes.

How to Approach Investment Opportunities:

-

Be Skeptical: Treat all unexpected or unsolicited investment opportunities with caution.

-

Research: Use multiple sources to verify the legitimacy of the opportunity, including regulatory bodies and independent reviews.

-

Consult Professionals: Seek the advice of a financial advisor or investment professional, especially if an opportunity seems complex.

-

Invest What You Can Afford to Lose: Never invest more than you can afford to lose, particularly in highly speculative markets.

-

Stay Informed: Keep up to date with news from regulatory bodies and consumer protection organizations regarding current investment scams.

By understanding the importance of due diligence and the inherent risks of high-reward opportunities, individuals can better protect themselves from potential financial harm. It's essential to spread awareness about these issues to help others navigate the complex world of investing, especially in the relatively new and sometimes confusing realm of cryptocurrencies.

Google Need to Take Action. They Use Elon Musk as a Fake Founder!

I can understand the frustration and urgency when it comes to dealing with deceptive investment schemes that misuse well-known names like Elon Musk to create a false sense of security and legitimacy. Here's how both individual users and companies like Google can take action:

For Individual Users:

-

Reporting: If you encounter a scam or fraudulent website, report it. Google provides a way to report phishing, and you can also report to the Federal Trade Commission (FTC) in the United States, the Action Fraud in the UK, or the relevant authorities in your country.

-

Spreading Awareness: Share your knowledge and experience on social media, forums, and reviews to help others become aware of these scams.

-

Education: Educate those around you about the dangers of such scams and the importance of verifying investment opportunities.

For Companies Like Google:

-

Algorithmic Adjustments: Continuously improve algorithms to better identify and demote low-quality content, including scam websites.

-

User Education: Offer more visible warnings and educational content about common online scams.

-

Collaboration with Authorities: Work more closely with law enforcement and regulatory bodies to identify and take action against scam operations.

-

Verification: Tighten the process for ads and promoted content to ensure misleading or fraudulent schemes are not given a platform.

For Influential Figures Like Elon Musk:

-

Public Denouncements: Public figures who are frequently misused by scammers can help by denouncing these scams openly, making it clear they are not involved.

-

Legal Action: They can pursue legal action against those misusing their name, which can help in deterring future misuse.

It's a complex issue that requires a multi-faceted approach, including better regulatory frameworks, more sophisticated technology solutions, and ongoing public education to combat these deceptive practices effectively.

Remember, combating online scams is a shared responsibility. While search engines and regulators play a significant role, users also need to remain vigilant and report scams when they encounter them. By working together, the community can improve online safety and reduce the impact of these fraudulent schemes.