- Navigation

- Why do so Many Boiler Room Scammers Target the UK?

- Are the UK Website Regulations Stringent Enough to Prevent Boiler Room Scams?

- Do you Have to Reside in the UK to Have a .UK Website?

- What are the regulations you have to abide by when owning a UK website?

- What can Nominet, the FCA or the ASA Actually Do Against a Fraudulent Website Using a .uk Suffix?

- Is there a Foolproof Way to Make Money Easily?

Why do so Many Boiler Room Scammers Target the UK?

Boiler room scams are a type of investment fraud where scammers use high-pressure sales tactics to convince people to invest in fake or worthless stocks, often resulting in significant financial losses for the victims. While boiler room scams can happen anywhere in the world, they have been known to target the UK more frequently. Here are some reasons why:

|

1. Wealthy Population: The UK has a relatively wealthy population, with many people who are looking to invest their money to earn a higher return. Scammers target these individuals, often by offering "once-in-a-lifetime" investment opportunities with guaranteed high returns.

2. Regulated Financial Markets: The UK has a well-established financial market with strong regulatory bodies such as the Financial Conduct Authority (FCA). However, scammers often use fake credentials and manipulate information to create a false sense of credibility and legitimacy.

3. Language Barrier: The UK is an English-speaking country, and scammers may find it easier to communicate and convince victims who share the same language and cultural background.

|

4. Historical Precedent: Boiler room scams have a history of operating successfully in the UK, with a number of high-profile cases being reported in the media. This may give scammers the impression that the UK is a "soft target" for investment fraud.

5. Perceived safety. The number of government bodies and regulatory commissions in the UK do impose a feeling of safety among the public and even though these commissions can do nothing about these overseas websites they certainly make it sound as if they can.

It's important for individuals to remain vigilant and be wary of any unsolicited investment opportunities. Always research investment opportunities and seek advice from a regulated financial advisor before making any investments. If you believe you have been the victim of a boiler room scam, you should report it to the relevant authorities immediately.

Are the UK Website Regulations Stringent Enough to Prevent Boiler Room Scams?

While the UK has regulations in place to prevent investment scams and other forms of financial fraud, unfortunately, these regulations may not always be stringent enough to prevent boiler room scams from occurring. Boiler room scams often operate outside of the law, making it difficult for regulatory bodies to detect and prevent them.

Some of the regulations that the UK has in place to prevent investment scams and protect consumers include the Financial Services and Markets Act 2000, which requires that companies involved in investment activities be authorized and regulated by the Financial Conduct Authority (FCA). The FCA also publishes warnings about investment scams and maintains a register of authorized firms and individuals that the public can use to check the legitimacy of investment offers.

However, scammers often use deceptive tactics, including fake credentials and manipulative sales tactics, to lure victims into investing in fake or worthless stocks. They may also operate from offshore locations or use untraceable means of communication, making it difficult for regulatory bodies to identify and take action against them.

In addition to regulatory measures, it's important for individuals to take precautions to protect themselves from investment scams. This includes being wary of unsolicited investment offers, conducting thorough research before investing, and seeking advice from a regulated financial advisor.

Overall, while the UK has regulations in place to prevent investment scams, these measures may not always be sufficient to stop boiler room scams from occurring. It's important for individuals to remain vigilant and take proactive steps to protect themselves from financial fraud.

Do you Have to Reside in the UK to Have a .UK Website?

No, you do not have to reside in the UK to have a .uk website. The .uk domain name extension is open to registration by individuals and organizations from anywhere in the world. However, if you are registering a .uk domain name, you will need to provide a UK address for the domain registration. This address can be a physical address or a service address provided by a domain name registration service.

|

It's worth noting that some registrars may have additional requirements for registering a .uk domain name, such as providing proof of a UK presence or providing a UK-based contact. Additionally, if you are a non-UK resident and you are using a .uk website to sell goods or services to UK customers, you may be subject to UK tax and other regulatory requirements.

Overall, while you do not need to reside in the UK to have a .uk website, you will need to provide a UK address for the domain registration, and you may need to comply with additional requirements and regulations if you are using the website for business purposes.

|

What are the regulations you have to abide by when owning a UK website?

If you're operating a website in the United Kingdom (UK), there are several regulations you should be aware of and comply with. Here are some of the key regulations that may apply to your website:

1. Data Protection: If you collect, store, or use personal data of UK residents, you are required to comply with the UK Data Protection Act 2018 and the General Data Protection Regulation (GDPR). This includes obtaining explicit consent from users for collecting and processing their data, providing them with access to their data, and ensuring the security and confidentiality of their data.

2. Cookie Policy: If your website uses cookies, you must provide clear information about the types of cookies used and obtain consent from users before storing or accessing their cookies. This is typically done through a cookie policy or a pop-up banner.

3. eCommerce Regulations: If you sell goods or services through your website, you must comply with the UK eCommerce Regulations, which include providing clear information about prices, delivery times, and cancellation and refund policies. You must also ensure that your terms and conditions are clearly visible and easy to understand.

4. Accessibility: Your website must be accessible to users with disabilities, in compliance with the Equality Act 2010. This includes providing alternative text for images, ensuring that videos have captions or transcripts, and making sure that your website is navigable with keyboard-only access.

5. Intellectual Property: You must ensure that your website content, including images, text, and logos, does not infringe on any intellectual property rights, including copyright, trademarks, and patents.

These are just a few of the key regulations that may apply to your website in the UK. It's important to consult with a legal professional or conduct your own research to ensure that your website is fully compliant with all applicable laws and regulations.

What can Nominet, the FCA or the ASA Actually Do Against a Fraudulent Website Using a .uk Suffix?

Nominet, the FCA, and the ASA all have different roles and responsibilities when it comes to dealing with fraudulent websites using a .uk suffix.

Nominet is the registry for all domain names ending in .uk. They are responsible for maintaining the registry and ensuring that all registered domain names meet the terms and conditions of registration. If Nominet becomes aware of a fraudulent website using a .uk suffix, they can take action by suspending or revoking the domain name registration. However, Nominet's powers are limited to enforcing their terms and conditions of registration and they do not have the authority to prosecute criminal activity.

The FCA (Financial Conduct Authority) is the regulator for financial services in the UK. If a fraudulent website is offering financial products or services without authorization from the FCA, the FCA can take enforcement action against the website. This may include imposing fines, banning the individuals responsible from the financial industry, or even pursuing criminal charges.

The ASA (Advertising Standards Authority) is responsible for regulating advertising in the UK. If a fraudulent website is using misleading or false advertising, the ASA can investigate and take action against the website. This may include requiring the website to remove or modify the advertising, and imposing sanctions such as fines or referral to other regulatory bodies.

Overall, Nominet, the FCA, and the ASA all have different roles and responsibilities when it comes to dealing with fraudulent websites using a .uk suffix. While their powers may be limited in some cases, they each play an important role in protecting consumers from fraud and enforcing regulatory requirements in their respective areas.

Now While this is officially well and good, the reality is that the FCA and ASA have no power to do anything to anyone running a website unless they are operating out of the UK, and even if the scammers were in the UK they can just register their website with a hosting company in Estonia and the FCA becomes no more than three letters, and it is just the same with the ASA. The simple truth is that these bodies do more harm than good in that they make people feel there is some sort of regulation when there is none. These official government watchdogs cannot even take actions against the huge monster companies advertising these scams like Twitter, Facebook (Meta), Microsoft and Google (Alphabet.)

|

|

The huge money hoarding machine that the Internet has become is only interested in pushing as much money as possible to it's shareholders who are obviously rich already. The scam is the perfect way to overlook an engine pushing desperate people's money up to the rich. It is a condition that Elon Musk, Bill Gates and Larry Page must be aware of. They cannot have failed to notice how they are used within these fake news ads by now, so where is an Elon Musk tweet warning us all?

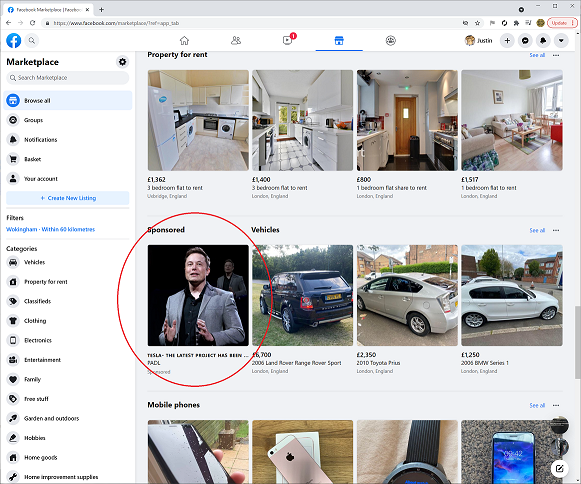

A Typical Elon Musk scam on Meta's Facebook pages show the scale of the problem. In this ad on the left you can see that the ad is almost indistinguishable from a real article unless you are being extremely careful, and the honest truth is that most people are not.

|

Part of what is completely fascinating is that people believe these idiotic trading robots really do run on some sort of autopilot, sometime even after they have been scammed once already. We have seen cases of people asking us which robot really is good as they want to try and make back the money they have lost!

No trading robot is completely automated as of 2023 and the only way that you can try and make money is by setting certain rules in your MT4 or MT5 metatrader software. Trading with these tools is highly dangerous and should not be undertaken by the inexperienced. Never believe anyone that tells you making money is easy as if it was true money would be worthless.

Is there a Foolproof Way to Make Money Easily?

No, there is no foolproof way to make money easily. Any offer or scheme that promises to make you rich quickly and easily is likely to be a scam. Making money typically requires hard work, skill, knowledge, and often some level of risk-taking.

While there are legitimate ways to earn money, such as working a job or starting a business, these typically require effort, dedication, and time. There is no shortcut to financial success, and anyone who promises otherwise is likely trying to scam you.

It's important to be wary of any offers that seem too good to be true and to do your due diligence before investing your time or money in any opportunity. This includes researching the company or individual behind the offer, seeking advice from trusted professionals, and carefully reviewing any contracts or agreements before signing.

Ultimately, the best way to build long-term financial security is to work hard, save money, invest wisely, and make informed decisions. While there are no guarantees of success, taking a disciplined and responsible approach to your finances can help you achieve your financial goals over time.